RWA

Share

RWA (Real World Assets) refers to the tokenization of tangible assets—such as real estate, private credit, and government bonds—on the blockchain. By bringing traditional financial instruments on-chain, RWA protocols like Ondo and Centrifuge provide DeFi users with stable, real-yield opportunities. In 2026, the RWA sector is a multi-trillion-dollar bridge between TradFi and DeFi, enabling fractional ownership and global liquidity for previously illiquid assets. Follow this tag for insights into on-chain credit markets, regulatory compliance, and asset-backed security innovations.

43553 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

XRP Now Hosts Over $1B Worth of Tokenized Commodities

2026/02/07 14:28

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

2026/02/07 14:01

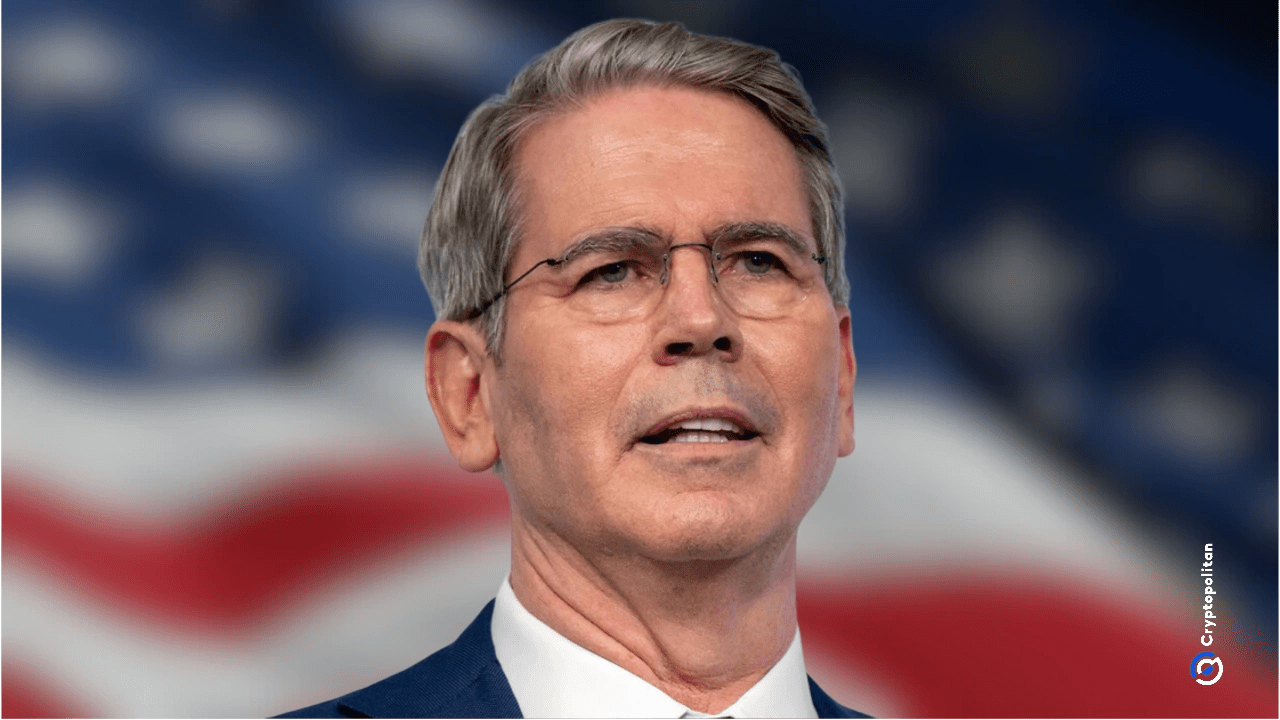

Trump’s Scott Bessent says “false choice” to pit his strong‑dollar line against the president’s

2026/02/07 13:58

The ENS will launch its ENSv2 on Ethereum, leaving its own L2.

2026/02/07 13:50

The Critical Analysis Of HBAR’s Journey To $0.5

2026/02/07 13:48