Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

1. Market observation

Keywords: ALPACA, MIKAMI, BTC

The May Day holiday is coming, and the United States will release GDP data for the first quarter of 2025 tonight, which will be an important assessment of the economic situation in the early days of Trump's administration. Morgan Stanley lowered its GDP forecast for the first quarter from zero growth to a year-on-year decline of 1.4%, Goldman Sachs lowered it from -0.2% to -0.8%, and JPMorgan Chase adjusted it to -1.75%. Under the wave of panic buying triggered by Trump's tariff threats, the surge in corporate imports has led to a widening trade deficit. Analysts believe that stockpiling before tariffs has distorted economic data, and the actual damage may be exaggerated. In addition, the US non-farm payrolls data will be released on May 2, becoming another market focus. Economists warn that the tariff war launched by the Trump administration may lead to severe turbulence in the US labor market, increasing the possibility of the Federal Reserve's interest rate cut in June. Slok, chief economist of Apollo, a Wall Street asset management institution, predicts that the US labor market may weaken significantly in the coming months. The market generally believes that the tariff dispute may exacerbate inflation, increase unemployment, and even trigger an economic recession.

Bitcoin has been fluctuating around $94,000-95,000 for a week, and has returned to the cost basis level of short-term holders (about $92,900). Most institutions are optimistic about Bitcoin. Among them, Geoffrey Kendrick, head of global digital asset research at Standard Chartered Bank, predicts that Bitcoin is expected to reach a record high of about $120,000 in the second quarter. Bernstein analysts believe that now is the time to buy and maintain the target price of $200,000 at the end of the year, predicting that Bitcoin will reach $500,000 by the end of 2029 and $1 million by the end of 2033. This optimism resonates with MicroStrategy's large increase of $1.42 billion last week-the company purchased 15,355 bitcoins at an average price of $92,737. In addition, Japanese fashion brand ANAP, US real estate company Cardone Capital, and Brazil's largest commercial bank Itaú have also recently announced that they will join the ranks of Bitcoin reserves. It is worth noting that Trump's "Bitcoin Strategic Reserve" executive order will also usher in a key node on May 5. QCP Capital analysis believes that this capital inflow led by traditional financial institutions makes this round of market more sustainable than before.

Binance's recently launched Alpha Points System has become a new battlefield for airdrop hunters, but the speed of new projects is getting faster and faster, and the difficulty of obtaining points is gradually increasing. Recently launched projects such as Sign, MilkyWay, Haedal Protocol, and B² Network have made players call it "getting harder and harder". The market joked that Binance must have a master behind this move. In addition, ALPACA staged a "dying struggle" before it was about to be delisted from Binance on May 2. The price plunge and explosion became the norm, and the amount of liquidation within 24 hours was nearly 40 million US dollars. After the BONK project launched Letsbonk.Fun, the boop.fun platform that NFT whale dingaling is about to release attempted to continue the community's enthusiasm with the promise of "airdropping at launch". After launching NFT, Japanese actress Yua Mikami once again issued the Meme coin MIKAMI, but made it clear that it was not for the Japanese market. Looking back on the past, similar projects of actresses issuing coins have mostly ended in failure, and the market is cautious about its prospects.

2. Key data (as of 12:00 HKT on April 30)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $95,039.82 (+1.56% YTD), daily spot volume $24.702 billion

-

Ethereum: $1,808.70 (-45.91% YTD), with daily spot volume of $13.769 billion

-

Fear of corruption index: 56 (neutral)

-

Average GAS: BTC 2.25 sat/vB, ETH 0.35 Gwei

-

Market share: BTC 63.5%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: PUNDIX, SIGN, XRP, SAFE, DRIFT

