Analysts: Bitcoin faces the risk of further decline as leverage ratios soar and a large amount of funds turn to Ethereum

PANews reported on August 27th that, according to The Block, K33 analysis suggests that Bitcoin's recent price weakness is likely to continue. Surging leverage and a massive shift of funds toward Ethereum make the market vulnerable to further declines in the short term. Research Director Lunde stated that open interest in Bitcoin perpetual futures has surged to a two-year high (over 310,000 BTC), increasing by 41,000 BTC in just two months, with an accelerated increase of 13,000 BTC over the weekend, potentially marking a turning point for the market. Furthermore, the annualized funding rate has jumped from 3% to nearly 11%, suggesting overly aggressive long positions. The current market bears similarities to the leverage accumulation seen during the summer of 2023-2024, both of which culminated in a massive series of liquidations in August. However, the peak in open interest this time occurred in late this month, suggesting the market may be entering a more prolonged period of consolidation, which could catch bargain hunters off guard. Lunde warned of an increased risk of a short-term long squeeze and advised caution in holding positions.

Furthermore, a long-term holder converted 22,400 BTC into Ethereum last week, pushing Ethereum to a new all-time high of $4,956 over the weekend, ending a 1,380-day correction. Despite Ethereum's sharp gains against the US dollar, its long-term returns against Bitcoin remain negative. Institutional investors saw CME traders reduce their Bitcoin positions, while the options market shifted to a defensive stance. Ethereum futures outperformed Bitcoin due to ETF inflows and increased corporate holdings.

You May Also Like

Analysts Eye Mirror Chain as the Passive Income Blockchain That Could Mint Millionaires for Life

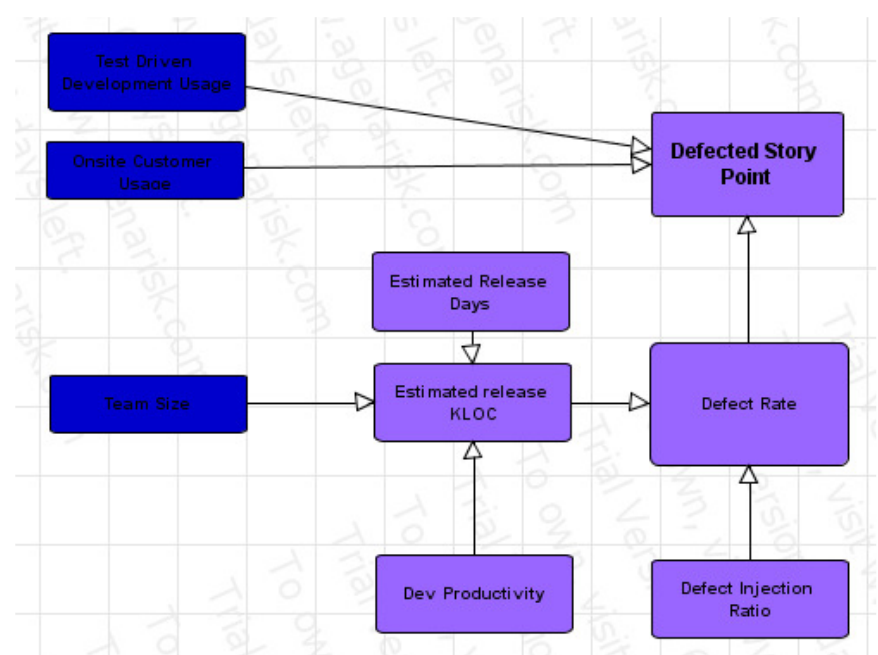

The Defected Story Points Model in Extreme Programming