Airdrop

Share

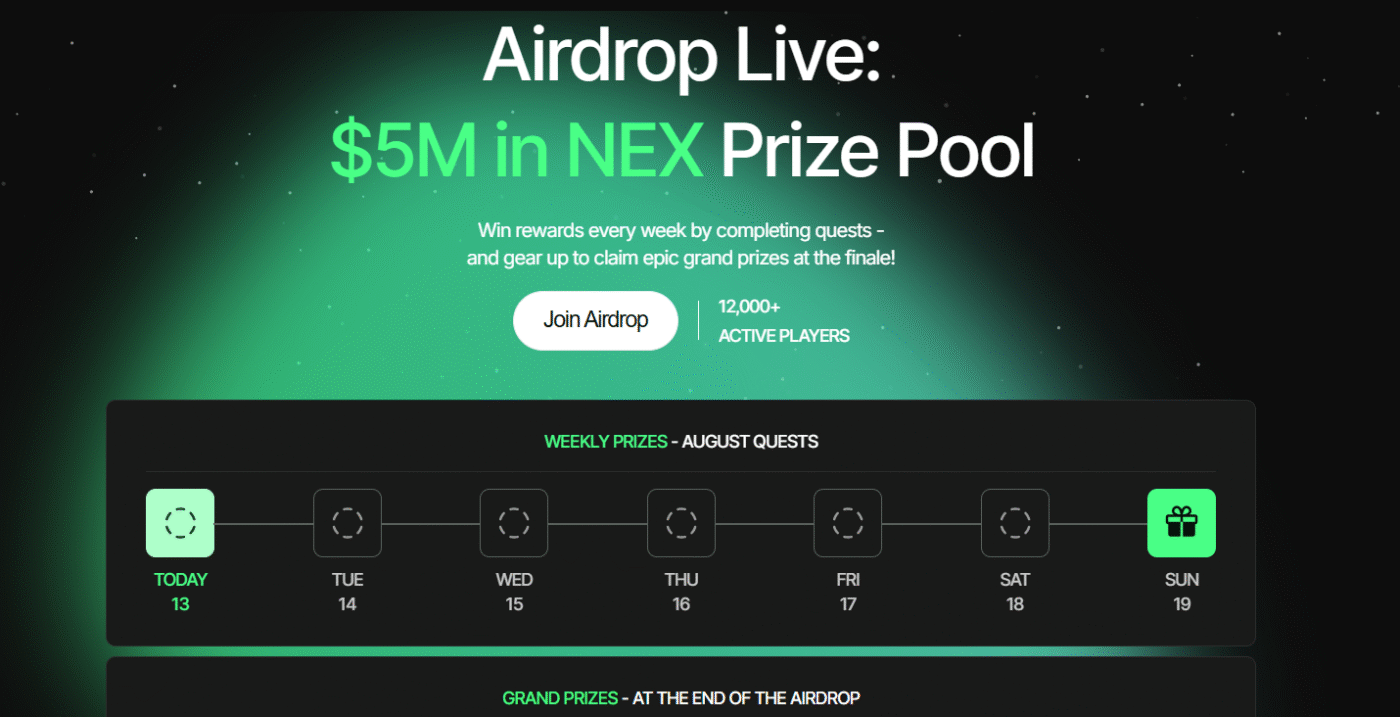

An Airdrop is a distribution of free tokens to a community, typically used as a marketing tool or a reward for early protocol adopters and testers. In 2026, the "points-to-airdrop" model has matured into merit-based incentive programs that utilize Sybil-resistance and Proof-of-Humanity to filter out bots. Airdrops remain a primary method for decentralized governance (DAO) bootstrapping. Follow this tag for the latest on retroactive rewards, eligibility criteria, and how to participate in the most anticipated token distributions in the ecosystem.

5433 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Ripple CEO Quotes Buffett’s “Be Greedy When Others Fear” As XRP Wavers ⋆ ZyCrypto

2026/02/08 00:13

Tokenized Real Estate Nears $360M as UAE and US Take the Lead

2026/02/08 00:09

Tether Freezes $544M in Crypto Tied to Turkish Illegal Betting Probe

2026/02/07 23:55

Shiba Inu Team Warns of Safe Wallet Address Poisoning Scam

2026/02/07 23:47

Shiba Inu Sees 16% Surge in Futures Activity, Hinting at Major Price Breakout!

2026/02/07 23:40