Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points

Bitcoin BTC $116 419 24h volatility: 0.3% Market cap: $2.32 T Vol. 24h: $54.97 B price found support above $115,000 on Wednesday, September 17, as markets absorbed the US Federal Reserve’s latest move. The Fed opted to cut rates by 25 basis points from 4.50% to 4.25%, a smaller reduction than the 50 basis points widely expected.

The decision followed overheated consumer inflation data last week, leaving speculative traders uncertain about US monetary policy direction for the coming quarters.

US Federal Funds Rate Trends, 2025 | Source: TradingEconomics, September 17, 2025

However, the Federal Open Market Committee (FOMC) called for caution in its accompanying statement, hinting at downside risks from slower job gains and a slight uptick in unemployment rates.

Despite this, the committee maintained expectations for additional rate cuts totaling 50 basis points later in 2025, though timing remains unclear.

Fed Decision Sparks Limited Market Liquidations Despite Gold Rally Concerns

Earlier in the week, gold’s rally to all-time highs above $3,700 had sparked fears of massive crypto liquidations in the event of a disappointing Fed rate decision. However, derivatives market movement suggests limited downside impact.

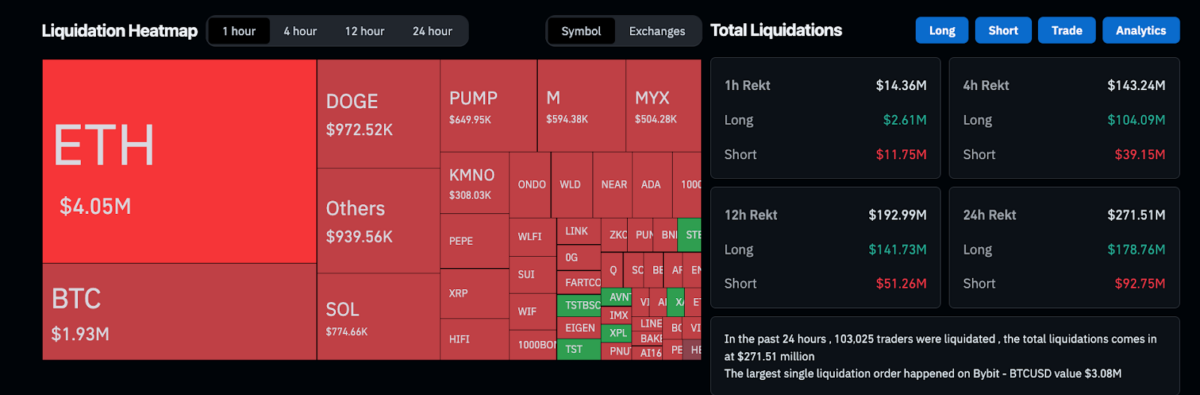

Crypto market liquidations, September 17, 2025 | Source: Coinglass

According to Coinglass figures, 24-hour total crypto market liquidations reached $267.44 million, with $178.64 million in longs and $88.81 million in shorts. Notably, only $36.19 million of those liquidations occurred within the hour following the Fed’s announcement, suggesting the market absorbed the decision without panic selling.

Bitcoin Bulls Hold Key Support While Short Squeeze Potential Builds at $118K

Liquidation maps provide further insights into Bitcoin’s near-term trajectory. These maps track futures positions deployed at specific price levels, helping traders anticipate potential price reversal zones. At first glance, bears appear to have the upper hand, with $3.3 billion in active shorts outpacing $2.3 billion in longs.

A closer look shows over 35% of the active long positions are concentrated around $114,458, where $814 million could be liquidated. With the intraday total liquidations of $267 million well below that threshold, these positions are likely to remain intact. This suggests Bitcoin remains positioned for an early rebound if bulls hold the line above $114,500.

Bitcoin Liquidation Maps as of September 17, 2025 | Source: Coinglass

On the upside, short positions cluster heavily around $118,000, where more than $1.8 billion could face liquidation. Lacking stronger resistance zones, a breakout above this level could ignite a short squeeze, propelling Bitcoin price toward the $124,500 peak recorded in August.

Unless trading volume increases significantly, Bitcoin is likely to consolidate between $114,000 and $118,000 in the near term, as market participants may remain cautious given the US Fed’s concerns about unemployment risks.

nextThe post Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points appeared first on Coinspeaker.

You May Also Like

Could Lyno Become the Next Ethereum Killer? Inside Its AI-Powered Blockchain Strategy

Coinbase CEO Pushes Congress on Crypto Bill as Support Builds in Washington