ETH Liquidity Hits Record $163.5B: Is a Big Rally Coming?

TL;DR

- Ethereum stablecoin liquidity hits $163.5B, with $99.1M revenue showing strong demand for blockspace.

- ETH trades sideways near $4,360, key resistance at $4,500, support zones at $4,200–$3,880.

- The accumulation map shows ETH near the “Steady” zone, historically linked to long-term investor positioning.

Stablecoin Liquidity and Network Revenue

Ethereum’s stablecoin supply has climbed to a record $163.5 billion in September 2025, up from $152 billion in August. The increase marks one of the strongest liquidity inflows to the network this year and supports activity across decentralized finance and trading platforms.

Ethereum also generated $99.1 million in network revenue over the past 180 days. The figure reflects steady demand for blockspace as users continue to pay transaction fees. Analyst Cipher X commented,

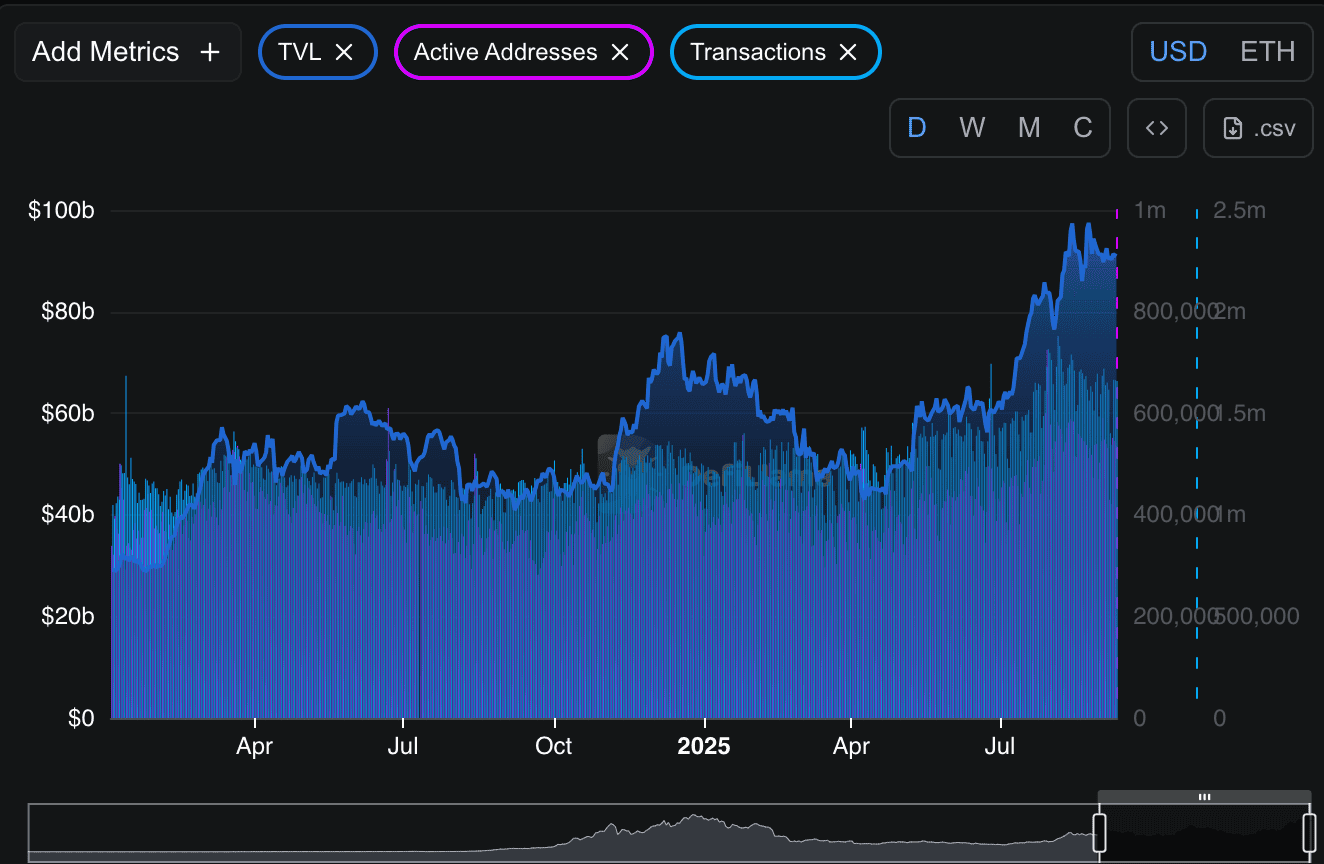

Meanwhile, Ethereum remains the largest platform for DeFi, the total value locked standing at $90.9 billion. According to DefiLlama, this amount has slightly gone down in the last 24 hours, though overall levels are still close to yearly highs.

Source: DefiLlama

Source: DefiLlama

In addition, user movement is active. The network recorded 540,717 active addresses in one day alongside 64,794 new addresses. Daily transactions stood at 1.66 million, indicating a constant demand across applications such as lending, staking, and trading.

Trading Range and Market Outlook

ETH was trading at around $4,360 after nearly two weeks of sideways movement. Resistance sits at $4,500, with a potential move higher targeting $4,883. On the downside, support is seen between $4,200 and $4,100, with deeper levels at $4,060 and $3,880.

Crypto analyst Ted noted,

He also highlighted that Ethereum generated $1.4 million in fees yesterday, the highest among all blockchains.

Long-Term Accumulation Perspective

A fresh monthly MACD crossover has appeared on Ethereum’s chart, which some traders view as a long-term shift after extended consolidation. Merlijn The Trader called it a “monster ignition,” suggesting renewed momentum.

Merlijn also shared an accumulation map, showing ETH near $4,362 in the “Steady” band, just above “Still Cheap.” This area has historically aligned with accumulation phases for long-term holders and larger investors. The upper red zones, labeled “HODL” and “Take Profit,” have coincided in past cycles with retail-driven rallies and profit-taking.

With record liquidity, strong user activity, and technical signals aligning, Ethereum is at a point where its next move depends on whether price breaks above $4,500 or falls back toward lower support.

The post ETH Liquidity Hits Record $163.5B: Is a Big Rally Coming? appeared first on CryptoPotato.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns