NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12704 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Don’t Make the Same Mistake Again

Author: BitcoinEthereumNews

2025/09/17

Share

Recommended by active authors

Latest Articles

xAI co-founder Wu Yuhuai announces his departure.

2026/02/10 16:36

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD

2026/02/10 16:26

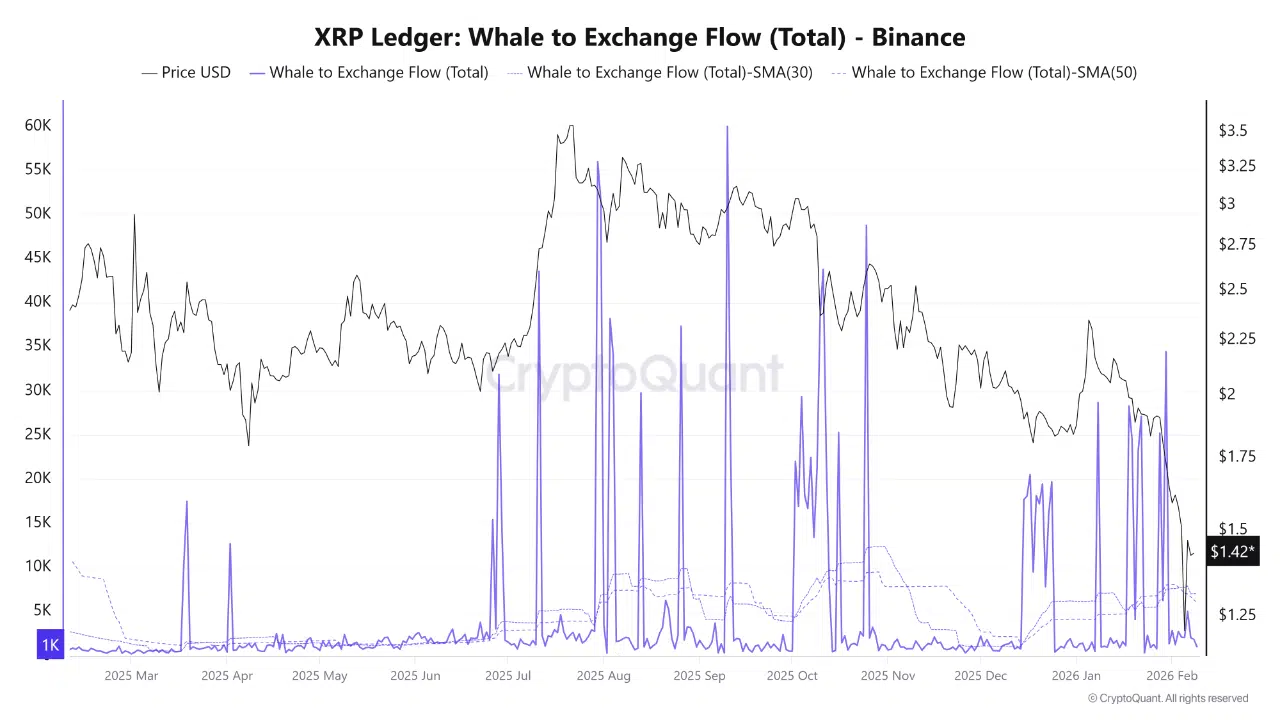

XRP Whale Selling Remains Absent as Price Slides

2026/02/10 16:14

XRP price prediction: How could China’s Treasury sell call impact XRP?

2026/02/10 16:00

Why the Bitcoin Boom Is Not Another Tulip Mania

2026/02/10 15:44