How Thousands of Nodes Using Multi-Signatures Can Open Up the Future of BTC Restaking

If the main themes of the previous two cycles were DeFi and NFTs, then the keyword for the current cycle is undoubtedly the Bitcoin ecosystem.

With Bitcoin reaching historic highs in the first quarter of 2024, the community has begun to recognize that the Bitcoin ecosystem still lacks richer and more advanced infrastructure. To meet the growing demand, the Bitcoin ecosystem has started moving towards a more tangible development path, which includes Bitcoin Layer 2, Bitcoin DeFi, and Bitcoin cross-chain technologies, collectively forming the BTCFi ecosystem. Among these areas, Bitcoin cross-chain technology plays the most crucial role.

How the Mirror Protocol Redefines the Security of L2

In the "gold rush" of how Bitcoin can participate in application scenarios, rather than becoming another Bitcoin Layer 2 project, the Mirror Staking Protocol has chosen to sell "safety helmets" on the sidelines, providing a bridge with decentralization comparable to BTC for the new wave of "gold diggers."

Due to the plethora of open-source versions, which are easy to implement and cost-effective, most Bitcoin Layer 2 solutions currently adopt a combination of multi-signature (Multi-signature) and Ethereum Virtual Machine (EVM) methods. Whether it's multi-party computation (MPC) multi-signature schemes, threshold signature schemes, Hash Lock, or Discrete Log Contracts (DLCs), their core revolves around multi-signature and EVM. This method allows users to cross-chain their Bitcoin to a multi-signature address and generate new Bitcoin tokens on the EVM chain, making it compatible with the functionalities of EVM smart contracts.

Many Bitcoin Layer 2 projects are reluctant to discuss the security issues of Bitcoin Layer 2 staked funds and even deliberately conceal their own centralized security risks. However, the security of Bitcoin Layer 2 is a crucial topic; have we already forgotten the collapses of Luna, Three Arrow, and FTX in 2022? For Bitcoin Layer 2 projects themselves, security is a key factor that determines the life and death of the project. For users, the security of Bitcoin application scenarios directly relates to the safety and liquidity risk of their staked assets, and any security breach could lead to significant financial losses.

In this context, the Mirror Staking Protocol (referred to as the Mirror Protocol) with its unique security assurance scheme, redefines the security of BTC cross-chain and the characteristic of nodes freely entering and leaving.

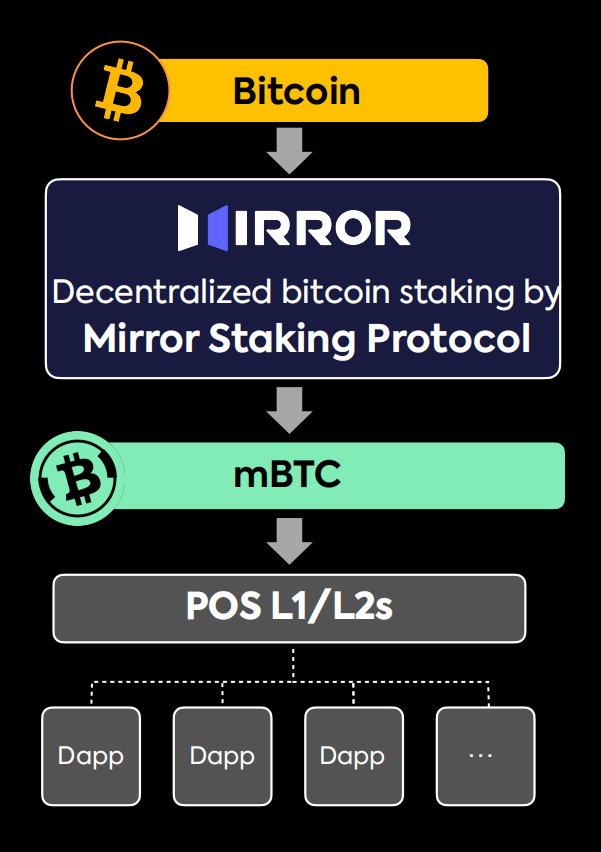

The Mirror Protocol is a truly decentralized and trustless Bitcoin staking protocol. This protocol provides a genuinely decentralized and secure solution for importing Bitcoin into numerous PoS L1/L2s. The testnet is already live and about to enter the public testing phase. It has been audited by SlowMist.

