Trading time: Trump releases positive news to boost the crypto market, Bitcoin breaks $100,000 again, Ethereum surges 20%, analysis reminds of the seasonal pattern of "sell in May"

1. Market observation

Keywords: SOL, ETH, BTC

After the United Kingdom and the United States reached a trade agreement, Trump immediately encouraged investors to "buy stocks now." This series of good news ignited market optimism. According to the agreement, the export tariffs on British steel and aluminum products to the United States will be abolished, and the automobile tariff will be significantly reduced from 27.5% to 10%. However, the 10% "reciprocal tariff" previously imposed by the United States will remain. Boosted by this, the three major U.S. stock indexes rose collectively, with the S&P 500 index rising nearly 1.6% at one point, and the Nasdaq soaring 2%. At the same time, the U.S. dollar index returned to above the 100 mark, resulting in a general weakening of non-U.S. currencies. Gold was also under pressure due to the strengthening of the U.S. dollar. Spot gold fell below $3,300 overnight, a drop of nearly 2%.

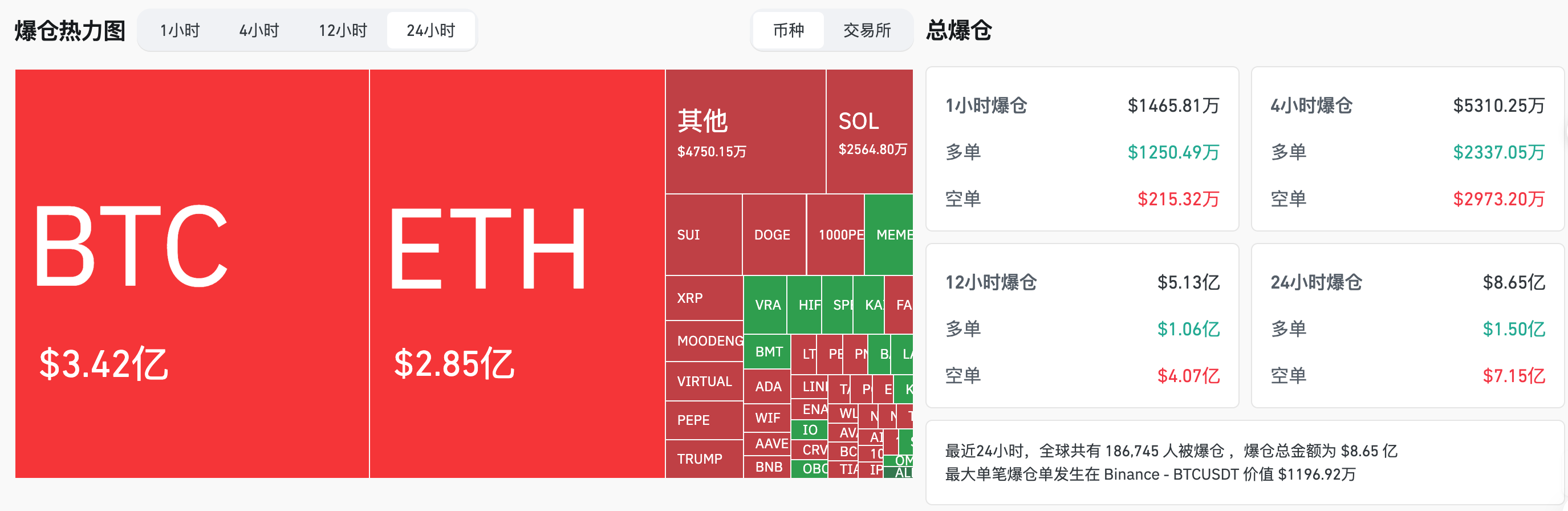

The cryptocurrency market was also boosted by Trump's call. Bitcoin broke through the $100,000 mark for the first time since February, and hit $104,000 this morning, briefly surpassing Amazon to become the world's fifth largest asset. This strong rise led to a short position blowout of $836 million yesterday, making it the largest single day in history. Geoffrey Kendrick, head of digital assets at Standard Chartered Bank, said that the previous target of $120,000 for Bitcoin in the second quarter "may be too conservative." However, BTSE Chief Operating Officer Jeff Mei also reminded investors to pay attention to the seasonal pattern of "selling in May" - historical data shows that Bitcoin fell 35% in May 2021 and 15% in May 2022.

