Bitcoin Liquidations Surge to $1.16 Billion; Economist Claims BTC Is 15% Lower vs. Gold

Economist Peter Schiff has renewed his criticism of bitcoin, questioning its status as “digital gold” after the cryptocurrency marginally dropped following Israel’s military strike on Iranian nuclear facilities.

Gold Surges After Israeli Strikes

Economist and bitcoin critic Peter Schiff appeared to reignite a feud with bitcoin maximalists by questioning bitcoin ( BTC)’s “digital gold” credentials after it plummeted 2% just moments following Israel’s strike on alleged Iranian nuclear facilities. According to data, bitcoin at one point traded at $103,081 late on June 12 before it appeared to stage a recovery.

Although the top digital asset and indeed the entire crypto economy were already in the red prior to Israel’s strike, the action appeared to exacerbate matters for BTC, with oil and stock markets also taking a hit. At the time of writing (June 13, 5 a.m. CAT), BTC traded around $103,327, down 4.5% from 24 hours earlier. The drop saw more than $1.16 billion in long and short positions liquidated within 24 hours.

Writing on social media, Schiff pointed to how BTC appeared to take a cue from traditional markets while gold, which is up more than 30% in 2025, went the opposite direction after the attack.

“Israel attacks Iran. Oil prices jump 5% while S&P futures fall 1.5%,” Schiff wrote. “In response, investors seeking a safe haven buy gold, sending its price up 0.85%. Meanwhile, investors dump Bitcoin, pushing its price down 2%. How can anyone consider Bitcoin to be a digital version of gold?”

‘Latecomers Left Holding the Bag’

According to Schiff, if bitcoin was indeed a digital version of gold, its price should have risen in line with that of the precious metal. Meanwhile, in an earlier post, the economist claimed that BTC was “now more than 15% below its Nov. 2021 peak” — that is, when priced in gold. He argued that BTC’s failure to rise against gold despite the hype that has lasted three and half years “is strong evidence that the bubble has peaked.”

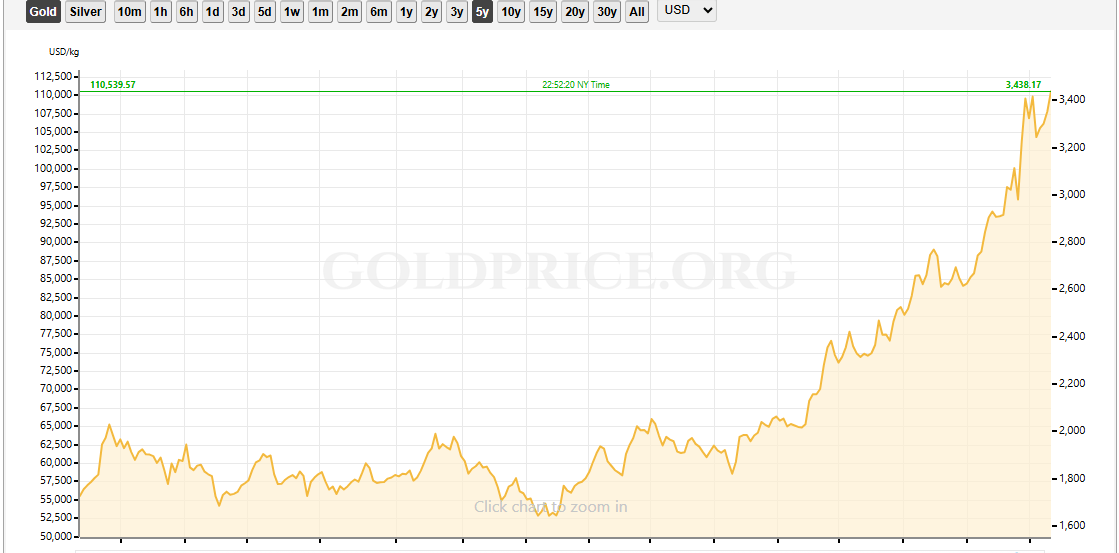

For context, in November 2021, BTC reached its then all-time high of just under $68,000, while gold was below $1,800 per ounce, as shown by data from financial data provider Goldprice.org. While gold continued to make incremental gains in the two years that followed, BTC trended downwards, and by November of the following year, it had dropped to a low of just under $16,000.

Since then, BTC has trended upwards, with the top digital asset hitting a new all-time high of $111,814 on May 22. Gold, on the other hand, commenced its rally in the last quarter of 2023, with the precious metal reaching its peak of around $3,500 in April.

However, despite BTC nearly doubling its price since its November 2021 peak, Schiff insisted that the cryptocurrency is 15% lower, when “priced in gold.” He ended the post stating:

“A major top has been formed, as Bitcoin has been distributed from strong to weak hands. The whales have been cashing out to latecomers who will be left holding the bag.”

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future