BlackRock CEO's annual letter to investors: Bitcoin may challenge the global status of the US dollar, and tokenization is the future financial highway

Author: Weilin, PANews

On March 31, Larry Fink, CEO of BlackRock, one of the world's largest asset management companies, released a 27-page annual letter to investors . In the letter, Fink issued a rare warning: If the United States cannot control its ever-expanding debt and fiscal deficit, the "global reserve currency status" that the US dollar has relied on for decades may eventually give way to emerging digital assets such as Bitcoin.

Bitcoin may undermine the dollar's status as a reserve currency

Fink raises a thought-provoking question on page 20 of the report: “Will Bitcoin Undermine the U.S. Dollar’s Reserve Currency Status?”

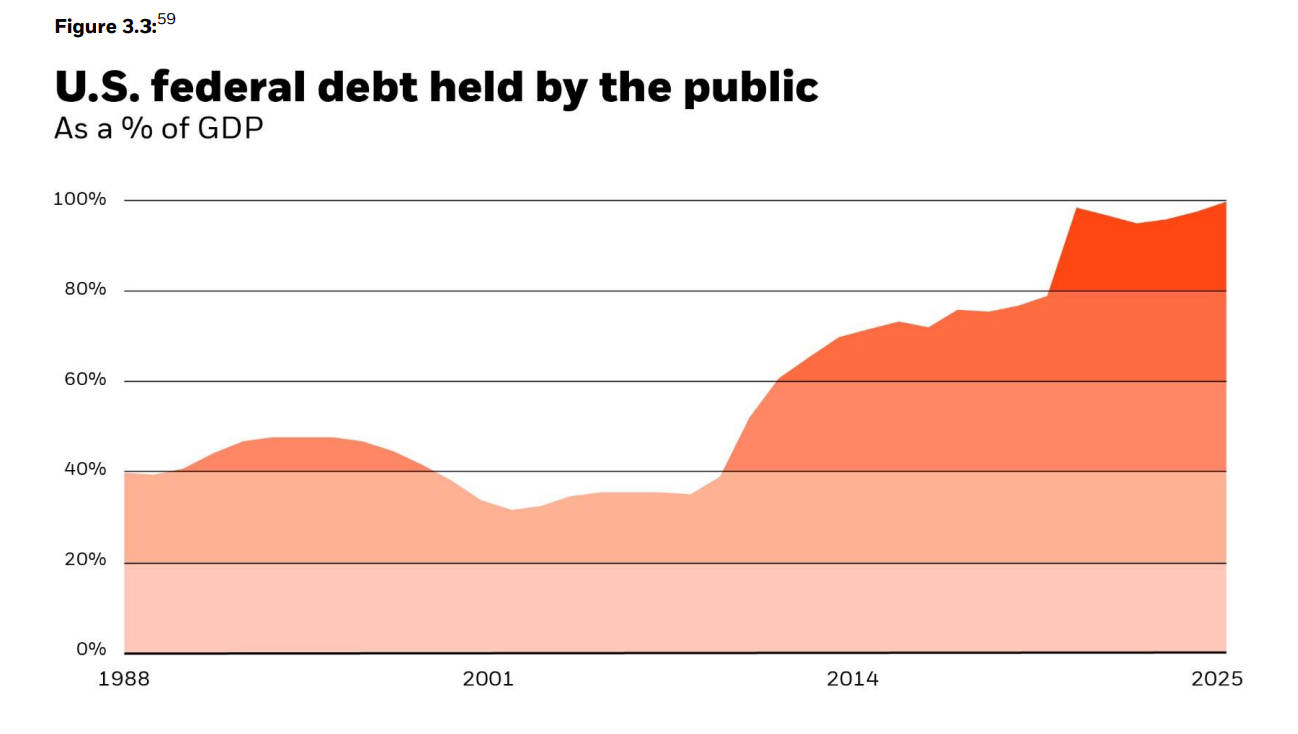

He said that for decades, the United States has benefited from the dollar's status as the world's reserve currency. But this status is not guaranteed forever. Since the "debt clock" in Times Square began counting in 1989, the U.S. national debt has grown three times faster than GDP. This year, interest payments alone will exceed $952 billion, exceeding defense spending. By 2030, mandatory government spending and debt service will devour all federal revenues, forming a long-term deficit.

U.S. federal debt held by the public as a percentage of GDP

While warning of the risks of traditional finance, Fink also made it clear that he is not against the development of digital assets. Link wrote: It should be noted that I am obviously not against digital assets. But two things can be true at the same time: decentralized finance is an extraordinary innovation. It makes the market faster, lower cost and more transparent. However, it is this innovation that may also weaken the economic advantage of the United States - if investors begin to think that Bitcoin is safer than the US dollar.

In reviewing the performance, Fink pointed out that the Bitcoin ETF launched by BlackRock in the United States became the largest exchange-traded product in history, with assets under management exceeding US$50 billion in less than a year. IBIT is the third most attractive product in the entire ETF industry, second only to the S&P 500 Index Fund. More than half of the demand comes from retail investors, and three-quarters comes from investors who have never held iShares products before. This year, BlackRock has expanded its Bitcoin products to exchange-traded products (ETPs) in Canada and Europe.

