The Future of Telecommunications (2025–2030): 5G, 6G, IoT, AI & Security

SPONSORED POST*

The Current State of the Telecommunications Industry

Most businesses today rely on telecom far beyond simple calls or SMS. The future of the telecom industry is about powering digital communications, cloud services, IoT ecosystems, and enterprise connectivity. Imagine running an e-commerce store in 2025: AI chatbots handle customer service, sales reps close deals over video calls, and logistics teams track shipments in real time via IoT sensors. None of this works without global telecom innovations.

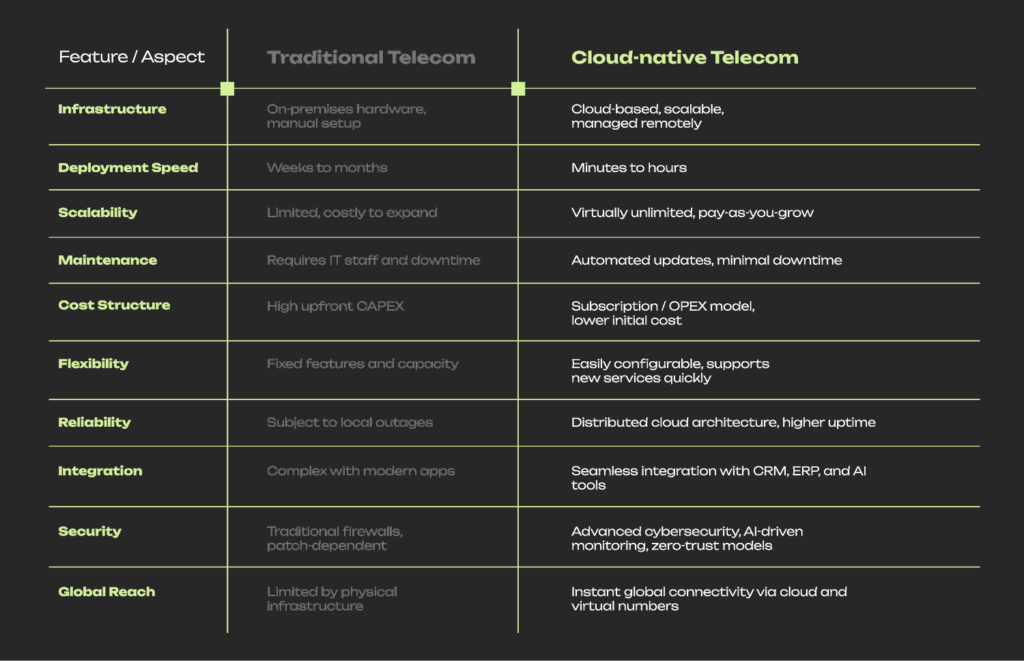

And the next five years will bring a wave of changes: some already visible, others just around the corner. Today, telecom innovations such as cloud PBX, SIP trunking, and virtual DID numbers enable seamless digital communications worldwide.

Telecom operators are heavily investing in fiber, wireless technologies, and automation to support telecom trends 2025 and beyond. According to the International Telecommunication Union (ITU), global internet traffic has tripled in the past five years, demonstrating the growing demand for advanced business VoIP solutions and enterprise communication technologies.