Overlapping Multi-Signature Groups (MSG) Algorithm

The core innovation of the Mirror Protocol is the Overlapping Multi-Signature Groups (MSG) algorithm, which is also how it ensures the security of Bitcoin Layer 2 projects.

This algorithm has been validated and published in the top-tier paper, "Decentralized Asset Custody Scheme with Security against Rational Adversary," which has been included in the prestigious Web and Internet Economics (WINE) conference.

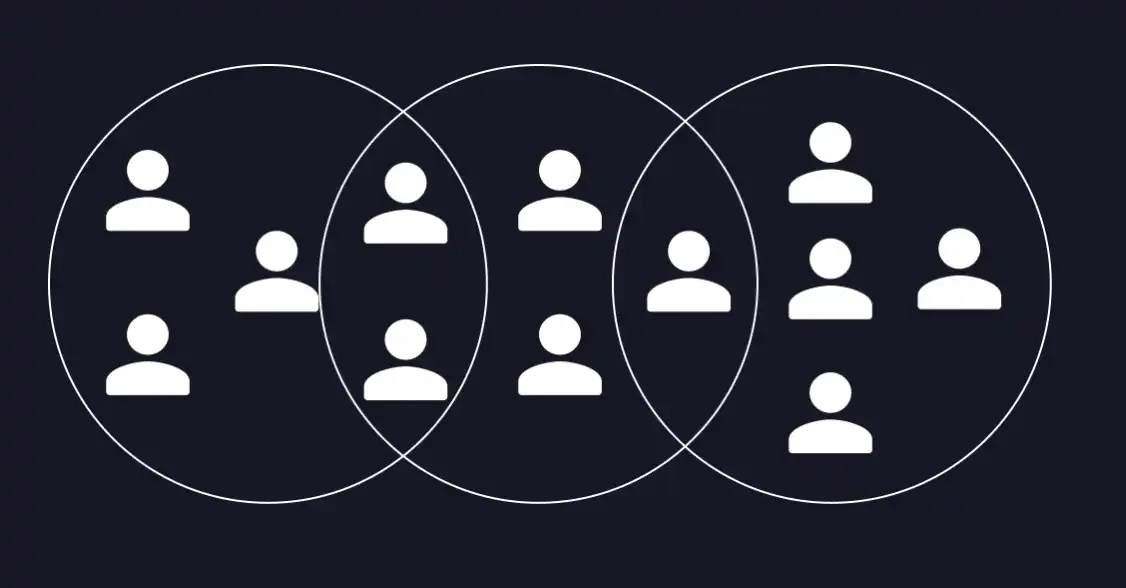

The paper proposes a decentralized asset custody framework that can securely manage a large volume of client assets, which are several times greater than the custodians’ collateral. This framework reduces management costs and increases activity by distributing custodians and assets across multiple custodian groups, with each group fully controlling a small portion of the assets allocated to it. Decisions within each custodian group require the consent of a sufficient number of group members, which can be achieved through voting or threshold signatures. Under this framework, transactions can be processed more efficiently within a very small number of group members because computational and communication costs are significantly reduced. Both activity and robustness are enhanced as even a single active custodian group can handle transactions.

