Story Protocol Founder Abandons $2B Company With Measly $45 in Fees Revenue, Community Cries ‘Soft Rug Pull’

The crypto community has erupted with accusations against Story Protocol co-founder Jason Zhao, alleging he orchestrated a ‘soft rug pull‘ after departing from his $2 billion on-chain intellectual property (IP) venture that generates merely $45 in daily revenue.

In an August 16 X announcement, Zhao disclosed his decision to step down from his co-founder position while transitioning to a strategic advisory role within the protocol.

The announcement ignited a firestorm of criticism from crypto participants who suspect he is departing after securing substantial personal gains.

Dev Exposes Truth Regarding Story Protocol Rug Pull Allegations

A prominent crypto developer expressed outrage, stating that Story Protocol secured over $130M in funding from elite VCs, including a16z and others, yet delivered minimal practical utility.

“The blockchain produced just $45 in fees during the past 24 hours despite assertions of tokenizing $61T in IP.”

While founder-led exits are unfortunately common in cryptocurrency, such departures rarely occur following substantial capital commitments from prestigious venture capital firms like a16z.

Although the impact on the team’s primary product and ongoing development is unclear, numerous commenters on Zhao’s announcement have characterized this as a founder-led exit, prompting widespread accusations of rugpull.

Story Protocol’s whitepaper positioned the project as a blockchain initiative designed to transform intellectual property management through on-chain solutions.

Rather than relying on outdated copyright frameworks, the platform seeks to empower creators to register, monitor, and monetize their works, including books, films, music, and AI-generated content, through a decentralized network.

According to the token distribution structure, Zhao and three additional co-founders control 20% of the total one billion token supply, equivalent to approximately 200 million tokens.