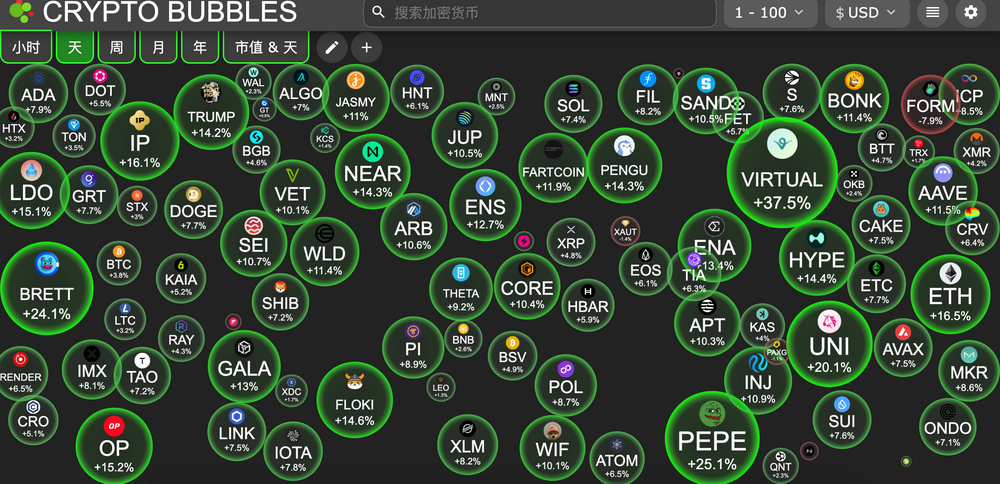

Ethereum performed even better, soaring more than 20% in a single day, breaking through $2,200, and the ETH/BTC ratio returned to the 0.02 level after a month. Despite this, Ethereum still has a lot of room to rise to return to its historical high of 0.05. It is worth noting that despite the price increase and the recent Pectra upgrade of the network, Ethereum network activity remains flat, with weak growth in transaction volume and active addresses. Since 2021, on-chain activities at the base layer have stagnated, and institutional demand has generally been on a downward trend. Therefore, the sustainability of its upward trend remains to be seen.

