BlackRock’s Securitize Plans $1B Merger as $BEST Presale Soars Past $16M

KEY POINTS:

The real-world tokenization sector is set for another boost, as Securitize plans a $1B SPAC merger.

The real-world tokenization sector is set for another boost, as Securitize plans a $1B SPAC merger.

Backed by heavyweights like BlackRock, Morgan Stanley, and ARK Venture Fund, the project brings real-world assets like stocks, bonds, and real estate on-chain.

Backed by heavyweights like BlackRock, Morgan Stanley, and ARK Venture Fund, the project brings real-world assets like stocks, bonds, and real estate on-chain.

Meanwhile, the Best Wallet Token ($BEST) presale has crossed the $16.4M milestone, as investors increasingly opt for noncustodial wallets amid rapid crypto adoption.

Meanwhile, the Best Wallet Token ($BEST) presale has crossed the $16.4M milestone, as investors increasingly opt for noncustodial wallets amid rapid crypto adoption.

Securitize may soon go public through a $1B Special Purpose Acquisition Company (SPAC) merger with Cantor Equity Partners II Inc., a blank-check company sponsored by Cantor Fitzgerald LP. The deal isn’t final yet. If completed, it could bring more credibility and capital to the real-world asset (RWA) tokenization market, projected to grow to $16T by 2030.

