Zcash (ZEC) Price: Privacy Coin Attracts Investors as Accumulation Grows

TLDR

- Zcash has a $6.8 billion market cap and shares Bitcoin’s 21 million coin supply limit and proof-of-work mining system.

- The cryptocurrency offers privacy features using zk-SNARKs technology that hide transaction details from public view.

- Whale investors increased their Zcash holdings by 6.7% over the past week, showing growing confidence.

- Technical indicators including Chaikin Money Flow show bullish divergence and positive capital inflows.

- Zcash is trading near $396 and could rally toward $504 and $540 if it breaks above $450 resistance.

Zcash is trading near $396 after recent sideways movement. The privacy-focused cryptocurrency has a market cap of $6.8 billion.

Zcash (ZEC) Price

Zcash (ZEC) Price

The coin shares several features with Bitcoin. Both use proof-of-work mining and have a maximum supply of 21 million coins. Both experience halving events approximately every four years.

The main difference is Zcash’s privacy technology. The cryptocurrency uses zk-SNARKs cryptography to hide transaction details. This means users can send money without revealing sender, receiver, or amount information to the public.

About 20% of each mined Zcash block goes to development funds. These funds support ongoing upgrades and community projects. This self-funding mechanism helps maintain the network’s development.

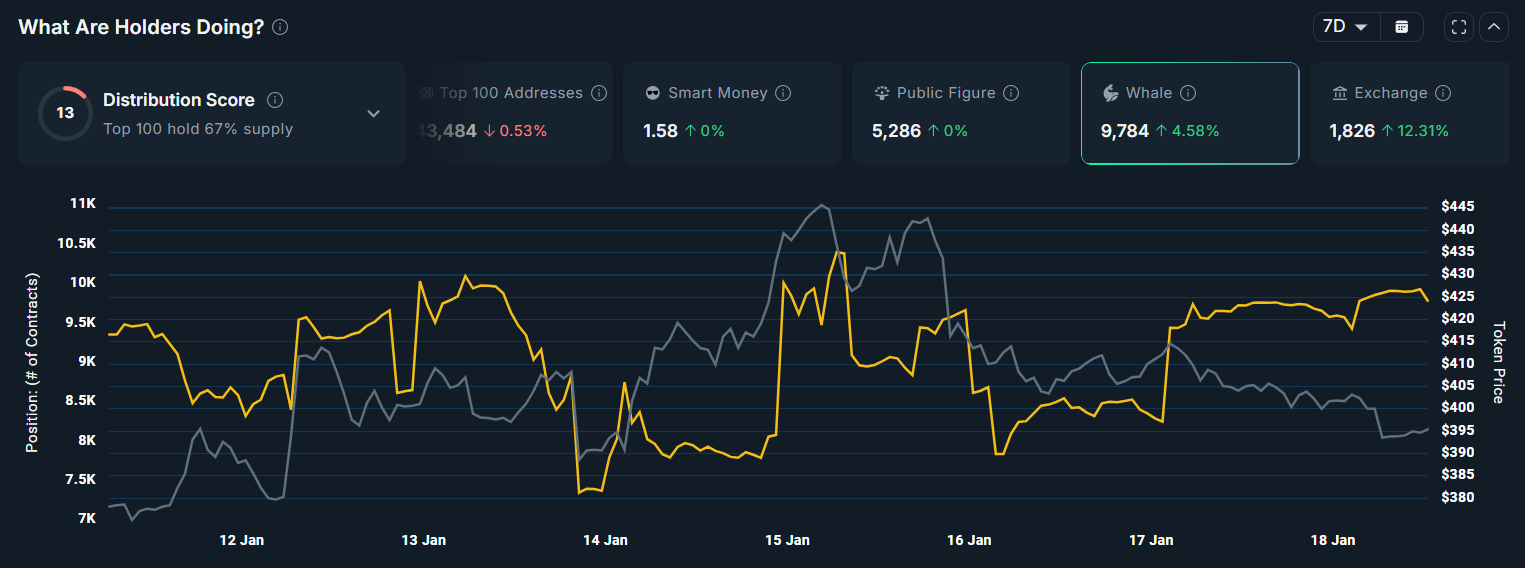

Growing Whale Accumulation

Large investors have been buying Zcash recently. Addresses holding more than $1 million worth of ZEC increased their holdings by 6.7% over the past week.

Source: Nansen

Source: Nansen

This steady accumulation signals growing confidence from major players. The buying pace has remained consistent rather than sudden.

The Chaikin Money Flow indicator recently climbed above zero. This confirms a shift toward net capital inflows into Zcash.

Technical Setup Points to Potential Rally

Zcash is currently trading within a triangle pattern on price charts. The coin recently dropped below the $405 support level.

Technical indicators show bullish divergence forming. While the price has made lower lows, the Chaikin Money Flow has created a lower high. This suggests buying pressure that hasn’t yet reflected in the price.

A break above $450 would confirm a bullish breakout from the triangle pattern. If this happens, Zcash could rally toward $504. Further strength might push the price to $540.

The downside risk remains present. If selling pressure emerges and the triangle breaks down, Zcash could fall toward $340.

For Bitcoin to reach Zcash’s current market cap, the privacy coin would need to grow from $6.8 billion to $1.9 trillion. Bitcoin has risen about 160% over the past five years.

Zcash trades at $396 as of January 18, 2026. The cryptocurrency continues to show signs of accumulation from large holders while technical indicators suggest a potential upward move.

The post Zcash (ZEC) Price: Privacy Coin Attracts Investors as Accumulation Grows appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

A trader closed his ASTER position for a profit of $435,000 and resumed shorting BTC.

Tether CEO Delivers Rare Bitcoin Price Comment