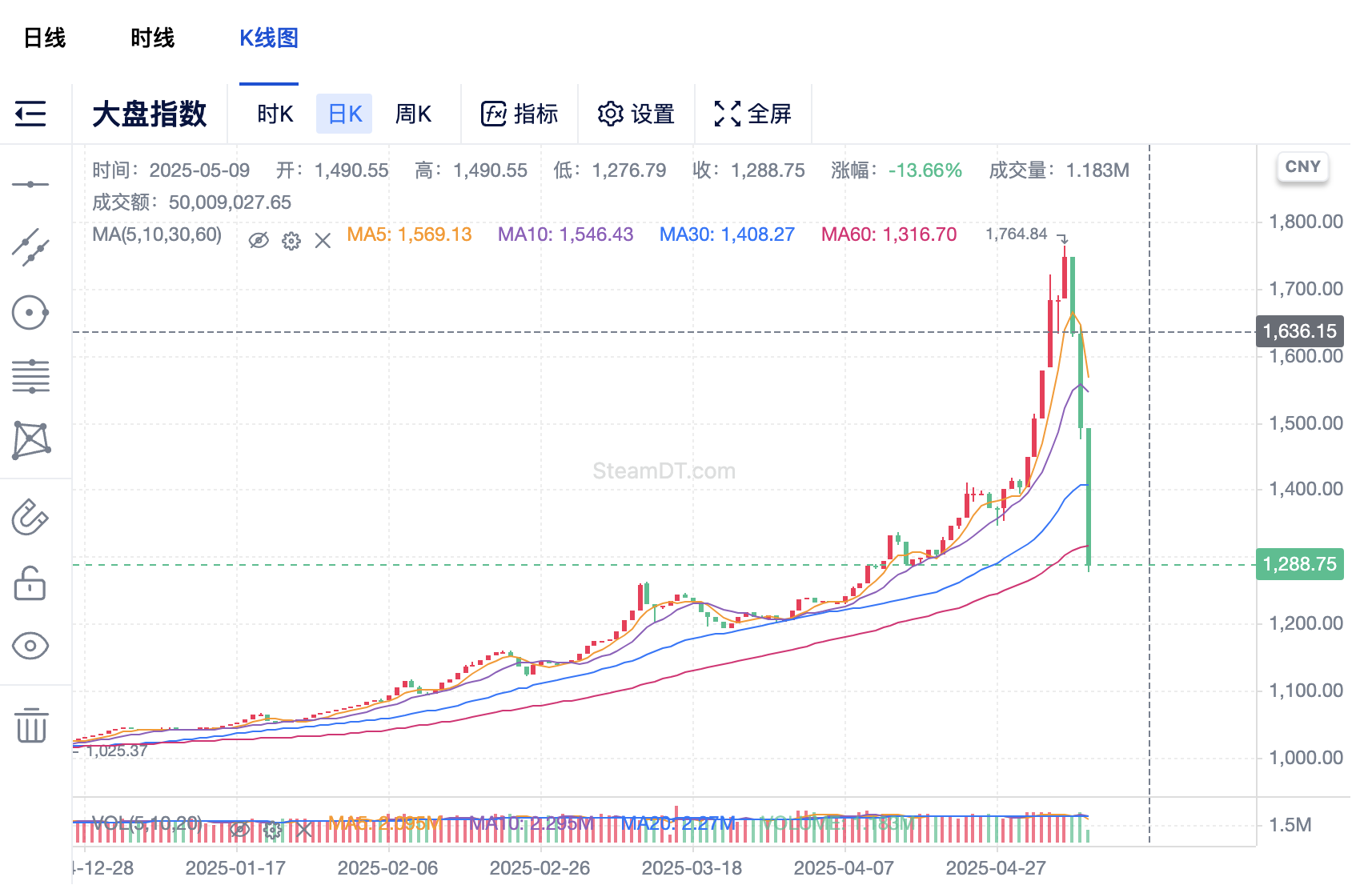

The altcoin market followed the trend of mainstream coins and rose across the board, with some strong coins rising by more than 20%. Many projects in the Ethereum ecosystem performed particularly well, such as MOODENG, NEIRO, PEPE, EIGEN, LQTY, ETHFI, etc., with increases of more than 30%. In contrast, Solana's rise was relatively mild, rising only 8% to $162, and its on-chain activities seemed to be diverted by the secondary market, with no high-quality fast-through disks appearing in the past 24 hours. Interestingly, there is a clear conversion of capital flows between crypto assets and other digital asset markets - the CS jewelry market has fallen sharply in recent days, forming an almost opposite trend to the crypto market, and basically recovering the gains of the previous week.

The CS jewelry market has seen a sharp decline

2. Key data (as of 12:00 HKT on May 9)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN, Steamdt)

-

Bitcoin: $102,546 (+9.78% YTD), daily spot volume $47.583 billion

-

Ethereum: $2,214.65 (-33.49% YTD), with daily spot volume of $37.764 billion

-

Fear of Greed Index: 73 (Greed)

-

Average GAS: BTC 1.01 sat/vB, ETH 1.07 Gwei

-

Market share: BTC 63.4%, ETH 8.3%

-

Upbit 24-hour trading volume ranking: XRP, LAYER, BTC, ETH, VIRTUAL

-

24-hour BTC long-short ratio: 0.9623

-

Sector gains and losses: Meme sector rose 10.14%, AI sector rose 9.98%

-

24-hour liquidation data: A total of 186,745 people were liquidated worldwide, with a total liquidation amount of US$865 million, including BTC liquidation of US$342 million, ETH liquidation of US$285 million, and SOL liquidation of US$25.86 million

-

BTC medium and long-term trend channel: upper channel line ($97519.88), lower channel line ($95588.79)

-

ETH medium and long-term trend channel: upper line of the channel ($1914.51), lower line ($1876.60)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 8)

-

Bitcoin ETF: $117 million

-

Ethereum ETF: -$16.11 million (net outflow for 3 consecutive days)

4. Today’s Outlook

-

Doodles will launch $DOOD airdrop tonight at 21:05

-

Coinbase plans to launch 24/7 Bitcoin and Ethereum futures trading on May 9

-

Movement (MOVE) will unlock approximately 50 million tokens at 8:00 PM on May 9, accounting for 2.0% of the current circulation and worth approximately $8.7 million.

The stocks with the largest increases in the top 500 by market value today: MOODENG up 100.15%, PNUT up 48.05%, NEIRO up 42.06%, VIRTUAL up 32.50%, and EIGEN up 30.49%.

5. Hot News

-

CleanSpark's quarterly revenue increased by 62.5% year-on-year, and its Bitcoin assets are close to $1 billion

-

Mining company MARA's Q1 revenue increased by 30%, and its Bitcoin holdings soared to 47,531

-

Ripple and SEC formally reached a settlement agreement and intends to settle the case with $50 million

-

Acurast will launch its token sale on CoinList at 1:00 AM on May 16

-

Stablecoin GENIUS bill fails in Senate vote, Democrats accuse Trump of currency conflict of interest

-

Coinbase's first-quarter revenue fell short of expectations, trading activity fell 10%

-

Coinbase to List Space and Time (SXT)

-

DeFi Development Corp, a listed company, spent about $2.97 million to increase its holdings by 20,473 SOL

-

Trump: US will raise $6 billion in external revenue by imposing 10% tariffs on UK

-

The US SEC is studying tokenized securities registration exemption scheme to accelerate the application of distributed ledger technology

-

Arbitrum DAO approves 35 million ARB allocations to Franklin Templeton, Spiko, and WisdomTree’s tokenized U.S. Treasury bonds

-

The top 9 whales on the Trump dinner list are suspected of clearing all their tokens. If they sell, they will lose $434,000

-

Coinbase to acquire crypto options platform Deribit for $2.9 billion

-

Missouri may exempt cryptocurrencies and stocks from capital gains tax

-

Indian listed company Jetking plans to raise funds to gradually increase its holdings of Bitcoin, with the goal of hoarding a total of 18,000 Bitcoins by 2030

-

The Sei community is considering abandoning the Cosmos native account and switching to the EVM architecture

-

Upbit will list Celestia(TIA) and io.net(IO)

You May Also Like

Financing Weekly Report | 13 public financing events; Privacy blockchain Miden completes $25 million seed round, led by a16z Crypto and others

Are Paid Trading Courses Worth It? I Bought 3 to Find Out