NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12642 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

HODLing Might Be Better Now

Author: BitcoinEthereumNews

2025/09/11

Share

Recommended by active authors

Latest Articles

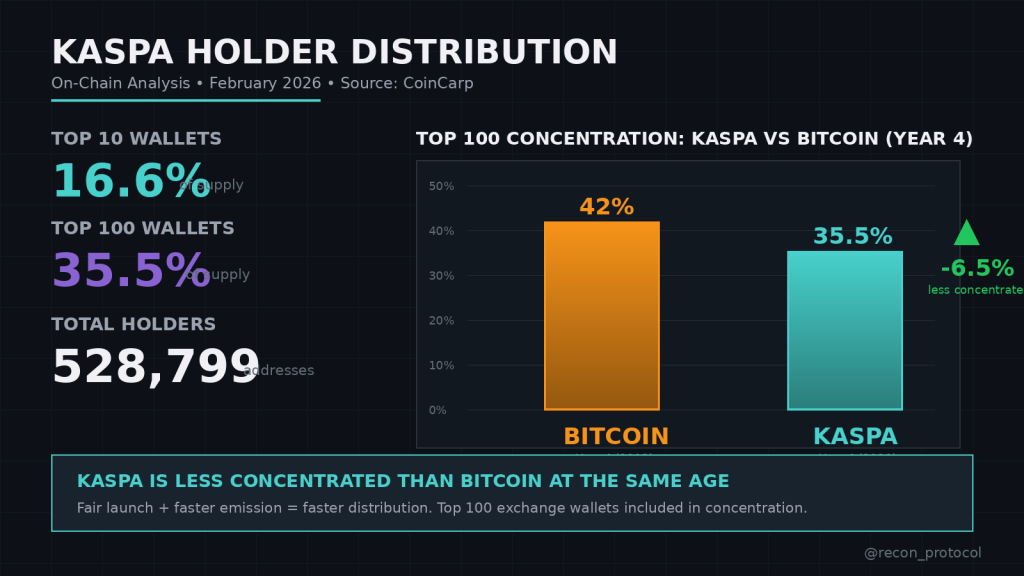

Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration

2026/02/09 17:45

XRP Price at $10 Dreams or $0.70 Reality? This Chart Maps the Next Move

2026/02/09 17:00

Solana Champion Kyle Samani Takes Aim at Hyperliquid After Departure

2026/02/09 16:59

Motivational Speaker Rocky Romanella Launches Intentional Listening Workshop to Transform Business Communication

2026/02/09 16:00

Ohio Implements Stricter Distracted Driving Laws with Increased Penalties

2026/02/09 16:00