Dogecoin Price Prediction as Maxi Doge Attracts Crypto Whales

But to the delight of degens, Dogecoin has been defying the trend.

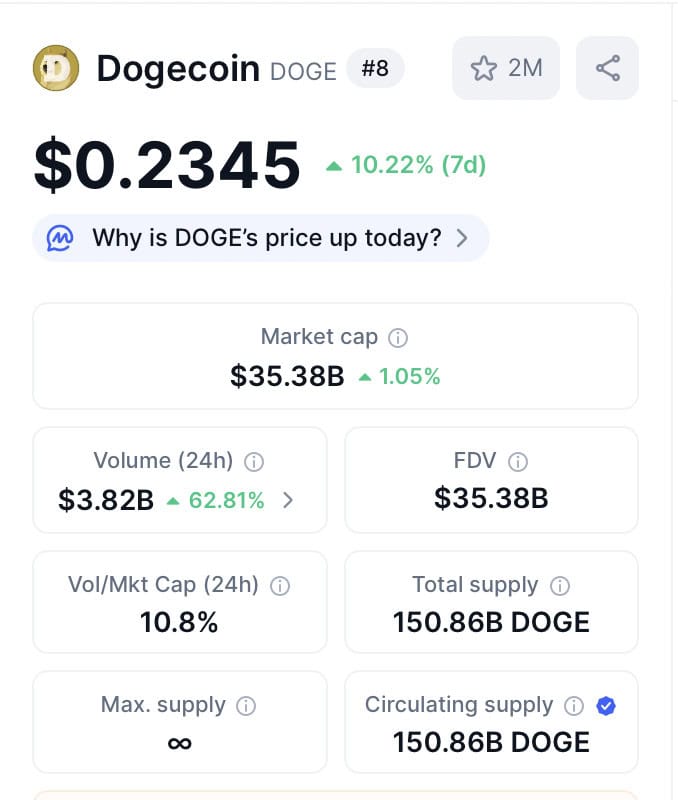

The meme coin captain has jumped 10%+ on the weekly chart, recording a 24-hour trading volume of $3.82B on Tuesday.

Can Dogecoin sustain the rally, or has it peaked already?

The growing traffic to $DOGE-derivative coins, like Maxi Doge ($MAXI), suggests stronger rallies may be ahead. But there are more reasons why $DOGE is one of the top cryptocurrencies to watch this season.

