Zcash Price Prediction: ZEC Jumps 10%, Is It The Best Crypto to Buy Now?

While Bitcoin and many altcoins remain stuck around critical price zones, Zcash (ZEC) has already posted one of the year’s most notable rallies and continues to show strength as fresh developments influence its short-term outlook.

Over the last 24 hours, $ZEC has climbed around 10%, outperforming a largely sideways broader market and now trades slightly above $442.

This move appears driven by a mix of improving regulatory sentiment, bullish technical signals, and ongoing network upgrades, leading analysts to revisit the Zcash price prediction and evaluate whether it still ranks among the best crypto to buy now.

Zcash Surges on Regulatory Signals, but Is the Move Sustainable?

Zcash’s latest upswing is being driven by rising optimism around regulation. The US SEC Privacy Roundtable held on December 15 suggested a changing stance, acknowledging privacy as a valid component of financial systems rather than a risk factor.

Privacy-enabled transactions, a core feature of Zcash, fit into this evolving regulatory outlook, easing delisting concerns and strengthening confidence among institutions. In addition, Cypherpunk Technologies’ $68 million $ZEC treasury purchase highlights growing interest from professional market participants.

Even with these positive developments, some analysts, including Raoul Pal, warn that the recent price jump could reflect capital reallocation instead of a true structural breakout.

He notes that Zcash still needs to demonstrate sustained strength. A genuine bullish trend is confirmed only when an asset continues to outperform as the wider market advances. At present, Zcash seems supported more by short-term positioning than long-term conviction.

Source – Cilinix Crypto YouTube Channel

Zcash Advances Node Architecture With Zebra 3.1.0 Release

The launch of Zebra 3.1.0 represents a meaningful milestone in Zcash’s shift toward a modern, Rust-based node framework. This release improves Docker functionality across ARM64 and AMD64 architectures, maintaining support for platforms like Apple Silicon and cloud-hosted ARM environments.

Enhanced multi-architecture handling now allows users to automatically pull the appropriate images, resolving earlier compatibility challenges. Zebra 3.1.0 also adds a mempool dust filter that prevents transactions with extremely small outputs, helping limit spam and lower resource strain for node operators.

Source – znfd.org

In addition to core updates, Zebra 3.1.0 upgrades the RPC interface by expanding maximum response sizes and offering increased configuration flexibility. This enables developers and infrastructure services to efficiently access large sets of node data.

Although these changes may not produce immediate effects for everyday users, they help reinforce the network infrastructure that supports Zcash’s long-term resilience and indirectly bolsters the $ZEC market.

Zcash Price Prediction

Zcash price prediction analysis points to a potential breakout after an extended consolidation phase above the $375 level, which previously acted as a key value area high.

Price action has shown resilience, holding momentum while volume remains consistently strong, suggesting underlying strength rather than exhaustion.

A confirmed move above the $450 resistance could open the door for a rally toward the $455–$465 zone, where a liquidity gap and key technical levels align. If bullish conditions persist, upside extensions toward $470 and even the $515–$540 range remain possible.

However, further confirmation is still required before declaring a sustained breakout. Overall, the outlook leans cautiously bullish, with higher targets dependent on holding momentum and clearing near-term resistance levels.

Why Investors Are Eyeing This Presale as the Top Crypto to Buy Now

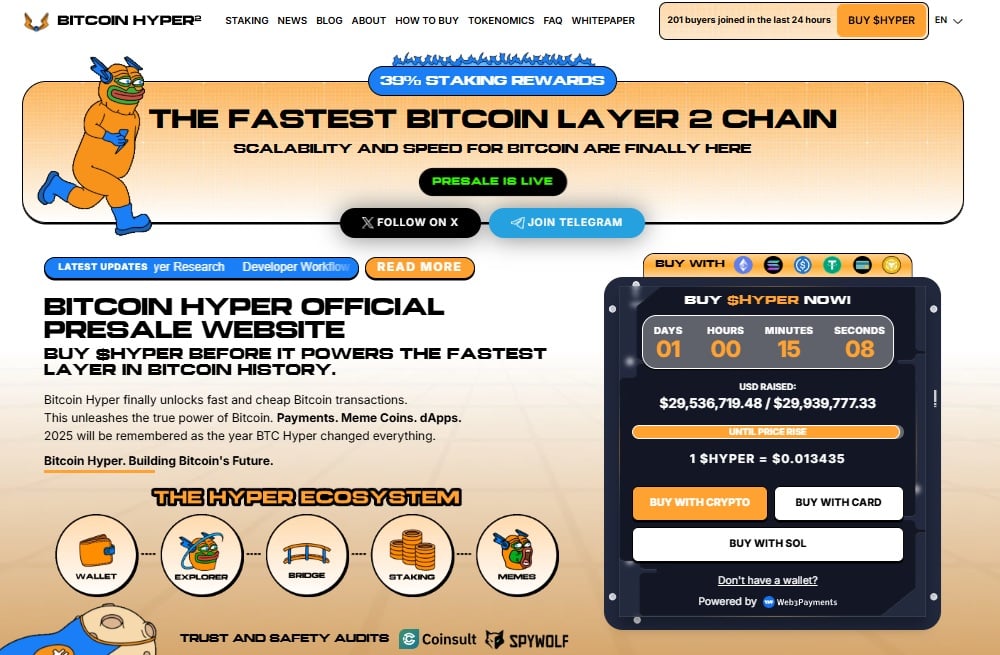

Bitcoin Hyper (HYPER) is one of the most innovative additions to the Bitcoin ecosystem, offering a high-speed layer 2 solution designed for efficiency and scalability. By creating a parallel blockchain that mirrors Bitcoin, users can send, receive, and interact with BTC almost instantly and with minimal fees.

This layer 2 system leverages zero-knowledge proofs and a canonical bridge to ensure transactions remain secure and fully trustless, aligning with Bitcoin’s decentralized principles.

The project has already secured close to $30 million in its current presale, offering up to 39% staking APY. Investors can purchase $HYPER tokens at $0.013455 using a bank card or cryptocurrency via the Best Wallet app.

Alongside Zcash, benefiting from upgrades like Zebra 3.1.0, Bitcoin Hyper offers technical advantages that boost usability and long-term potential. Together, these cryptos are gaining attention as top crypto to buy now for innovation and network efficiency.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

Ayrıca Şunları da Beğenebilirsiniz

Wormhole launches reserve tying protocol revenue to token

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected