CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4215 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

XRP Now Hosts Over $1B Worth of Tokenized Commodities

2026/02/07 14:28

Revealing Long/Short Ratios Show Remarkable Market Equilibrium Across Top Exchanges

2026/02/07 14:01

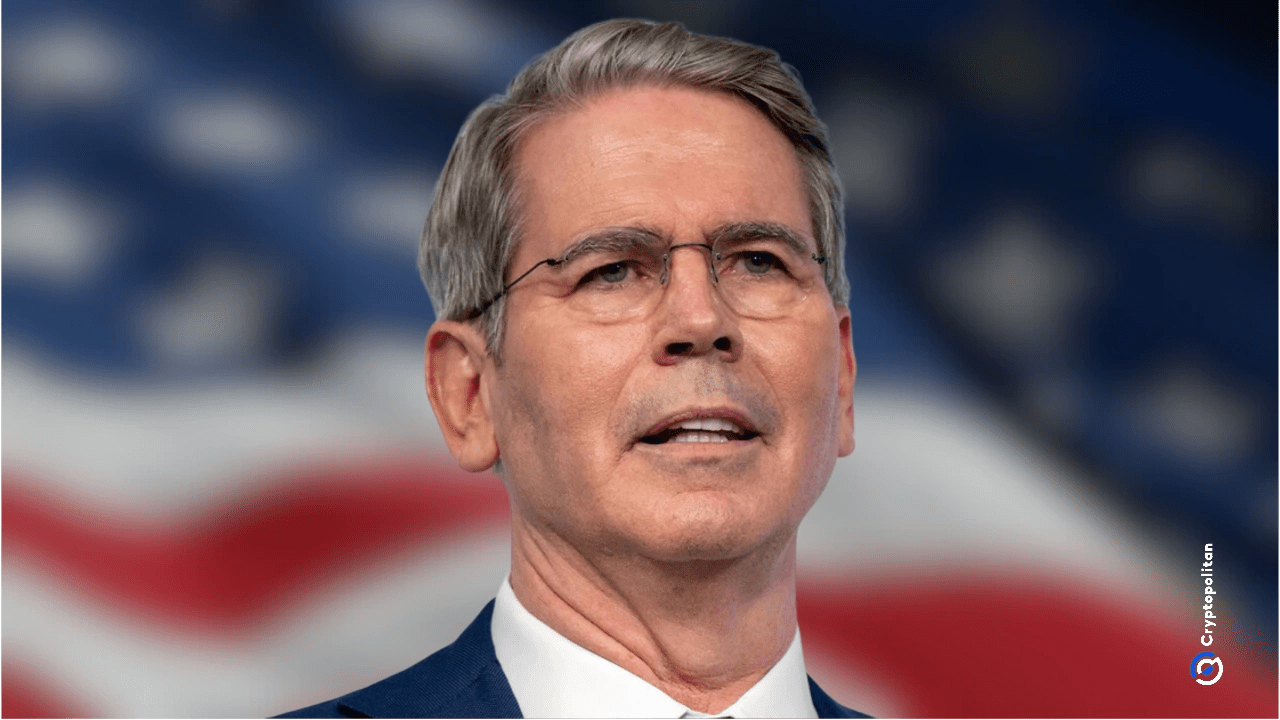

Trump’s Scott Bessent says “false choice” to pit his strong‑dollar line against the president’s

2026/02/07 13:58

The ENS will launch its ENSv2 on Ethereum, leaving its own L2.

2026/02/07 13:50

The Critical Analysis Of HBAR’s Journey To $0.5

2026/02/07 13:48