Bitcoin to $62K? Peter Brandt Weighs In—Here’s What the BTC Price Charts Suggest

The post Bitcoin to $62K? Peter Brandt Weighs In—Here’s What the BTC Price Charts Suggest appeared first on Coinpedia Fintech News

A Supreme Court decision on Trump’s tariffs is coming up, and it’s rattling markets again. Traders are even pricing in a high chance, around 70%, that the court could rule the tariffs illegal. That uncertainty has led to a pause in the crypto market.

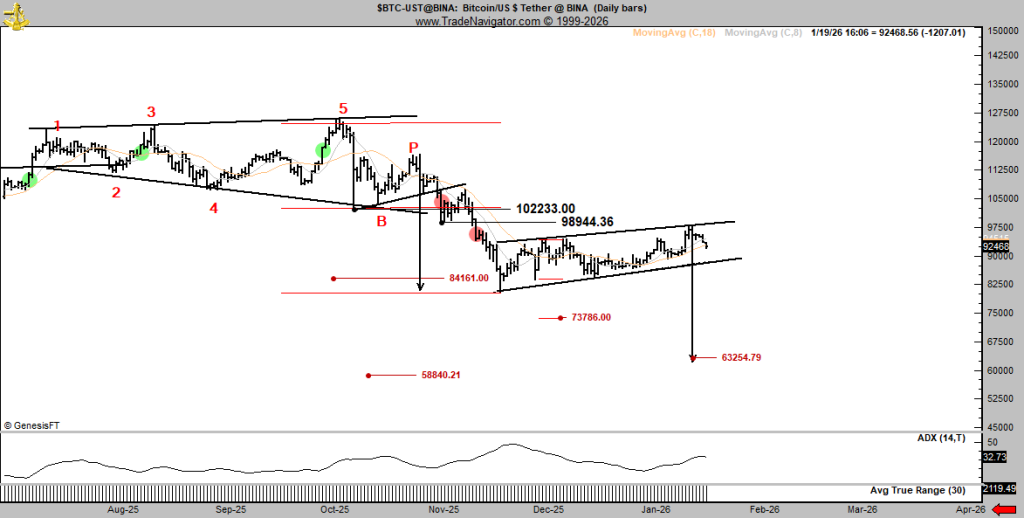

The Bitcoin price has already dipped below $92,000, sliding approximately 6% to 7% from its recent highs above $98,000. Some analysts now think this could turn into a deeper correction, with worst-case targets near $60,000. The big question is: can BTC bounce back, or is this just the start of a bigger pullback?

Is Bitcoin Price Heading to $60,000?

Before marking the ATH above $126,000 in early Q4, the Bitcoin price had surged above $124,000 a couple of times in Q3 2025. This displayed the bulls holding a tight grip over the rally, while the rejection that followed weakened them. Despite a bullish rebound, the bears successfully restricted the levels below $95,000, which has now become a strong psychological barrier to curb the bearish trajectory.

With the price facing a fresh pullback, a popular analyst, Peter Brandt, now believes the BTC price could have officially begun with a strong descending trend.

Analysts don’t pick $60,000 randomly. They often use “measured moves” after a topping breakdown. First, they measure the height of the prior range and project that distance below the breakdown level. Some also use an equal-leg projection, where the next selloff matches a previous down leg. The target is then cross-checked with historical support zones, like old consolidation floors or breakout areas. Since BTC is also moving inside a rising wedge/channel, a breakdown from that structure can add weight to a low-$60,000 target.

Interestingly, popular analysts like Ali and ColinTalksCrypto agree with this point and see this pullback in the coming 6 to 8 months.

Why Bitcoin Price May Drop in the Next Few Months?

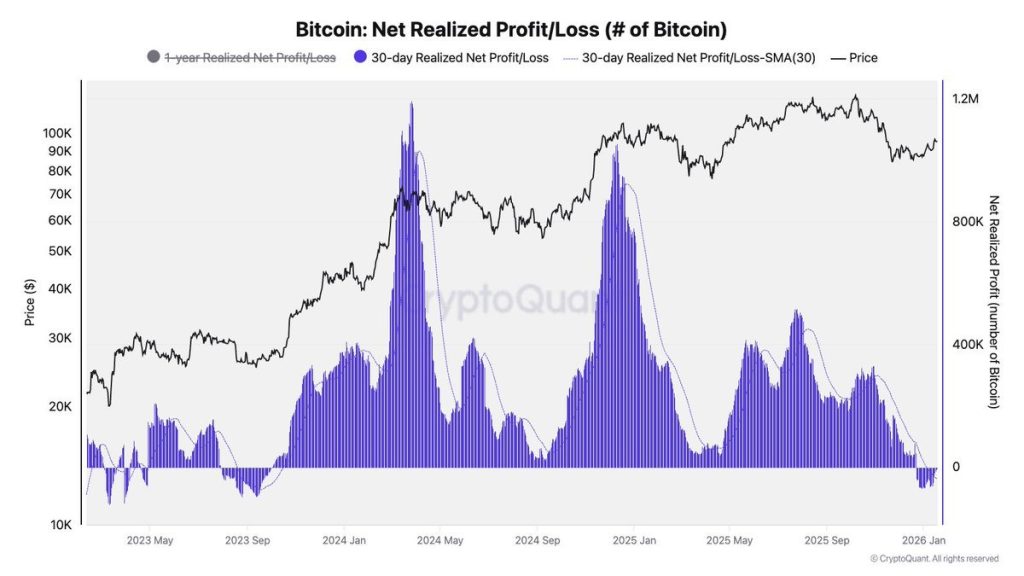

Bitcoin is showing signs of cooling as traders book fewer profits and price action turns choppy. The CryptoQuant “Net Realized Profit/Loss” chart tracks whether investors are selling in profit or at a loss. After months of strong profit-taking during rallies, the latest bars are sliding back toward zero and slightly negative. That shift often appears when demand weakens, and the market starts absorbing selling pressure. With momentum fading, some analysts are now mapping deeper downside zones.

Source: X

Source: X

This chart suggests profit-taking has dried up, and realized losses are starting to appear. When the 30-day net realized profit/loss dips below zero, it often signals stress: weaker hands sell, buyers hesitate, and support levels get tested. If that negative reading persists, BTC can enter a larger corrective phase rather than a quick dip. Analysts then combine this on-chain shift with technical downside projections and past support zones, which commonly cluster in the $60,000–$63,000 range.

What’s Awaited for the BTC Price Rally?

Both charts point to a market at a decision point. The realised profit/loss data shows profit-taking has cooled, and the reading is flirting with negative territory. This often appears when momentum fades and sellers gain room. At the same time, the price chart shows BTC compressing inside a rising wedge/channel after a drop, suggesting a breakout or breakdown is near. If the Bitcoin (BTC) price reclaims the $98K–$102K zone, bullish momentum can return. If it loses channel support, a deeper slide toward $73K and even $60K–$63K becomes more realistic.

Ayrıca Şunları da Beğenebilirsiniz

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

What Is Ripple Doing at Davos — and Who’s With Them?