CEX

Share

CEXs are platforms managed by centralized organizations that facilitate the trading of cryptocurrencies, offering high liquidity and user-friendly fiat on-ramps. Leaders like Binance, OKX, and Coinbase serve as the primary gateways for institutional and retail entry. In 2026, the industry focus is on Proof of Reserves (PoR), enhanced regulatory compliance, and hybrid models that offer self-custody options. This tag provides updates on exchange security, listings, and global market trends.

4250 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Quantum Computing Crypto Threat Is Exaggerated: CoinShares Reveals Sobering Reality

2026/02/09 06:25

Platinum Near $2,100 as Gold and Silver Face Speculative Exodus

2026/02/09 06:15

Tom Lee Says Ethereum’s 40% Crash Fits a Classic V-Shaped Recovery Pattern

2026/02/09 06:03

Top Crypto Presales for February Include Pepepawn and OPZ, but the Upcoming Crypto That Looks Like a True 100x Thunder Is DeepSnitch AI

2026/02/09 06:00

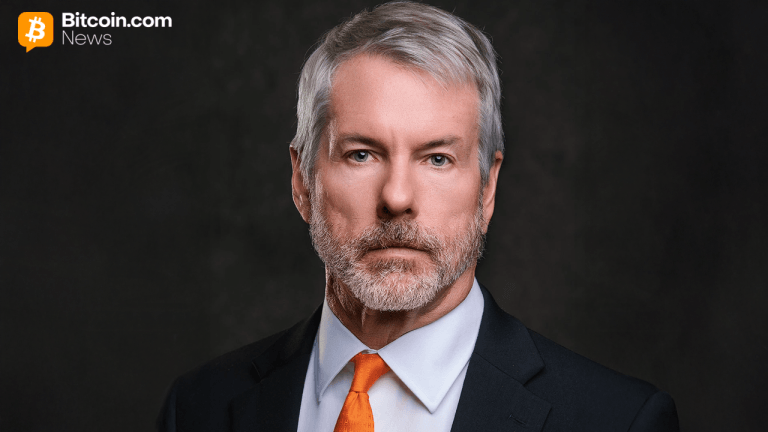

Strategy’s Boss Hints at New Bitcoin Accumulation as Unrealized Loss Tops $3.4 Billion

2026/02/09 05:30