5G Adoption and the Road to 6G: What Businesses Need to Know

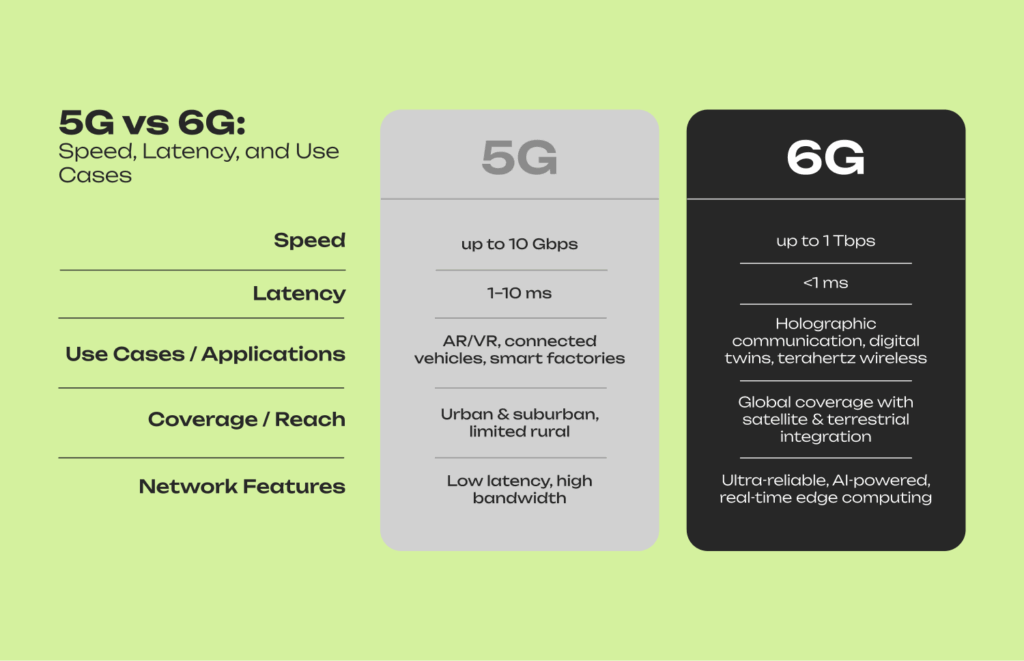

The rollout of 5G networks continues to reshape mobile communications. As of mid-2025, global 5G subscriptions are projected to reach approximately 2.9 billion, accounting for about one-third of all mobile subscriptions (Ericsson, June 2025 Mobility Report). In the first quarter of 2025 alone, 145 million new 5G subscriptions were added, highlighting the rapid pace of adoption (GSA, 2025).

5G provides ultra-low latency, high-speed connections, and support for massive IoT networks, enabling innovations such as connected vehicles, smart factories, and immersive AR/VR applications. These capabilities are driving the digital transformation of businesses and industries worldwide.

Meanwhile, early research into 6G networks is already underway. 6G promises speeds up to 100 times faster than 5G, ultra-reliable low-latency connections, and support for technologies like holographic communications, digital twins, and terahertz wireless transmission. While commercial 6G deployment is expected around 2030, ongoing research is helping telecom operators, including DID Global, plan for future network integration and next-generation services

Fiber-Optic Expansion: The Backbone of Future Telecom

Fiber-optic networks remain the core of global connectivity. They are critical for cloud services, mobile backhaul, and IoT applications. The FTTH Council Europe predicts over 200 million European households will have fiber by 2028.

This expansion will boost telecom reliability in both urban and rural areas, ensuring that cloud-based telecom services like Cloud PBX and VoIP run smoothly without latency.

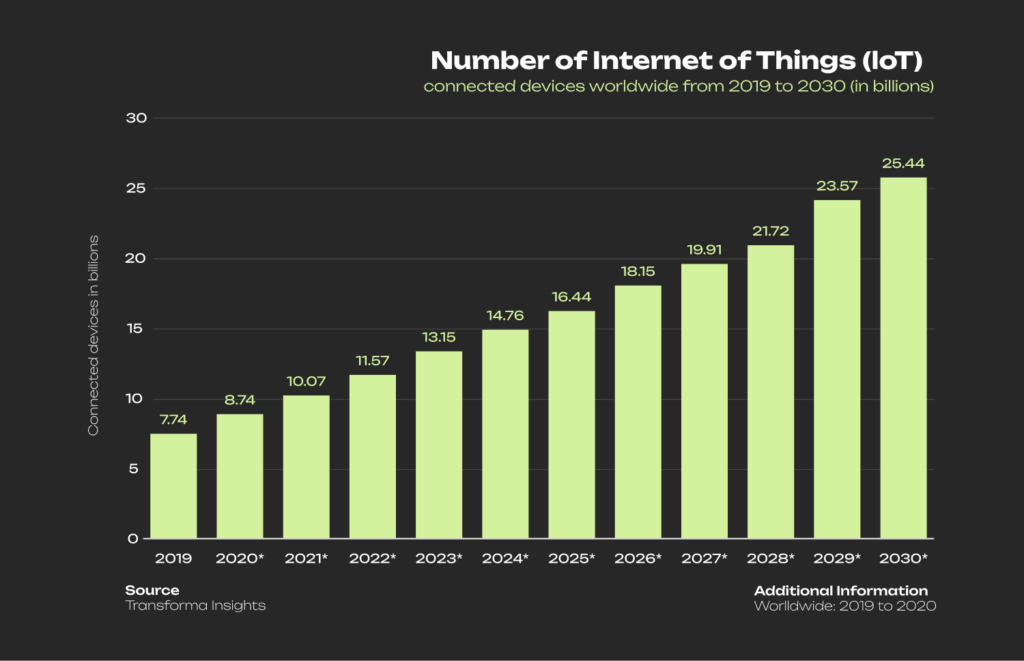

IoT Growth and Telecom Infrastructure: Preparing for 30B Devices

The Internet of Things (IoT) is one of the most powerful telecom trends. Billions of connected devices: from wearables to industrial machines, depend on telecom infrastructure.