-

24-hour BTC long-short ratio: 1.03

-

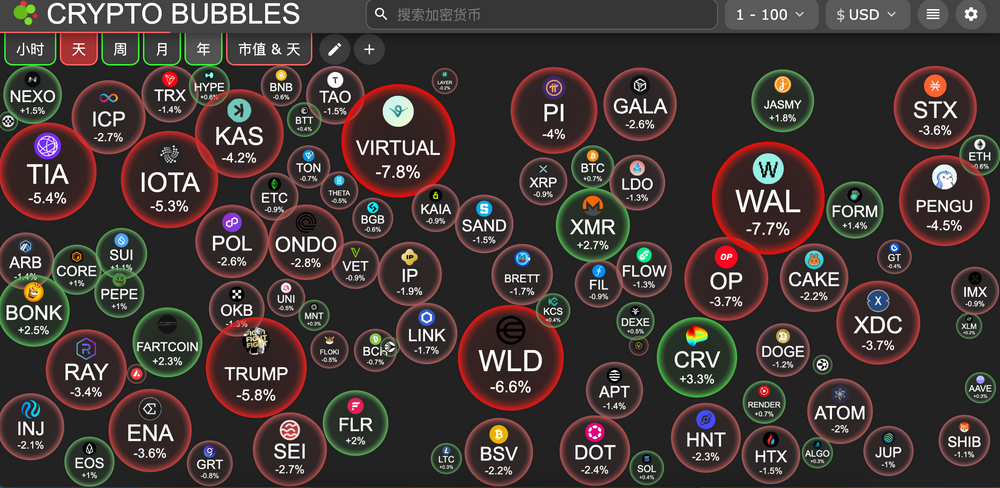

Sector ups and downs: NFT sector fell 3.5%, Layer2 sector fell 2.22%

-

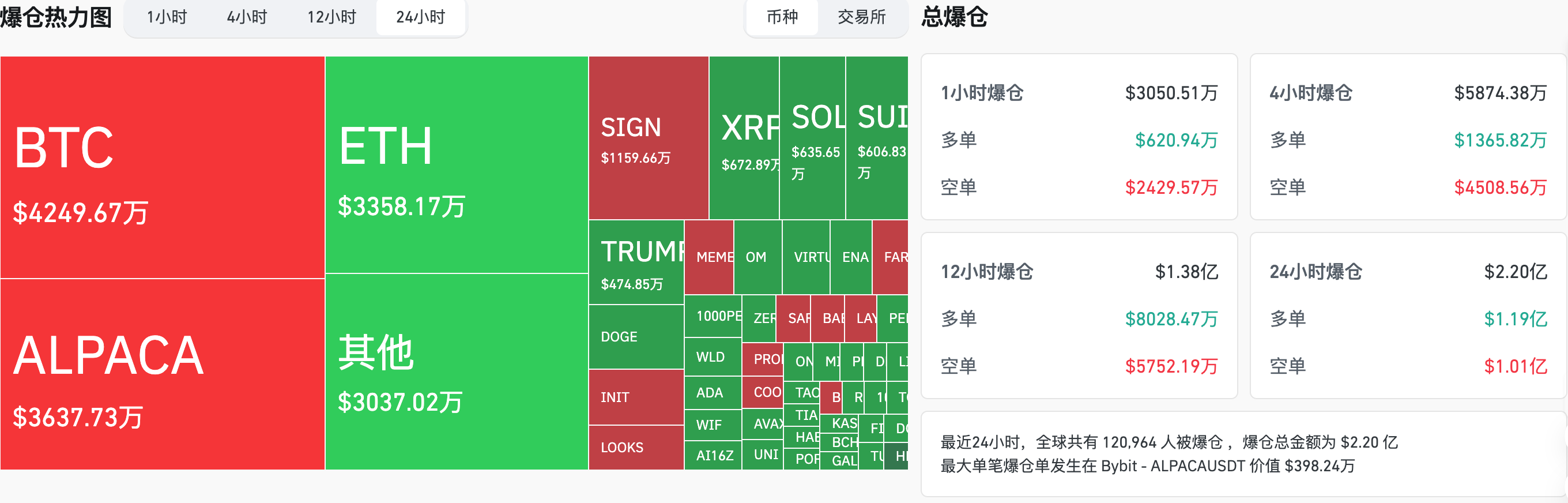

24-hour liquidation data: A total of 120,964 people were liquidated worldwide, with a total liquidation amount of US$220 million, including BTC liquidation of US$42.49 million, ETH liquidation of US$33.58 million, and ALPACA liquidation of US$36.37 million

