Ethereum Liquidity Wave Could Set The Stage for a $10,000 Surge

- Ethereum trails Bitcoin in liquidity gains, but exchange outflows and U.S. institutional demand hint at a $10,000 target.

- On-chain data shows ETH supply declining on exchanges, suggesting a potential revaluation aligning with global liquidity expansion.

Ethereum appears poised to attract investors after on-chain analysts from XWIN Research Japan on CryptoQuant assessed that a strong surge in global liquidity could push its price towards $10,000.

As of the writing time, ETH is changing hands at about $4,540, with a 4-hour gain of 0.59%, a 24-hour decline of 0.46%, and a 7-day gain of 9.85%. Its market cap is around $549.01 billion, with a daily spot volume of $4.79 billion.

According to XWIN, over the past three years, the M2 money supply in the United States has increased sharply, reaching approximately $22.2 trillion. This surge in liquidity was first reflected in Bitcoin, which has risen by more than 130% since 2022.

Ethereum, however, lagged behind, increasing by only around 15%. Analysts refer to this phenomenon as liquidity lag, where ETH has not yet fully responded to the surge in global liquidity.

Institutional Flows Push Ethereum ETFs to $28 Billon Holdings

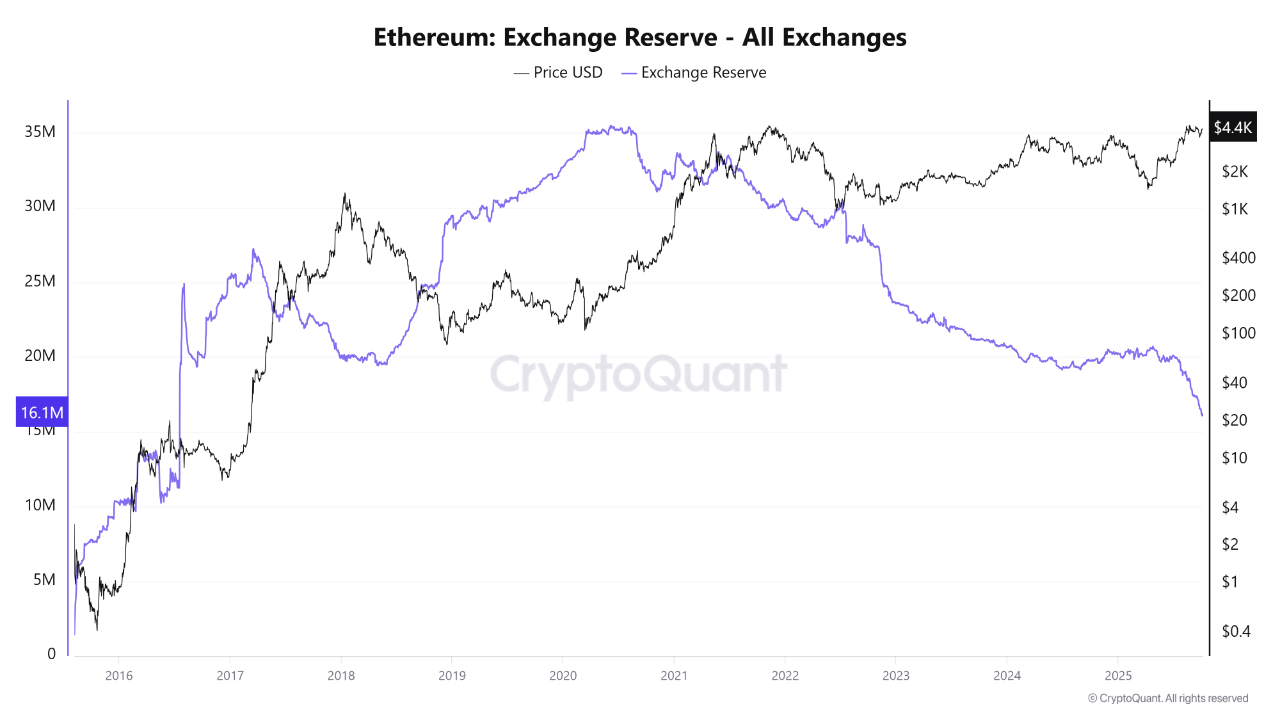

The latest on-chain data shows a different situation than in previous years. ETH reserves on exchanges have dropped drastically to 16.1 million units, a decrease of more than 25% since 2022. In fact, two weeks ago, the exchange balance was recorded at just 14.8 million ETH after approximately 2.7 million ETH worth $11.3 billion was withdrawn in one month.

