Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

15865 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Trump's 'insidious' new scandal is also among his most 'ominous': analyst

2026/02/17 08:20

Trump officials subject themselves to 'legal humiliation' out of 'slavish fealty': WSJ

2026/02/17 08:03

XRP Forming Gravestone Doji Pattern, Bearish Sign?

2026/02/17 08:01

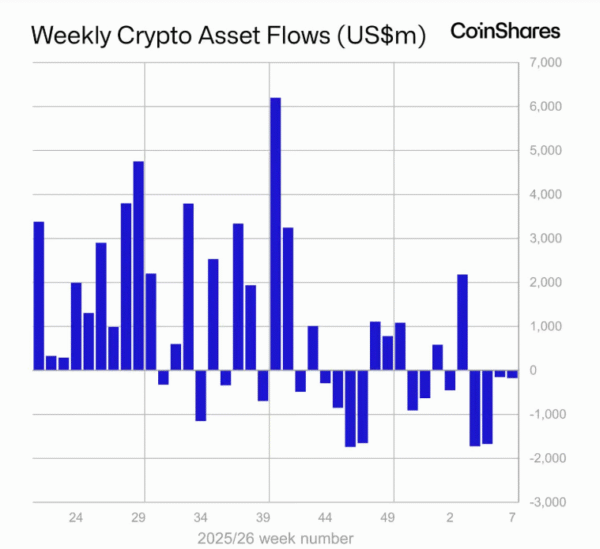

Selling Pressure Persists in Crypto Funds, CoinShares Reports

2026/02/17 07:59

Weeks After White House Appearance, Nicki Minaj Joins Trump Family’s Crypto Forum

2026/02/17 06:23