Adoption is growing among corporations and financial institutions, with cross-border transactions driving interest.

Stablecoins are gaining momentum in global finance, with financial institutions and corporations increasingly exploring adoption, according to a new survey from EY-Parthenon.

The report finds that stablecoins are currently used by 13% of financial institutions and corporations globally. Meanwhile, more than half of non-users expect to adopt them within the next 6 to 12 months.

Moreover, EY-Parthenon estimates that by 2030, 5% to 10% of cross-border payments will be made using stablecoins, representing between $2.1 trillion and $4.2 trillion.

The push toward stablecoins reflects a broader shift in global payments as firms continue to push for faster settlement, lower costs, and improved liquidity. And adoption is already generating benefits: among current users, 41% reported cost savings of at least 10%, the report noted.

“Stablecoins — powered by blockchain and backed by real-world assets like cash and U.S. Treasuries — are emerging as a new tool for growth and innovation in global financial markets,” the report reads.

Across the financial sector, the report found that 80% of firms not yet using them are actively exploring adoption, and 60% expect interest to grow over the next year. This comes as many banks and financial institutions are preparing to offer stablecoin services through a mix of in-house systems and partnerships with external providers.

The report also notes that stablecoin adoption is held back by infrastructure and integration challenges, with only 8% of corporates currently accepting them. However, adoption could grow if more vendors get on board and firms focus on linking stablecoin infrastructure to existing treasury systems and ERP platforms.

“Integration with existing financial systems is a top priority,” the report reads. “Fifty-six percent of corporates prefer embedded APIs within their current treasury platforms, and 70% would be more inclined to adopt stablecoins if ERP integrations were available.”

The findings come just two months after the passage of the stablecoin-focused GENIUS Act, which the report identified as “a turning point in the evolution of digital payment infrastructure and transaction processing.” The regulatory clarity is expected to further boost stablecoins’ growth trajectory, experts say.

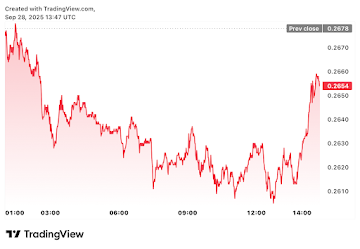

Currently, the total stablecoin market capitalization is nearly $291 billion, marking a 69% increase from this time last year, according to DeFiLlama.

Source: https://thedefiant.io/news/research-and-opinion/stablecoins-are-set-to-transform-global-payments-ey-parthenon