US Crypto Theft Wallet Launches Solana Meme Coin — Why PumpFun Deleted $LICK

A Solana-based meme coin launched by a wallet linked to an alleged theft of U.S. government-controlled crypto assets has collapsed rapidly after a brief surge in trading activity.

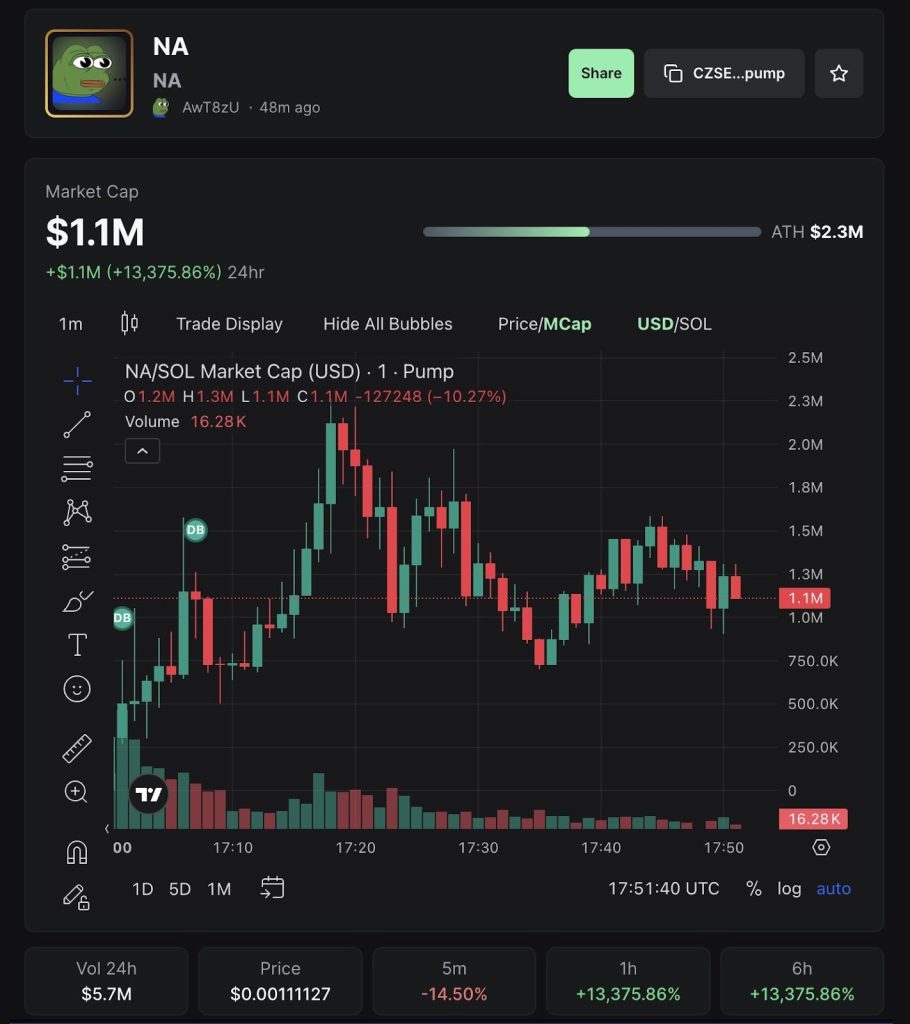

The token, John Daghita (LICK), was created on the Pump.fun launchpad and initially drew strong speculative interest, pushing its market capitalization to nearly $2.3 million within hours of launch.

On-chain data shows the token surged by more than 13,300% before sharply reversing course.

A screenshot shared by Bubblemaps shows that LICK later fell to around $0.0011, shedding over 14% of its value within five minutes as selling pressure intensified.

Source: Bubblemaps

Source: Bubblemaps

Trading data indicates that the deployer wallet accumulated tokens early at low valuations, making four purchases before the rapid price rally and subsequent collapse.

Shortly after the sell-off, the token appeared to be deleted from Pump.fun, effectively ending its trading activity.

Bubblemaps Finds Concentrated Supply in LICK Token Debut

Further scrutiny came from Bubblemaps, which reported that the deployer of LICK held approximately 40% of the total token supply at launch.

Such concentration is widely viewed by analysts as a warning sign, as it allows insiders to exert outsized control over price action and liquidity.

Bubblemaps claimed that the same individual tied to the alleged theft controlled the deployer wallet and a significant share of the supply during the token’s launch phase.

The launch attracted attention after blockchain investigator ZachXBT said the wallet associated with the token deployer was connected to tens of millions of dollars in crypto allegedly tied to U.S. government-seized assets.

In an X post on Jan. 23, ZachXBT claimed the individual behind the online alias “John Daghita,” also known as “Lick,” had displayed control over wallets holding approximately $23 million during a recorded dispute with another actor in a Telegram group.

Public records show that Command Services & Support, a Virginia-based firm whose president is Dean Daghita, received a U.S. Marshals Service contract in October 2024 to assist with the custody and disposal of certain digital assets seized by the government.

ZachXBT alleged that John Daghita, the president’s son, gained unauthorized access to wallets connected to those holdings.

The allegations have not been tested in court, and no criminal charges have been announced.

Meme Coin Chaos Deepens Across Solana’s Pump.fun Ecosystem

The incident has also drawn attention from policymakers, as Patrick Witt, director of the White House Crypto Council, said in a post on X that he was reviewing the claims following ZachXBT’s disclosures.

Additionally, Blockchain investigator Specter reported that John Daghita deposited $35.2 million into Tornado Cash over two days, draining his primary wallet.

Remaining funds were distributed across multiple wallets and chains.

Specter also flagged high-value ETH and SOL transfers and warned that recipients may be receiving stolen funds, citing ongoing links to related wallets and Telegram activity.

According to BitcoinTreasuries.NET, U.S. authorities may control more than 328,000 Bitcoin through various seizures, including assets from the Bitfinex case, potentially worth around $30 billion at current prices.

Beyond the specific allegations, the LICK collapse fits into a broader pattern within Solana’s meme coin ecosystem.

Data from early 2025 suggests that more than 98% of tokens launched on Pump.fun exhibit characteristics associated with rug pulls or rapid pump-and-dump schemes.

Recent cases have reinforced these concerns, as in December, Solana-based AI token AVA fell more than 96% after onchain analysis showed roughly 40% of its supply had been accumulated by wallets linked to the deployer at launch.

In January, the WhiteWhale memecoin briefly lost around 60% of its market value within minutes after a large holder sold a significant portion of the supply, an event widely described by traders as a rug pull despite later partial recovery.

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Trump Owns $870 Million Bitcoin Amid Crypto Market Meltdown