Fink further pointed out that ETFs have not only achieved great success in the United States, but are also becoming a key tool to promote the development of investment culture in Europe. He said that many European investors who entered the capital market for the first time took their first step through ETFs, especially iShares products. At present, only one-third of European individual investors participate in capital market investment, which is far lower than the more than 60% in the United States. This not only makes them miss the growth opportunities provided by the capital market, but also their savings account returns are often eroded by inflation in the context of low interest rates.

To increase this proportion, BlackRock is working with a number of mature European institutions and emerging platforms, such as Monzo, N26, Revolut, Scalable Capital and Trade Republic, to jointly lower investment barriers and improve local financial literacy.

Bullish on RWA, saying tokenization is the "highway" of the future of finance

Extending from ETFs to the current popular encryption technology, Fink believes that tokenization is becoming a key force in reshaping financial infrastructure.

Link wrote that the circulation of global funds today still relies on the "financial pipelines" established in the era when orders were shouted by voice in the trading hall and fax machines were still regarded as revolutionary tools. Take the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as an example - it supports trillions of dollars in global transactions every day, and its operation is more like a relay race: banks pass instructions in turn, and carefully check the details at each step. In the 1970s, when the market size was smaller and the transaction frequency was lower, this relay method made sense. But today, continuing to rely on SWIFT is as inefficient as sending an email to the post office for forwarding.

Although this system was reasonable in the past, its efficiency is now unable to support the globalized and digitalized financial needs.

In Fink's view, the emergence of tokenization will completely change this inefficiency. If SWIFT is the postal service, then tokenization is the email itself - assets can circulate directly and in real time, bypassing all intermediaries.

Fink further described how tokenization profoundly changes the financial ecology, which is undoubtedly a disguised bullishness on the RWA market. "It converts real-world assets (such as stocks, bonds, and real estate) into digital tokens that can be traded online. Each token represents your ownership of a specific asset, like a digital certificate of ownership. Unlike traditional paper certificates, these tokens exist securely on the blockchain, making buying, selling, and transferring instant, without cumbersome documents and waiting time. Every stock, every bond, every fund - every asset can be tokenized. Once realized, it will completely revolutionize the way of investing. The market will no longer need to close, and transactions that originally took days to complete can be settled in seconds. The hundreds of billions of dollars of funds currently frozen due to settlement delays will be able to be immediately injected back into the economy, driving more growth."

Perhaps most importantly, he said, tokenization will make investing more "democratic." Tokenization can democratize access. Tokenization allows assets to be held in fragments-assets can be divided into countless small pieces. This means that assets that were originally high-threshold (such as private real estate and private equity) will be open to a wider group of investors, greatly lowering the threshold for participation.

Tokenization can also democratize shareholder voting. Owning shares gives you the right to vote on shareholder proposals for your company. Tokenization makes voting more convenient because your ownership and voting rights are recorded digitally, allowing you to participate in voting securely and hassle-free from anywhere.

Tokenization can also democratize returns. Some investments have much higher returns than others, but are often only accessible to large investors. One reason is that there are legal, operational, bureaucratic "frictions". Tokenization can remove these barriers and allow more people to gain access to high-yield areas.

However, Fink also frankly pointed out that the popularization of tokenization still faces a key technical and regulatory challenge. "One day in the future, I believe that tokenized funds will become an everyday configuration for investors like ETFs - but the premise is that we have to overcome a key problem: identity verification."

He said that financial transactions require strict identity authentication. Apple Pay and credit cards can complete billions of identity authentications without any obstacles every day. Trading platforms such as the New York Stock Exchange (NYSE) and MarketAxess can also do it when buying and selling securities. But tokenized assets will no longer go through these traditional channels, so we need a new digital identity authentication system.

“It sounds complicated, but the world’s most populous country, India, has already achieved this goal. Today, more than 90% of Indians can complete transaction verification securely through their smartphones.”

In this annual letter, Fink also reviewed the historical development of the capital market, pointing out its important role in promoting social prosperity and helping individuals accumulate wealth through investment. He talked about the need to further promote financial innovation to bridge the gap between public and private markets, and emphasized the importance of expanding investment opportunities, especially allowing small and medium-sized investors to participate in asset classes that were originally only open to the richest people.

While he acknowledged the widespread economic anxiety today, Fink sought to reassure investors that such periods are not new - and that, as has been the case throughout history, the economy will eventually stabilize thanks to human resilience and the power of capital markets.

In general, Larry Fink's annual letter to investors warns of the risks to the dollar's global reserve status and is also a prediction about the future of finance. From the reconstruction of the capital market through tokenization to the bottleneck breakthrough of the required digital identity system, Fink reveals the irrationality of the existing system and points out the new direction that may be brought about by technological and institutional innovation.

You May Also Like

Is Your Online Poker Game Rigged? How Provably Fair Shuffling on Race Protocol Works

The Ministry of Public Security released 20 anti-fraud keywords including "virtual currency": the so-called "exchange for virtual currency investment" is all fraud