XRP Breakout Possible Before The Weekend, Expert Says

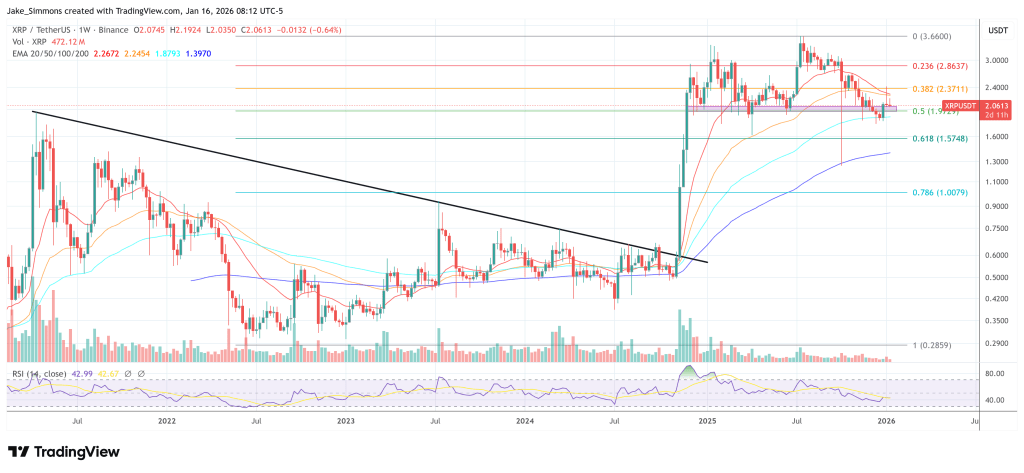

XRP could be approaching an inflection point as a closely watched chart pattern tightens into its apex and broader “risk-on” signals in equities flash green, according to XRPL developer Bird (@Bird_XRPL).

In a series of posts on X, Bird, the developer behind XRPL meme coin DROP, pointed to XRP’s hourly structure as setting up for a decisive move “before the end of the week,” arguing that a technical breakout could accelerate quickly toward a nearby upside objective.

“Take a look at XRP on the hourly. A move is about to happen before the end of the week,” Bird wrote alongside a chart showing a contracting triangle with price compressing into the tip. “A measured move if we send upwards could push us straight to that $2.69 mark which finally gets us into ‘bull run’ mode.”

Russell 2000 Breakout Puts XRP on Alert

Beyond the short-term pattern, Bird anchored his thesis to US small caps, arguing that the Russell 2000’s behavior has historically mattered for XRP and the broader altcoin complex.

“The Russell 2000 is about to close its highest weekly close in history. That matters ALOT for XRP,” Bird said. “Historically, XRP and altcoins have always tracked the Russell 2000 extremely closely. It’s the true risk on index for mid caps (not mega caps like the S&P or MAG7 where most capital has been parked).”

Bird’s argument is that XRP still trades more like a mid-cap risk asset than a mega-cap “store of value” proxy, making the Russell’s breakout a useful macro tell for when speculative capital rotates back into higher beta exposures. He described the current backdrop as “capital rotating” and “risk … back on,” suggesting that the market may be entering a window where positioning can change quickly if narratives align.

In a longer follow-up thread, Bird described XRP’s extended consolidation as increasingly out of sync with what he views as constructive macro conditions across risk assets.

“We’re at a genuinely clinical moment for XRP. We’ve gone sideways for over a year, yet the Russell 2000 is now in full price discovery, other stock markets have been at all time highs for a long time, metals are elevated, and Bitcoin dominance is chopping at levels that historically dumps at,” he wrote.

Bird also pointed to a prior episode as a reference point: “In November ’24, the Russell turned green and XRP went parabolic roughly 10 days later,” he said, arguing that this time the Russell has gone further by reclaiming highs and holding strength across timeframes. In his view, the remaining constraint is rotation, not necessarily a sharp drawdown in metals or other assets, but simply a pause that allows risk appetite to re-price.

On XRP and Ripple specific context, Bird said “acquisitions done, partnerships rolling out, NDAs lifting, legal clarity forming,” and argued that the market is nearing a point where “a single narrative, catalyst, or push can ignite XRP fast.”

The key near-term test is whether the tightening technical structure resolves upward as Bird expects and whether cross-asset risk appetite continues to support alt beta. If both align, Bird’s framework suggests traders will be watching for a momentum break that could carry XRP toward the $2.69 objective and, in his view, potentially open the door to a faster path toward fresh cycle highs.

At press time, XRP traded at $2.06.

Ayrıca Şunları da Beğenebilirsiniz

Trade War Headlines Trigger $800M In Liquidations Overnight: Longs Get Wiped Out Across Crypto Markets

Rokid Ai Glasses Style Now Available Globally