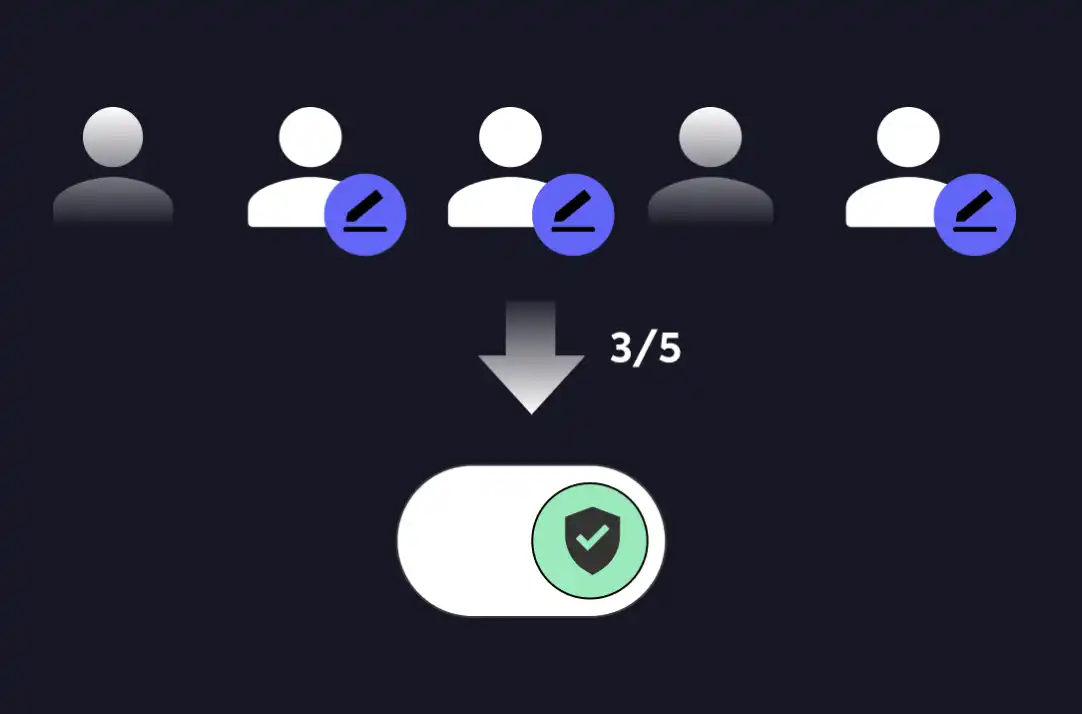

In practical implementation, Mirror groups nodes at the Multi-Signature Groups level. Each group consists of any 5 nodes, and 3 out of these 5 can control the inflow and outflow of assets through multi-signature. Each node is also required to stake 1 mBTC as a penalty for misconduct.

For Overlapping Groups, each node can group with any other four nodes, forming overlapping groups. If there are 1,000 nodes, this can result in 3,000 groups.

The Mirror Protocol's unique design is not only suitable for cross-chain asset mapping, such as mapping Bitcoin to Ethereum, but it also effectively reduces the capital costs of custodial services. Through a rational adversary model, it ensures that even in cases of partial corruption among custodians, a large amount of customer assets exceeding the collaterals are protected.

With its innovative algorithm and meticulous design, the Mirror Protocol offers a new mechanism for staking and security assurance for PoS L1/L2 projects. This not only helps to expand Bitcoin’s application scenarios but also optimizes staking rate, security, and decentralization by having the staked assets co-managed by thousands of nodes.

Furthermore, the practical application of the Mirror Protocol's algorithm embodies the concept of modular blockchain design. By generating mBTC, which is pegged 1:1 to Bitcoin, it has achieved compatibility with EVM and plans to expand to a multi-chain ecosystem (including Solana, Ton, Bera, etc.). This mechanism also supports restaking, allowing users to restake mBTC on mainstream EVM DApps, further enhancing its potential in the decentralized finance (DeFi) ecosystem.

Financing and Team Background

The ability to implement a new asset custody algorithm is also a crucial guarantee of the Mirror Protocol team’s success. The team is composed of elites from top institutions and companies such as Microsoft, Google, MIT, Tsinghua University's Yao Class, and others. The authors of the aforementioned top-tier paper, who are also part of the Mirror team, are CSO Zhaohua Chen, a Ph.D. graduate from Peking University, and Guang Yang from Conflux. Their research has been recognized at the Web and Internet Economics (WINE) conference, demonstrating the team's profound capabilities in blockchain technology and security. Following the paper's inclusion in the WINE conference, the official account of the Center for Computational Frontiers at Peking University (CFCS) also posted a congratulatory message.

In terms of financing background, although the specific amount has not yet been disclosed, the seed round of the Mirror Protocol received investments from UTXO (the investment arm of BTC Magazine), CMS Holdings, Conflux, and IMO Ventures. Notably, Bitcoin Magazine, established in 2012, is one of the oldest and most mature sources focused on Bitcoin information, with extensive research into Bitcoin application scenarios.

**Decentralized Node Election Process:**

As part of the design of the Overlapping Multi-Signature Groups (MSG) algorithm, the Mirror Protocol introduced a more decentralized and empowered node election process and strategy.

