RWA

Share

RWA (Real World Assets) refers to the tokenization of tangible assets—such as real estate, private credit, and government bonds—on the blockchain. By bringing traditional financial instruments on-chain, RWA protocols like Ondo and Centrifuge provide DeFi users with stable, real-yield opportunities. In 2026, the RWA sector is a multi-trillion-dollar bridge between TradFi and DeFi, enabling fractional ownership and global liquidity for previously illiquid assets. Follow this tag for insights into on-chain credit markets, regulatory compliance, and asset-backed security innovations.

43573 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

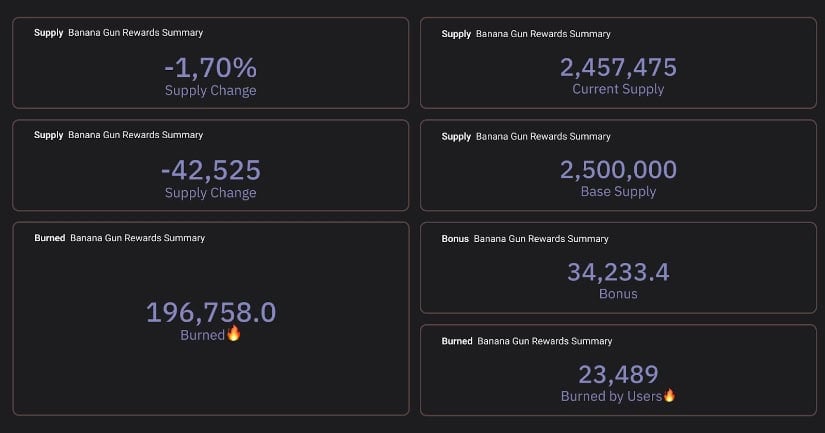

An Analysis of $BANANA & $GOOD

Author: BitcoinEthereumNews

2025/09/03

Share

Recommended by active authors

Latest Articles

Remittix Success Leads To Rewarding Presale Investors With 300% Bonus – Here’s How To Get Involved

2026/02/07 16:39

Republic Europe Announces Indirect Investment in Kraken IPO

2026/02/07 16:31

The week in photos: January 31 to February 6, 2026

2026/02/07 16:00

Will ‘under pressure’ Ethereum withstand the surge in selling?

2026/02/07 15:59

The Technology Behind IPTV and Why It Is Transforming Television in the Netherlands

2026/02/07 15:49