Token2049

Share

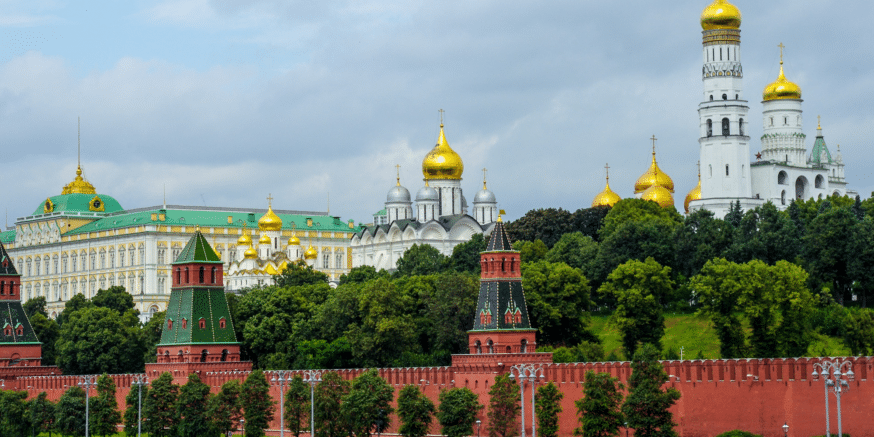

Token2049 is the premier global crypto event series, with flagship 2026 editions in Dubai (April) and Singapore (October). It brings together the most influential VCs, founders, and institutional leaders to define industry trends. This tag tracks high-level networking insights and breakthroughs in DePIN, GameFi, and mass-market Web3 adoption emerging from these world-class summits.

454 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

US Stocks Close Lower: Major Indices Retreat Amid Market Uncertainty

2026/02/04 05:31

Vitalik Buterin Questions the Continued Relevance of Ethereum’s Layer 2 Solutions

2026/02/04 05:30

ZenithBlox Introduces Compliance-Orchestrated Blockchain Infrastructure (COBI)

2026/02/04 05:26

RedotPay Emerges as Clear Leader in Cryptocurrency Card Payments in 2025

2026/02/04 05:15

Venture Global, Inc. Announces Timing of Fourth Quarter 2025 Earnings Release and Conference Call

2026/02/04 05:00