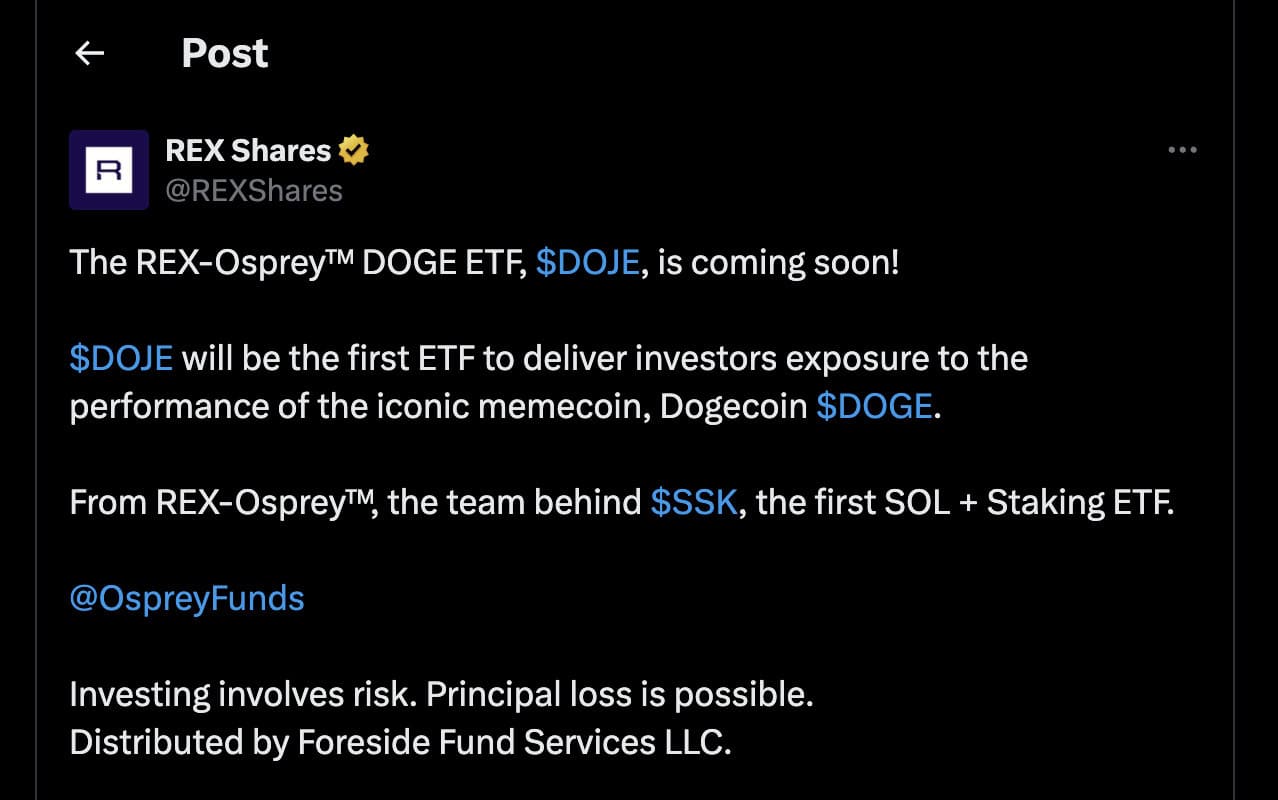

$DOGE Price Prediction After Rex-Osprey $DOGE ETF Sparks FOMO

Although it has been ages since $DOGE hit its all-time high of $0.7376 in 2021, it still ranks first among meme coins, with a massive market cap of $35B+.

This year alone, the $DOGE price has jumped 142%, tapping into broader market surges. And today’s 24-hour trading volume reflects a 60%+ increase.

Source: CoinMarketCap

To understand the rally better, we need to look at the factors driving it.

Of course, the macro backdrop has helped: the latest US jobs data report reveals that just 22K jobs were added in August, compared to 79K in July. The unemployment rate, on the other hand, is edging toward 4.3%.

Both of these hint at a Fed rate cut, which, in turn, could pump capital into the crypto market. But that doesn’t give the complete picture, as other cryptos, including $BTC, haven’t benefited from the macro shifts as much as Dogecoin.

For this, $DOGE has the Rex-Osprey $DOGE ETF buzz to thank. Backed by REX Shares and Osprey Funds, the ETF would offer US investors exposure to Dogecoin without holding it.

Source: X/@REXShares

$DOGE has the potential to pull in speculative flow to the market from traditional investors who are wary of interacting with crypto directly.

