From MrBeast to DeFi, Aster Sees Strong Gains with $30M in Fees

Aster, a derivatives decentralized exchange, is showing signs of a potential breakout amid a huge purchase from YouTuber MrBeast and surpassing all protocols in terms of 24-hour fees.

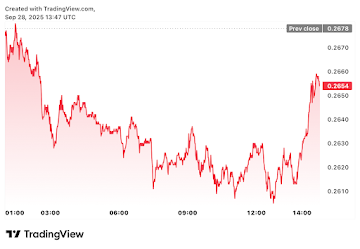

The native token of the DEX, ASTER, rose 9% over the past 24 hours to $1.96. Its market capitalization is currently hovering just over $3.2 billion.

The price hike comes as Aster, which is backed by Changpeng Zhao’s YZi Labs, recorded an $87 billion derivatives trading volume, according to data from CoinMarketCap. This accounts for a 90.6% market share as the second-largest volume, worth $6.4 billion, comes from its rival Hyperliquid.

Following the massive trading volume, Aster collected roughly $30 million in 24-hour fees, surpassing stablecoin leaders like Tether and Circle, which collected $22.2 million and $7.7 million in fees, respectively, according to DefiLlama.

Aster’s rival, Hyperliquid, accumulated only $3.17 million in fees over the same timeframe.

MrBeast Buys More ASTER

The YZi Labs-backed project didn’t just bring users from decentralized finance, but also caught the eye of Jimmy Donaldson, a famous YouTuber and entrepreneur known as MrBeast.

According to data from Lookonchain, MrBeast extended his ASTER holdings by 167,436 tokens on late Sept. 28.

He bought the assets for over 320,000 USDT, and currently has a total of 705,821 ASTER, worth roughly $1.3 million.

Due to MrBeast’s popularity, this movement could trigger the fear of missing out among investors, consequently pushing the ASTER price.

At this point, ASTER is down by 20.3% from its Sept. 24 all-time high of $2.42.

It’s important to note that the DeFi protocol already has a total value locked of $2.27 billion, marking a new ATH.

nextThe post From MrBeast to DeFi, Aster Sees Strong Gains with $30M in Fees appeared first on Coinspeaker.

You May Also Like

Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points

Edges higher ahead of BoC-Fed policy outcome