Hyperliquid (HYPE) Plunges 5% Again, Bitcoin (BTC) Defends $90K Level: Weekend Watch

Bitcoin’s price dipped below $90,000 again yesterday after failing at $94,000, but it has managed to reclaim that level on Saturday morning.

Ethereum, Solana, and Cardano have also declined over the past day by up to 4% in the case of ETH, which is just inches above $3,100.

BTC Defends $90K

The primary cryptocurrency had quite a volatile trading week, mostly influenced by the Wednesday FOMC meeting. As the anticipation built about another interest rate cut by the central bank, BTC skyrocketed from under $90,000 to a new multi-week peak of $94,500 on Tuesday.

It retreated slightly before the meeting, but once the Fed made the 25 bps rate reduction official, bitcoin went on the offensive once again, but was capped at $94,400. This time, the rejection was more violent and resulted in a price drop to under $89,500.

The bulls initiated another leg up to $93,600 on Thursday, but BTC couldn’t keep climbing. It calmed at $92,500 by Friday when it suddenly dumped by around three grand before it quickly reclaimed the $90,000 support. It has remained above that level since then, despite the most recent Donald Trump remarks on the interest rate front and the escalating tension with Venezuela.

Its market cap is still above $1.8 trillion on CG, while its dominance over the alts stands at 56.9%.

BTCUSD Dec 13. Source: TradingView

BTCUSD Dec 13. Source: TradingView

HYPE, ENA Keep Dropping

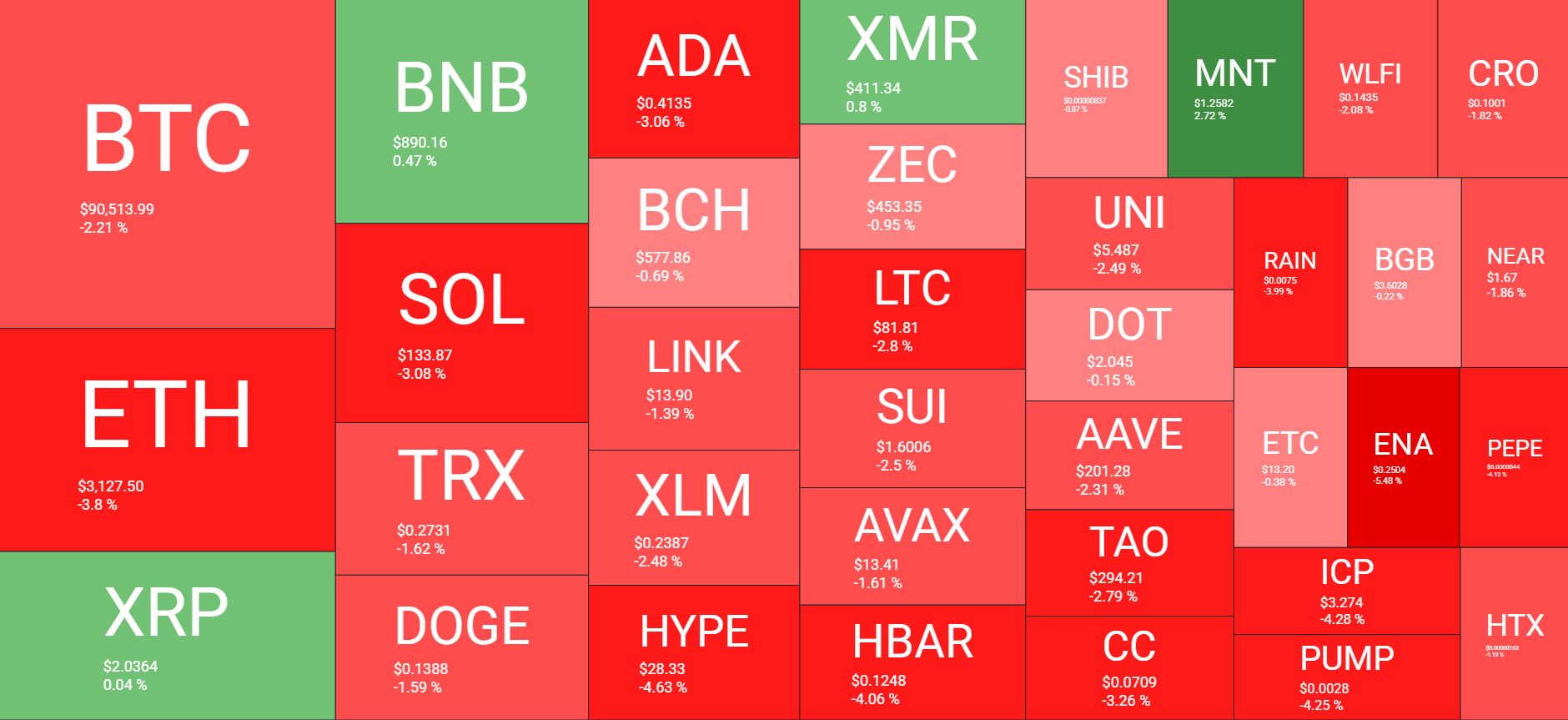

Ethereum dipped below $3,100 during Friday’s correction. Although it has reclaimed that level since then, it’s still 3.8% down on the day. SOL and ADA have declined by 3% each, while TRX, DOGE, LINK, and XLM have posted losses of around 1.5%-2.5%. HYPE and ENA have dropped by 4-5% to $28 and $0.25, respectively.

In contrast, HASH has skyrocketed by 13.5% to $0.03. M follows suit with an 8% surge that has taken it to $1.67 as of press time.

The total crypto market cap has shed around $40 billion in a day and is down to $3.175 trillion on CG.

Cryptocurrency Market Overview Daily Dec 13. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily Dec 13. Source: QuantifyCrypto

The post Hyperliquid (HYPE) Plunges 5% Again, Bitcoin (BTC) Defends $90K Level: Weekend Watch appeared first on CryptoPotato.

Ayrıca Şunları da Beğenebilirsiniz

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Gold continues to hit new highs. How to invest in gold in the crypto market?