**The node election process is as follows:**

- The candidacy for Mirror Protocol nodes is officially announced on Twitter, confirmed by the Node Election Committee and the Mirror team.

- During the voting period, community members can vote under Mirror’s Twitter account. The top 100 nodes by vote count will be automatically elected. Once elected, the technical team will assist in setting up the nodes.

Through this method, Mirror generates hundreds of nodes and grants them the right to subscribe to MIRR tokens, allowing users to choose who becomes a node investor for MIRROR. Nodes can receive up to $120,000 in subscription rights. The project now involves 300 to 500 influential node investors elected by users. Whether individual KOLs, institutions, media entities, or projects, anyone can become a node investor.

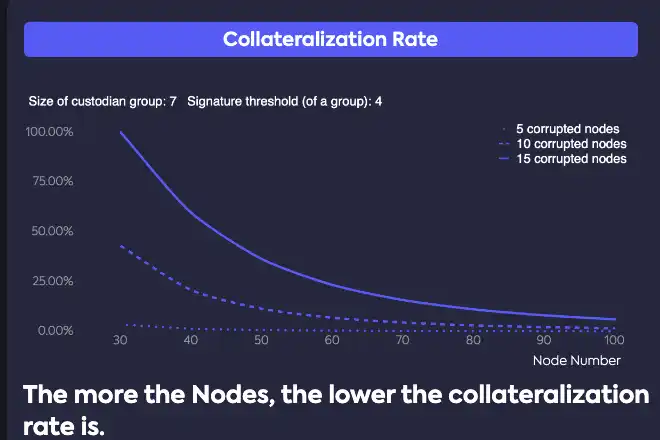

**More Nodes, Lower Collateralization Rates:**

The Mirror Staking Protocol's node election process is conducted in four rounds to gradually increase the number of nodes, with 100, 300, 600, and 1000 nodes respectively. The first round will elect 100 nodes.

To ensure security, nodes must stake at least 1 mBTC to the Mirror Staking Protocol and act as decentralized custodians for 12 months. The champion of the node election will receive a special reward, namely the option to purchase 1 million MIRR (Mirror's governance token) at an exercise price of $0.12. For nodes elected after the first place, the call options they receive will be according to the table below. The exercise price for the first round is also set at $0.12. In subsequent rounds, the exercise price will gradually adjust according to the market price. The above details the process of the Mirror Staking Protocol node election and the responsibilities and rights of the elected nodes.

Currently, the Mirror Staking Protocol has attracted over 200 KOLs and more than 50 project institutions to run for election on social media platforms like X in less than three weeks. Moreover, the election has garnered participation from over 50,000 independent addresses, with a total of over 3 million votes cast.

Roadmap and Token Economics

Roadmap: In March 2024, the Mirror Staking Protocol testnet was launched, utilizing overlapping multi-signature groups to bridge staked BTC L1 assets to PoS L1/L2s and generate mBTC, which is pegged 1:1 with BTC. Additionally, the first round of elections for 100 nodes was completed by March 2024.

The Mirror Staking Protocol mainnet is set to launch in May 2024, enabling the staking and bridging of BTC L1 assets to PoS L1/L2 networks. The protocol aims to collaborate with other PoS L1/L2s on application scenario projects to provide them with truly decentralized and secure Bitcoin bridging services. Together with other PoS L1/L2s, it plans to build BTC-based TVL and ecosystems, launching campaigns such as "Stake Once, Earn Double."

The expansion of mBTC access in the PoS L1/L2 ecosystems will continue, along with the initiation of an ecosystem fund to support various builders and developers in collaboratively constructing the BTC ecosystem with PoS L1/L2s, and enabling the restaking of mBTC.

