Cardano Price Prediction: ADA Price Forecasts Turn Sour & What Is The Best Crypto To Buy Today For 60x Gains?

The latest Cardano price prediction is causing a stir as analysts warn of slowing momentum and bearish pressure. While ADA struggles under market conditions, crypto traders are searching for a project with real upside potential and the chance for 60x gains.

This opportunity can be found in none other than Layer Brett, a next-generation Layer 2 crypto that blends meme energy with tangible blockchain utility. With over $3 million already invested in its ongoing presale, early buyers are positioning themselves for explosive staking rewards and a low gas fee crypto experience unlike anything on Ethereum’s congested Layer 1.

Cardano Price Prediction Points to Struggle Amid Weak Growth

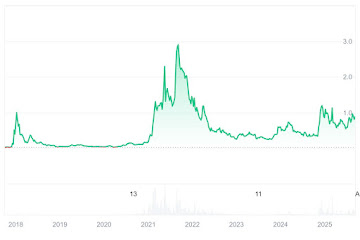

Cardano price chart. Source: CoinMarketCap

Cardano price prediction looks increasingly bearish as ADA struggles to regain momentum in 2025. The token remains down 71% from its all-time high, and without meaningful adoption of a native stablecoin, its long-term top-10 position appears at risk.

The biggest problem lies in Cardano’s ecosystem itself. Lacking a stablecoin, competitive DeFi activity, and consistent fee revenue, ADA cannot generate the liquidity or utility needed to fuel sustained growth. Trading volume is weak, adoption remains stagnant, and market participants show little confidence in substantial near-term progress.

Charles Hoskinson even has admitted to the stablecoin gap, noting that the network lacked a fundamental building block to expand the ecosystem. Devoid of this, the growth of Cardano might not be achievable and any rebound in price might collapse and the ADA will be left exposed in the face of new entrants.

Layer Brett: Secure, Scalable Layer 2 Crypto for Investors

While Cardano price prediction has traders rethinking ADA, Layer Brett presents a compelling alternative. Being a fully ERC-20 token, it is run on a Layer 2 blockchain that is designed to be fast, efficient, and scalable. Transactions are processed off-chain with a connection to Ethereum to provide near-instant confirmations at a pace that makes even the fastest meme coins seem slow.

Community engagement is a key driver of Layer Brett’s momentum. Social campaigns, referral rewards, and presale promotions are designed to boost adoption and reward loyalty. Layer Brett’s $1 million giveaway adds an extra layer of excitement, amplifying staking benefits and attracting attention from investors hunting for low-cap crypto gems.

The tokenomics are transparent and designed to foster growth. A fixed supply of 10 billion tokens supports a robust staking rewards system, early presale incentives, and ecosystem development. Then there’s the dynamic incentives, gamified staking, and upcoming NFT integrations, which keep holders actively engaged.

Security and accessibility remain central to Layer Brett’s vision. With no KYC requirements and a straightforward claim process after presale, users retain full control. The platform accommodates both newcomers and seasoned investors seeking the best crypto to invest in today, all while avoiding the slow, expensive pitfalls that often affect Cardano and other Layer 1 networks.

Conclusion

Cardano’s bearish outlook highlights its struggles with weak adoption and stalled growth, leaving many traders questioning its long-term relevance. As ADA falters, attention is rapidly turning to Layer Brett, a next-generation Layer 2 token that blends meme culture with real blockchain utility.

With $LBRETT priced at just $0.0055 and offering 807% staking rewards, urgency is high among investors seeking the next potential 60x breakout.

Layer Brett is still in presale, but it won’t be forever. Get in now before prices rise and rewards drop.

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

You May Also Like

Dramatic Spot Crypto ETF Outflows Rock US Market

Remittix Success Leads To Rewarding Presale Investors With 300% Bonus – Here’s How To Get Involved