Source: CryptoQuant

Source: CryptoQuant

A decrease in supply on exchanges typically reflects reduced selling pressure as assets are moved to private storage or locked in staking contracts.

Furthermore, capital flows into investment products are also evident. Ethereum ETFs in the United States now hold approximately 6.75 million ETH worth nearly $28 billion. This figure demonstrates increasing institutional investor confidence in this asset.

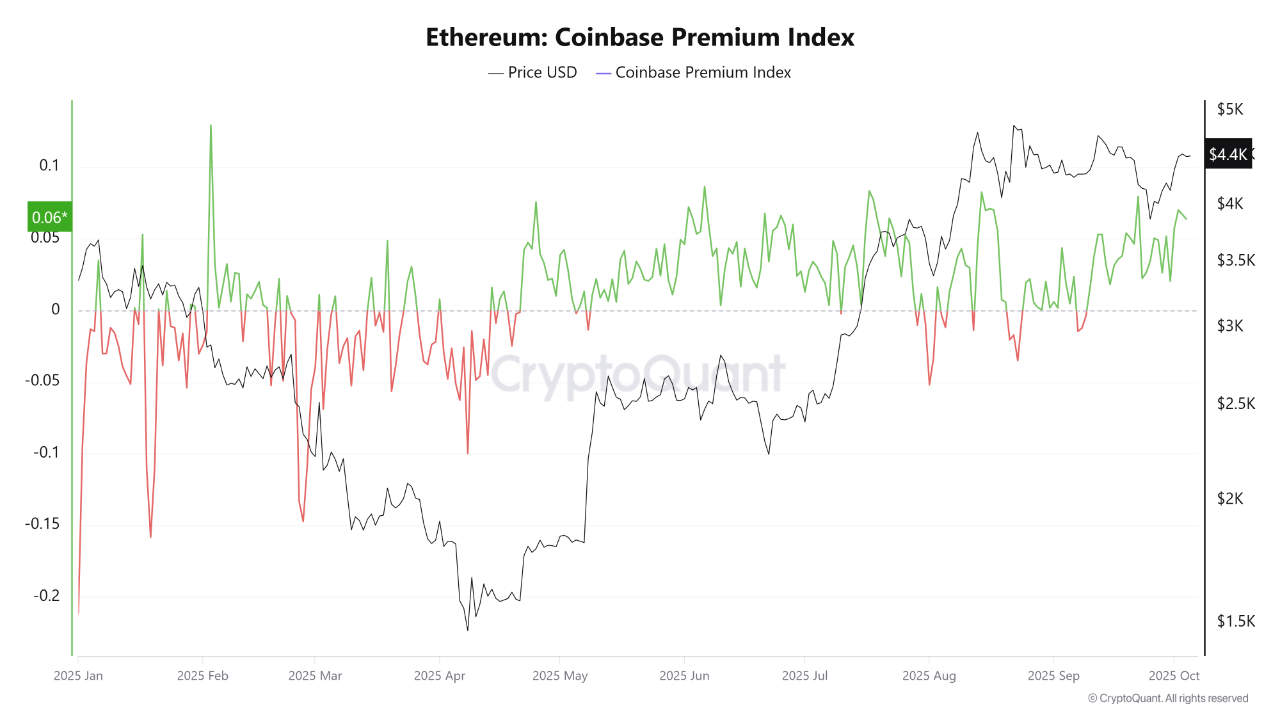

Meanwhile, the Coinbase Premium index has returned to positive territory, indicating renewed demand from large players in the US market. Similar conditions occurred in early 2020 and 2021, followed by a prolonged rally.

Source: CryptoQuant

Source: CryptoQuant

Potential Rotation from Bitcoin to Altcoins

On the other hand, analysts have highlighted a historical pattern where Ethereum is often late to monetary easing cycles. Typically, Bitcoin leads the rally first, then when BTC dominance falls below 60%, capital begins to flow into altcoins.

The ETH/BTC ratio has also strengthened. This pattern appears to be reappearing in 2025, opening the possibility of a new phase where Ethereum could take a leading role.

Furthermore, the CNF also noted at the end of September that Ethereum’s downside liquidity had been completely absorbed, leaving the market vulnerable to a potential short squeeze.

On-chain indicators show a fragile balance, where aggressive selling can suddenly reverse into a sharp surge in buying. This situation often fuels unexpected movements.

]]>Ayrıca Şunları da Beğenebilirsiniz

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

MMDA, sleep health organization launch drowsy driving campaign ahead of holidays