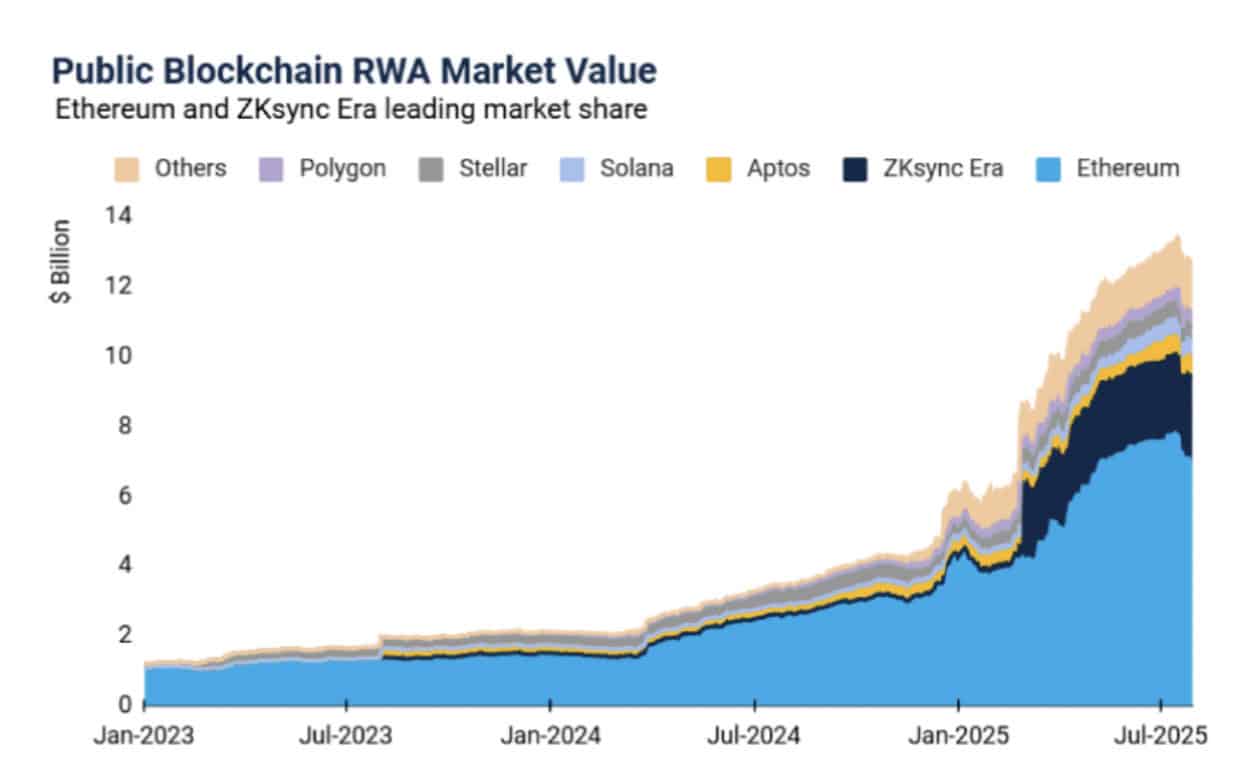

Source: Animoca Research

For those unfamiliar, Securitize is one of the leaders in RWA tokenization, backed by BlackRock, Morgan Stanley, and ARK Venture Fund.

Securitize on X

Securitize is known for powering BlackRock’s BUIDL, the largest on-chain US Treasury vehicle, worth over $ 2.8 billion. Next in line is Franklin Onchain US Government Money Fund (BENJI), which manages only one-third of that amount.

The project converts traditional financial instruments, such as stocks, bonds, funds, and real estate, into digital tokens.

Since they’re managed on the blockchain, they offer unmatched transparency compared to their traditional counterparts.

And being fractional, they unlock access to real-world assets, such as real estate, on a limited budget. Securitize is registered with the SEC and holds licenses in parts of Europe and Japan as well.

But more importantly, the move will benefit the broader market. Something as significant as this will encourage banks, funds, and asset managers to explore RWA tokenization on their own.

And who knows, more SPAC mergers might be on the way, building a future where traditional and blockchain assets can co-exist. Growing crypto adoption is not just evident in the real-world asset tokenization sector.

The rising demand for noncustodial wallets vividly demonstrates this trend, as investors seek safe storage for their digital assets.A good example is the viral Best Wallet Token ($BEST) presale. It just smashed through $16.4M, with whales snapping up tokens worth even $70.2K, $50.9K, and $49.5K in one go. What’s behind its growing popularity? Let’s find out.

Noncustodial Wallets in Demand as Crypto Adoption Grows – Is $BEST the Next Big Crypto to Explode?

The demand for secure, stress-free crypto wallets is rising faster than ever. Best Wallet bridges the gap. Best Wallet is a noncustodial wallet secured with Fireblocks MPC tech that allows users to manage their assets independently and control their private keys – without relying on exchanges or third-party platforms.

The wallet already supports five leading blockchains, including Ethereum, Bitcoin, Polygon, and BNB Chain, and plans to add 50 more. It’s practically the only wallet you’ll need to store all your digital assets in one place.

It comes as no surprise that the application boasts a growing community of hundreds of thousands of happy users on both Android and iOS. But the native crypto – Best Wallet Token – hasn’t been listed on exchanges yet, leaving a large upside for investors who buy early at low presale prices.

But the native crypto – Best Wallet Token – hasn’t been listed on exchanges yet, leaving a large upside for investors who buy early at low presale prices.

While the rising presale FOMO is expected to push the token up the charts after its initial exchange launch, what sustains the demand will be the wide range of utilities and perks tied to the token, as shown below. There isn’t much time left to join the presale, though. Having already crossed the $16.4M milestone, the sell-out is imminent. $ BEST is currently selling for $0.025785, but the next surge is expected within a day. The staking rewards – too good to pass up at 80% APY – also make early participation highly attractive, as the rate gradually declines with more investors joining in.

There isn’t much time left to join the presale, though. Having already crossed the $16.4M milestone, the sell-out is imminent. $ BEST is currently selling for $0.025785, but the next surge is expected within a day. The staking rewards – too good to pass up at 80% APY – also make early participation highly attractive, as the rate gradually declines with more investors joining in.

That’s conservative, given Best Wallet’s rapidly expanding feature-rich ecosystem, which also plans to launch a crypto debit card for everyday shopping in the next phase. Visit the $BEST presale to lock in early-bird prices and juicy staking APYs.

You May Also Like

Trump foe devises plan to starve him of what he 'craves' most

3 Crypto Trading Tips That Work