-

BTC medium- and long-term trend channel: upper channel line ($92403.85), lower channel line ($90574.07)

-

ETH medium and long-term trend channel: upper channel line ($1761.90), lower channel line ($1727.01)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 29)

-

Bitcoin ETF: $170 million (8 consecutive days of inflow)

-

Ethereum ETF: $18.4008 million (continuous inflow for 4 days)

4. Today’s Outlook

-

Binance will delist ALPACA, PDA, VIB and WING on May 2

-

Optimism (OP) will unlock approximately 31.34 million tokens at 8:00 am on April 30, accounting for 1.89% of the current circulation, worth approximately US$25.7 million;

-

Renzo (REZ) will unlock approximately 527 million tokens at 7 pm on April 30, accounting for 19.57% of the current circulation and worth approximately US$7.4 million;

-

Kamino (KMNO) will unlock approximately 229 million tokens at 8 pm on April 30, accounting for 16.98% of the current circulation, worth approximately $14.5 million.

-

Gunz (GUN) will unlock approximately 83.33 million tokens at 10 pm on April 30, accounting for 13.79% of the current circulation and worth approximately US$5 million.

-

Sui (SUI) will unlock about 74 million tokens at 8 am on May 1, accounting for 2.28% of the current circulation, worth about $267 million;

-

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8:00 am on May 1, accounting for 5.67% of the current circulation and worth approximately $11.3 million.

-

DYDX (DYDX) will unlock approximately 8.33 million tokens at 8:00 am on May 1, accounting for 1.09% of the current circulation and worth approximately US$5.4 million.

The U.S. will release first quarter GDP data on April 30

Number of initial jobless claims in the United States for the week ending April 26 (10,000 people) (20:30, May 1)

-

Actual: To be announced / Previous value: 22.2 / Expected: 22.5

U.S. unemployment rate in April (May 2, 20:30)

-

Actual: To be announced / Previous value: 4.2% / Expected: 4.2%

U.S. non-farm payrolls in April (10,000 people) (May 2, 20:30)

-

Actual: To be announced / Previous value: 22.8 / Expected: 13.5

The stocks with the largest increases in the top 500 by market value today: ALPACA up 250.49%, HOUSE up 79.09%, CTK up 37.16%, SIGN up 34.26%, and PUNDIX up 31.88%.

5. Hot News

-

Standard Crypto partners transferred 2,000 MKR and 20,000 AAVE to Coinbase 1 hour ago

-

Coinbase executive: Gold appreciation could lead to U.S. Treasury buying Bitcoin sooner than expected

-

Cardone Capital Establishes 10-Asset Real Estate Fund to Acquire More Than 1,000 Bitcoins

-

Dingaling will launch Solana's on-chain token issuance platform boop this week and will conduct airdrops

-

A whale withdrew 1.5 trillion PEPE from Binance 8 hours ago, equivalent to about 13.54 million US dollars

-

An investor/institutional address transferred 9 million UNI to Coinbase Prime 1 hour ago, equivalent to approximately 47.07 million US dollars

-

El Salvador Says It Will Still Buy Bitcoin After IMF Deal

-

Tether minted 2 billion USDT on the Ethereum network in the early morning

-

The UK has released a draft regulation on crypto assets, which will include cryptocurrency exchanges and other entities in the regulatory system

-

Binance Wallet will launch the 14th TGE: B² Network

-

DWF Labs announces market maker for JST token

-

Upbit to List SIGN in KRW, BTC, USDT Markets

-

Bitcoin exchange supply drops to 7-year low

-

MicroStrategy spent $1.42 billion last week to increase its holdings of 15,355 bitcoins, with an average purchase price of $92,737

You May Also Like

OpenAI offers rights holders new controls in Sora

Investors Are Rushing For Tether Gold After This Tokenization Move