CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4136 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

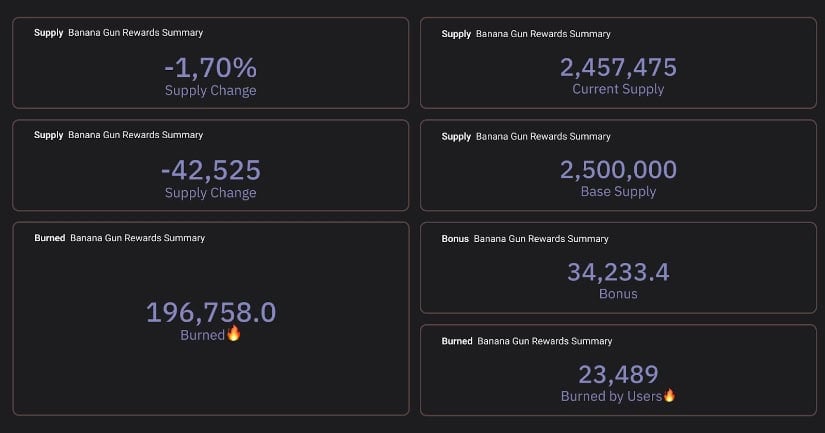

An Analysis of $BANANA & $GOOD

Author: BitcoinEthereumNews

2025/09/03

Share

Recommended by active authors

Latest Articles

U.S. Stocks Fall as Tech Declines and Investors Await Alphabet Results

2026/02/05 03:39

TRM Labs Becomes Unicorn with 70M$: BTC Fraud Risk

2026/02/05 03:33

XRP Plunges: Historic MACD Signal Sparks Alarm

2026/02/05 03:30

Free Informational Webinar: Land Entitlement Expert Provides a Look Into the Future of Land Use and Zoning Intelligence

2026/02/05 03:00

Vitalik Buterin Moves $29 Million Worth of Ethereum—Here’s Why

2026/02/05 02:45