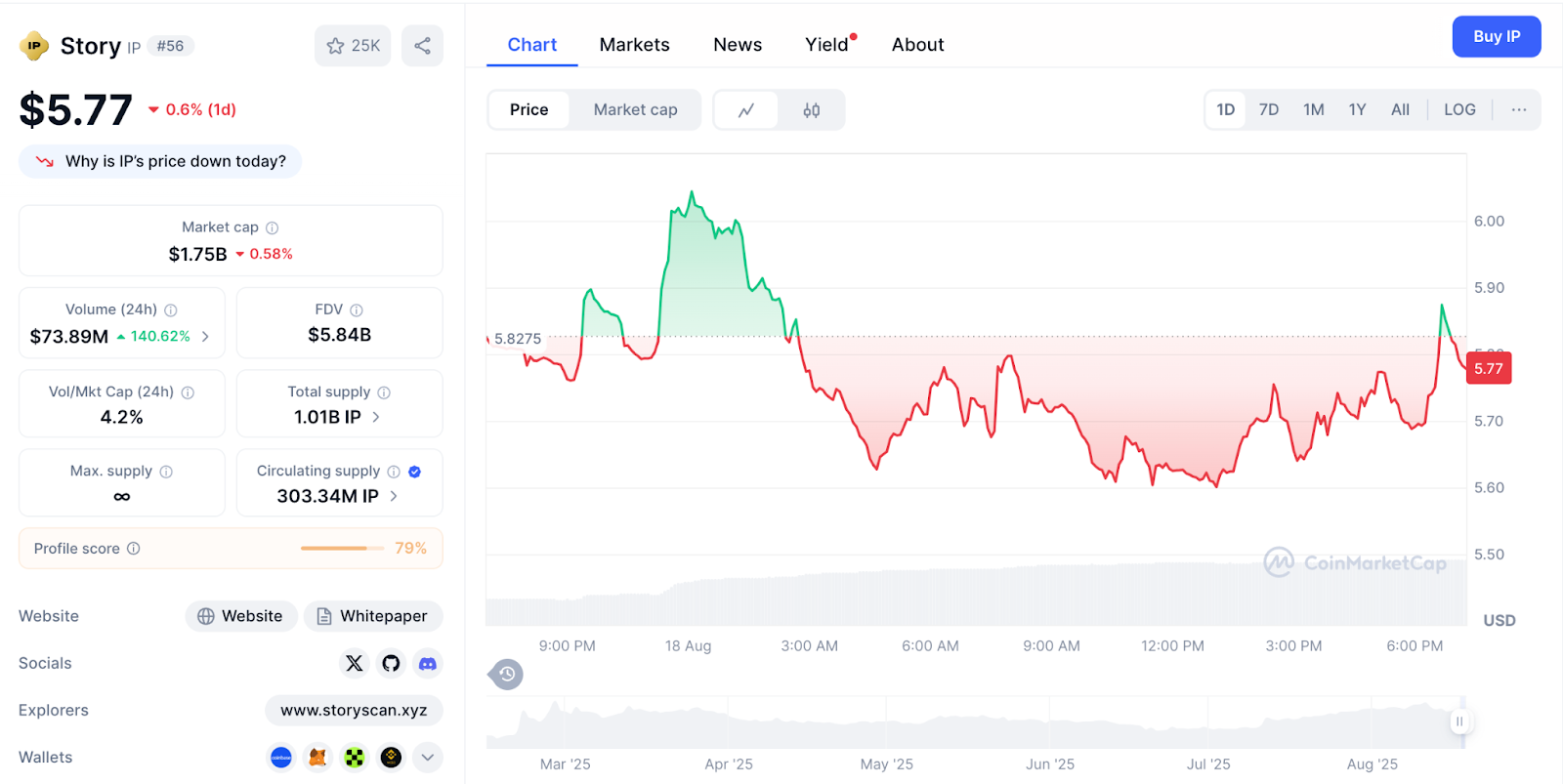

At the current trading price of $5.69, should Zhao hold 5% of the tokens and liquidate his position, he could potentially realize profits of approximately $284.5 million.

Source: CoinMarketCap

Source: CoinMarketCap

Story Protocol has historically attracted approximately $134.3 million in equity financing across multiple rounds.

These include a May 2023 seed round generating $29.3 million, a September 2023 Series A yielding $25 million, and a substantial August 2024 Series B led by Andreessen Horowitz’s a16z crypto division, contributing $80 million.

This funding establishes the company’s valuation at roughly $2.25 billion.

Hyperliquid Founder Slams Jason Zhao Over Story Protocol’s Meager Revenue Figures

Additionally, on August 11, Story Protocol obtained an $82 million token-based investment from Heritage Distilling, a publicly traded entity, as part of a strategic plan to create an IP token treasury within a broader $360 million IP token reserve framework.

Joseph Schiarizzi, founder of lending protocol Nerite, condemned the initiative, revealing that Story Protocol’s team sold $150,000 worth of tokens to increase the IP token’s price by 2%.

“Yet they think they can create a $300M reserve for a treasury company,”

Schiarizzi stated. He characterized the scheme as “an elaborate plan to DUMP ON RETAIL”

The founder of Hyperliquid-based yield protocol Harmonix Finance criticized Story Protocol’s dismal revenue performance, which, according to DeFiLlama, reached an all-time high of $3,163 despite maintaining a $5.8 billion fully diluted valuation (FDV).

The Harmonix founder said that Hyperliquid didn’t raise a single dime, and both the founder and core contributors have no fancy backgrounds.

Yet, they built the number 1 on-chain perp protocol, generating an average of $3 million in daily revenue.

Zhao’s Departure Explanation

Zhao has remained silent since his resignation announcement. However, he indicated in his post that his departure relates to his involvement with Poseidon, an AI data infrastructure layer developed by the protocol, focusing on biopharma and space research applications.

Reflecting on his tenure at Story Protocol, Zhao described it as “the most meaningful experience of his life.”

He noted: “What began as a whiteboard sketch when I was 22 turned into more than I could have imagined,” adding that Story IP has evolved into the foundational protocol for intellectual property, including fashion brand Balmain and K-pop group BTS in South Korea, processing millions of transactions.

Zhao seized the opportunity to introduce the incoming leadership, who will assume control.

According to his announcement, Story Protocol will enter a second phase under S.Y. Lee’s guidance alongside the new CPO, Andrea, who previously contributed to Amazon’s conversational AI initiatives.

You May Also Like

U.S. stocks closed: the three major stock indexes rose and fell, and Circle rose 34%

Bitcoin Miner TeraWulf Announces $400M Private Notes – Data Center Push, $60M Upsize Option