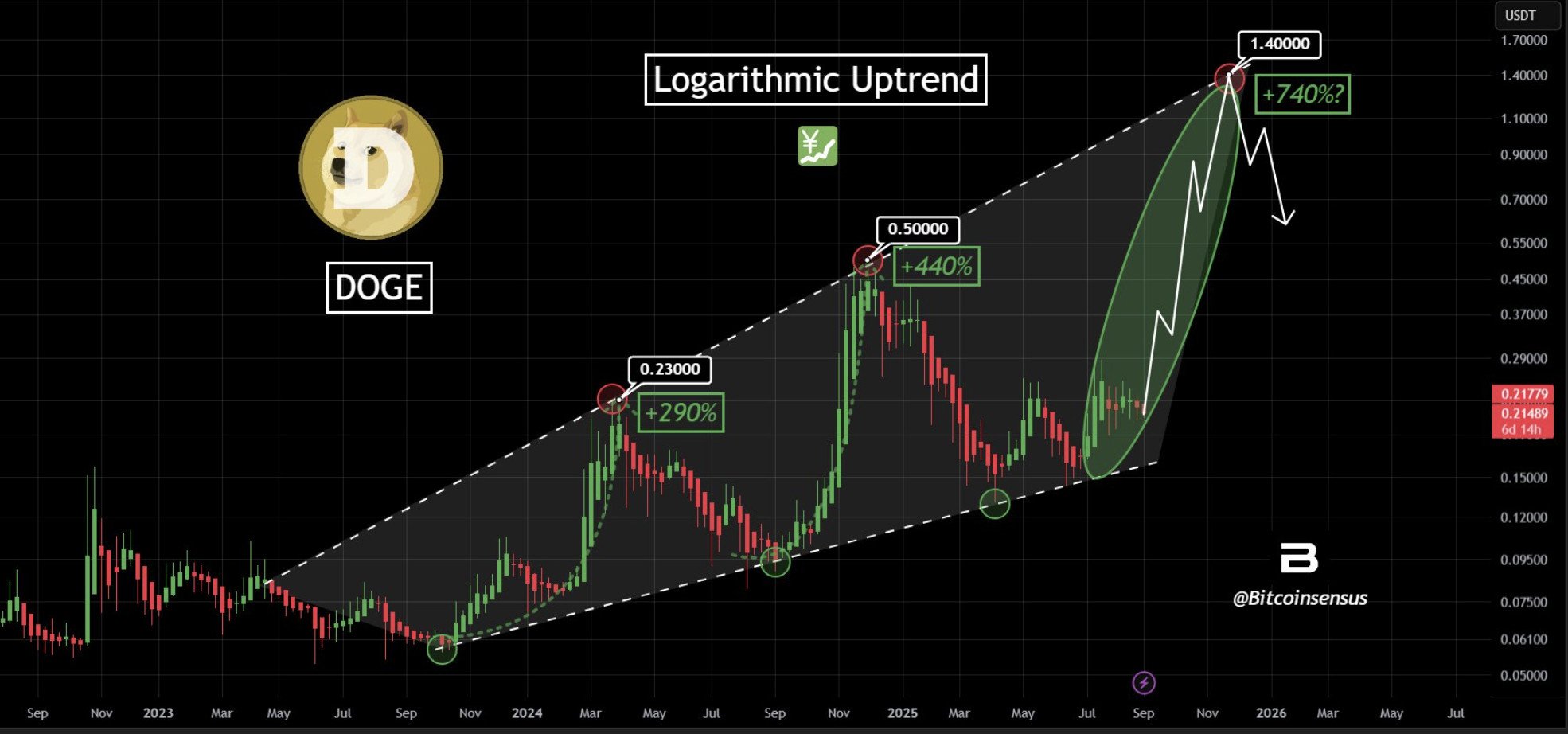

The ETF buzz has attracted wild predictions from crypto analysts. CoinDesi, for example, points out a logarithmic uptrend in play, with multi-year charts aligning $DOGE with a mega trend.

Source: CoinDesi on CoinMarketCap

If the trend is sustained, $DOGE could explode by around 740% to reach $1.40 by the end of the year.

That partly explains why Maxi Doge ($MAXI) is trending, with whales piling in fast.

Source: Etherscan

$DOGE’s Beefed-Up Cousin – The Latest Meme Coin Sensation

Maxi Doge ($MAXI) is $DOGE’s younger cousin, obsessed with retiring at 22. He has a solid plan to reach his goal – trading on 1000x leverage.

This buff, pumped up, energy drink-swilling meme coin has spent ‘seven dog years YOLOing into oblivion, chasing pumps, clout, and mum’s approval. One dream. Infinite risk. No exit plan,’ as the Maxi Doge presale website puts it.

Needless to say, $MAXI is successfully winning the attention of degens who share the dream. The $MAXI presale, where you can grab the coin for early-bird prices, is on the brink of reaching the $2M milestone.

Maxi Doge Competes With The Big Dogs

$DOGE continues to enjoy a special place in history and the privileges that come with it. For example, it hasn’t yet had to seriously think about engagement mechanics.

But for new contenders, it’s hard to stay relevant without a long-term plan. Even if they manage to pump in the first few weeks of the token launch, they can soon disappear into the dark depths of the market to make way for newer coins.

And the biggest allocation goes to marketing.

With strong engagement mechanics in place and eyes set on sustainability, it wouldn’t be surprising to see $MAXI enter the top 10 meme coin rankings.

The token has successfully completed two smart contract audits by Coinsult and SolidProof, winning early backers’ confidence. Both retail and whale investors are rushing to hoard the token at presale prices before its exchange listings.

A heads-up, though. The next price surge is just two days away, and the staking APY declines as more investors stake their tokens. So the clock is ticking. Before you jump in, though, take a look at our step-by-step guide to buying $MAXI.

Then head to the Maxi Doge presale today to secure your tokens.

$DOGE is Set to Take Off, But $MAXI Could Pump Higher

$DOGE’s price predictions look promising this year, fuelled by the ETF buzz and macroeconomic shifts. However, its heavy market cap prevents it from delivering exponential returns as it once did.

To make up for that, $DOGE investors are diversifying into younger coins like Maxi Doge ($MAXI), which – thanks to its strong narrative and pumped-up energy – is seeing growing community support and whale activity.

You May Also Like

Top 5 Twitter Accounts Every Crypto Trader Should Know

VS zet belangrijke eerste stap richting nationale Bitcoin reserve