By 2030, Statista forecasts over 29 billion IoT devices worldwide. This growth pushes telecom providers to offer secure IoT connectivity solutions, SIM management, and big data analytics.

AI in Telecommunications: Cost Savings and Smarter Networks

AI in telecom plays a critical role in automating operations, predicting network failures, enhancing security, and improving customer experience. From chatbots in customer service to AI-driven fraud detection, operators are turning telecom into a data-intelligent ecosystem.

A McKinsey study shows AI can cut telecom operational costs by up to 30%, while reducing downtime and boosting customer satisfaction.

Security and Reliability in Communications

With billions of connected devices, enterprise telecom security is crucial. Emerging solutions include:

- Blockchain for telecom identity management

- Zero-trust security models

- AI-driven cybersecurity monitoring

Gartner predicts that by 2026, 70% of telecom operators will adopt AI-based cybersecurity to prevent outages and data breaches.

The World Economic Forum warns that cyberattacks on telecom could have a domino effect on entire economies. This makes investments in resilient and reliable communication systems not just a business choice, but a national security priority.

How Telecom Innovations Impact Business and Society

Innovations in telecom reshape industries. For businesses, advanced telecom solutions reduce costs, enhance productivity, and unlock new revenue streams. For society, they provide access to telemedicine, e-learning, and financial services.

DID Global Research & Development

At DID Global, we actively invest in R&D to deliver future-proof telecom solutions. Key directions include:

- integration of next-generation protocols for seamless global interoperability,

- blockchain applications to protect customers from fraud,

- development of cloud-based telecom solutions such as SIP trunking, virtual numbers, and Cloud PBX,

- mobile-first communication services for enterprises worldwide.

Our goal is to build innovative communication technologies for business, ensuring security, flexibility, and scalability. See how DID Global can secure your business communications.

Telecom Forecast for the Next 5 Years

The telecom trends of 2025–2030 will include:

- Mass 5G adoption and early 6G pilots.

- Wider fiber-optic deployment in underserved regions.

- Explosive IoT ecosystems in healthcare, logistics, and smart cities.

- AI-driven automation across telecom operations.

- Stronger focus on cybersecurity in telecom networks.

- Scalable cloud-native telecom solutions for global businesses.

Business and Societal Impact

Telecom innovation enables businesses to automate processes, reduce costs, and expand globally. For society, it brings access to e-health, e-learning, fintech, and e-government services, even in underserved regions.

FAQ

1. What is the future of telecommunications in 2025?

By 2025, telecom will be dominated by 5G adoption, fiber expansion, and IoT growth, supported by AI-driven automation.

2. How will 6G impact mobile communication?

6G is expected to deliver speeds 100x faster than 5G, enabling holographic calls, smart cities, and real-time digital twins.

3. Why is AI important in telecommunications?

AI automates network management, improves customer service with chatbots, and enhances cybersecurity through predictive analytics.

4. What role does DID Global play in telecom innovation?

DID Global develops virtual numbers, Cloud PBX, SIP trunking, and anti-spam tools to help businesses embrace future telecom technologies.

5. What are the top telecom security challenges in 2025?

Preventing data breaches, securing IoT devices, and ensuring uninterrupted cloud communication are key challenges.

6. How can businesses prepare for 6G?

Invest in scalable cloud-native solutions, explore early integration with next-gen protocols, and partner with providers like DID Global.

Final Thoughts

The future of telecommunications is about intelligent, secure, and automated networks. From 5G and IoT to AI and blockchain, innovation is shaping how we live and do business.

At DID Global, we help companies stay ahead with scalable telecom solutions. Whether you need virtual numbers, cloud PBX, or global SIP trunking, we ensure your business is future-ready.

Contact us today for a free consultation and set up your virtual number in 15 minutes.

*This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

US won’t start Bitcoin reserve until other countries do: Mike Alfred

The US government will start buying Bitcoin for its strategic reserve when there is “enough pressure externally,” says crypto entrepreneur Mike Alfred. The US government is unlikely to start accumulating Bitcoin for its strategic reserve until other nations make the first move, says crypto entrepreneur Mike Alfred.Alfred said in a podcast published on Tuesday that the US government will start putting Bitcoin (BTC) into its reserve created earlier this year “when there is enough pressure externally.” “Once the US government recognizes that others are taking action before them, that’ll probably catalyze additional action in the future,” he said, adding that the timeline for the US government’s action is up in the air.Read more

The truth behind Yala's decoupling: From illegal collateralization to liquidity extraction, a meticulously planned escape.