Airdrop

Share

An Airdrop is a distribution of free tokens to a community, typically used as a marketing tool or a reward for early protocol adopters and testers. In 2026, the "points-to-airdrop" model has matured into merit-based incentive programs that utilize Sybil-resistance and Proof-of-Humanity to filter out bots. Airdrops remain a primary method for decentralized governance (DAO) bootstrapping. Follow this tag for the latest on retroactive rewards, eligibility criteria, and how to participate in the most anticipated token distributions in the ecosystem.

5460 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

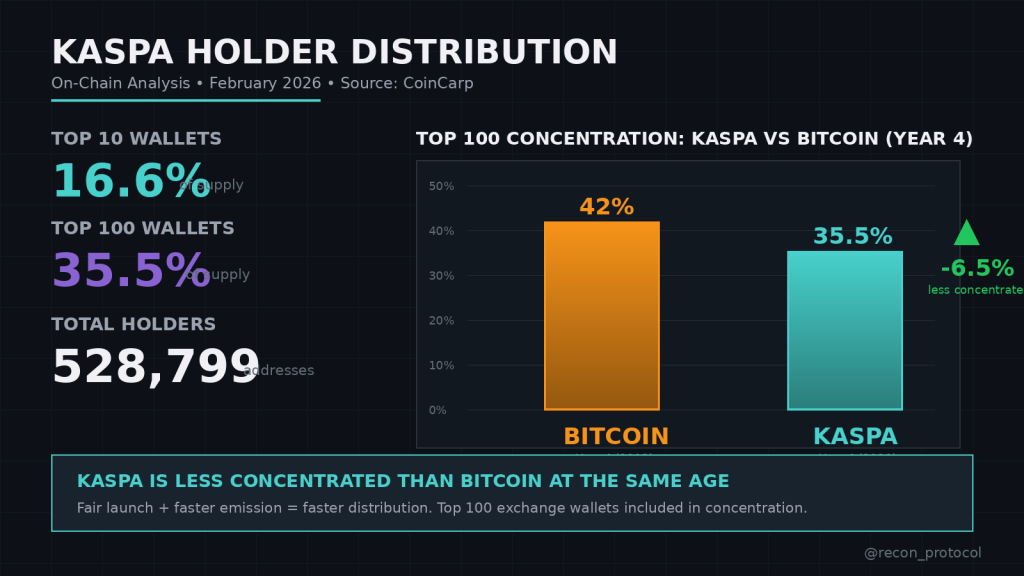

Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration

2026/02/09 17:45

XRP Price at $10 Dreams or $0.70 Reality? This Chart Maps the Next Move

2026/02/09 17:00

Solana Champion Kyle Samani Takes Aim at Hyperliquid After Departure

2026/02/09 16:59

Motivational Speaker Rocky Romanella Launches Intentional Listening Workshop to Transform Business Communication

2026/02/09 16:00

Ohio Implements Stricter Distracted Driving Laws with Increased Penalties

2026/02/09 16:00