Airdrop

Share

An Airdrop is a distribution of free tokens to a community, typically used as a marketing tool or a reward for early protocol adopters and testers. In 2026, the "points-to-airdrop" model has matured into merit-based incentive programs that utilize Sybil-resistance and Proof-of-Humanity to filter out bots. Airdrops remain a primary method for decentralized governance (DAO) bootstrapping. Follow this tag for the latest on retroactive rewards, eligibility criteria, and how to participate in the most anticipated token distributions in the ecosystem.

5496 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

xAI co-founder Wu Yuhuai announces his departure.

2026/02/10 16:36

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD

2026/02/10 16:26

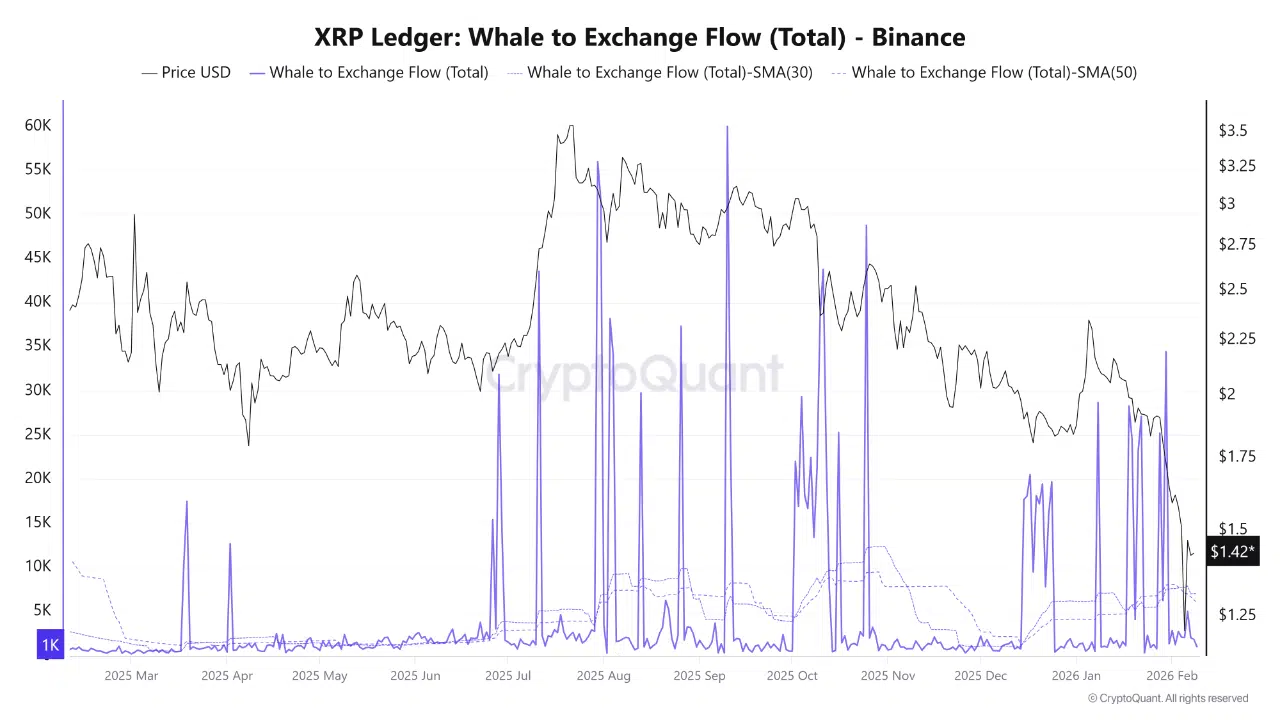

XRP Whale Selling Remains Absent as Price Slides

2026/02/10 16:14

XRP price prediction: How could China’s Treasury sell call impact XRP?

2026/02/10 16:00

Why the Bitcoin Boom Is Not Another Tulip Mania

2026/02/10 15:44