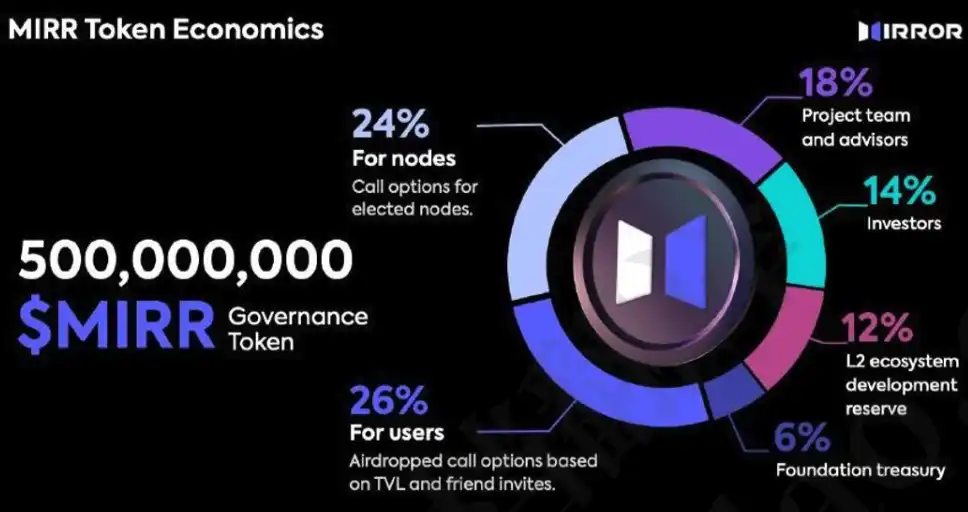

Token Economics: MIRR is the governance token of the Mirror Staking Protocol. The total supply of MIRR governance tokens is 1 billion.

- 24% for Nodes: There are four rounds of elections (100, 300, 600, and 1000 nodes). The first round consists of 100 nodes. The call options for each node are detailed in Table 1, with an exercise price of $0.12. Tokens are distributed over a 12-month period. The node ranked first will be granted 1 million call options, with this allotment decreasing incrementally down to the node ranked 20th, as illustrated in Table 1.

- 26% for Users: Users receive airdropped call options; distributed over 10 quarters with the first quarter releasing 10 million. The exercise price is also $0.12. Tokens are also distributed over 12 months. User distributions are based on quarterly points, including the TVL of BTC assets staked and the proportion of invited friends. Each user is assigned a unique invitation code, with TVL from directly invited friends counting as 50%, and TVL from second-tier friends as 20%.

Additionally:

- 14% for Investors: Seed round investors unlock over 12 months, and institutional round investors unlock over 24 months.

- 18% for the Project Team and Advisors: This allocation unlocks over four years, distributed monthly.

- 6% for the Foundation Treasury: This allocation unlocks over four years, distributed monthly.

- 12% for Layer 2 Ecosystem Development Reserve: This allocation unlocks over four years, distributed monthly.

Summary

- The Mirror Protocol is a truly decentralized and trustless Bitcoin staking protocol. This protocol provides a decentralized and secure staking solution for importing BTC to PoS L1/L2s.

- Team members come from Microsoft, Google, MIT, Tsinghua University's Yao Class, etc. MirrorL2`s CSO has won two IOI gold medals (International Olympiad in Informatics).

- Using an Overlapping Multi-Signature Groups (MSG) algorithm, it allows nodes to freely join and leave, enabling thousands of nodes to collectively manage custody, effectively balancing Bitcoin's staking rate, security, and decentralization—adhering to BTC's core principle of decentralized and freely enterable nodes.

- The core technology of the Mirror Protocol has been verified by top-tier research papers. The audited testnet is now live, with participation from over 50,000 independent addresses. https://arxiv.org/pdf/2008.10895.pdf

- The Mirror Staking Protocol provides a truly decentralized solution for importing BTC into PoS L1/L2s. If PoS L1/L2s are electric vehicle manufacturers, the Mirror Protocol is the battery pack supplier; if PoS L1/L2s are large language models (LLMs), the Mirror Protocol is the GPU cloud computing center. The Mirror Protocol can cooperate with all PoS L1/L2s, and plans to launch a "Stake Once, Earn Dual Token Returns" campaign in the future.

From a long-term perspective, Mirror not only opens the door for further decentralized participation in application scenarios within the Bitcoin ecosystem but also expands the potential and future of Bitcoin staking. The modular and scalable design of the Mirror Protocol means that it is not limited to Bitcoin; its underlying principles and technological framework can be applied to cross-chain operations and staking security for other blockchain assets. This enhances interoperability between different blockchain ecosystems and creates many new use cases.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Trump threatening broadcast station licenses — explained