Lending

Share

Lending protocols form the backbone of the decentralized money market, allowing users to lend or borrow digital assets without intermediaries. Using smart contracts, platforms like Aave and Morpho automate interest rates based on supply and demand while requiring over-collateralization for security. The 2026 lending landscape features advanced permissionless vaults and institutional-grade credit lines. This tag covers the evolution of capital efficiency, liquidations, and the integration of diverse collateral types, including LSTs and tokenized RWAs.

14631 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

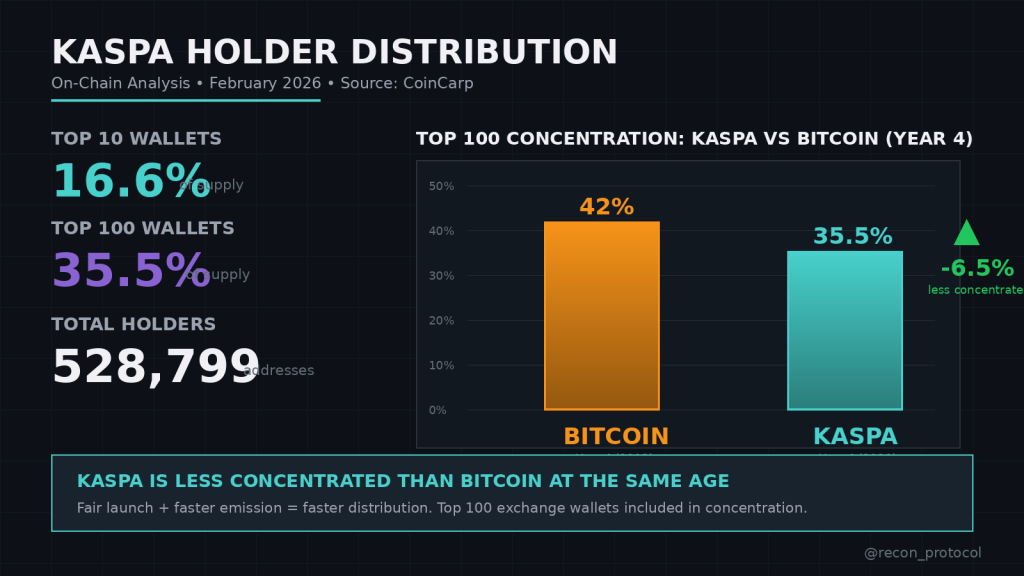

Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration

2026/02/09 17:45

XRP Price at $10 Dreams or $0.70 Reality? This Chart Maps the Next Move

2026/02/09 17:00

Solana Champion Kyle Samani Takes Aim at Hyperliquid After Departure

2026/02/09 16:59

Motivational Speaker Rocky Romanella Launches Intentional Listening Workshop to Transform Business Communication

2026/02/09 16:00

Ohio Implements Stricter Distracted Driving Laws with Increased Penalties

2026/02/09 16:00