Sei Taps Chainlink to Bring Official US Government Economic Data On-Chain

Chainlink Data Streams went live on the Sei network SEI $0.32 24h volatility: 4.5% Market cap: $1.90 B Vol. 24h: $158.91 M on September 10, bringing a new institutional-grade oracle solution to the blockchain.

The announcement positions Chainlink LINK $23.49 24h volatility: 2.4% Market cap: $15.94 B Vol. 24h: $802.95 M as a “preferred” oracle provider for Sei, tasked with setting a new standard for secure and verifiable onchain data.

According to the official announcement, the system uses a pull-based model to deliver market data with sub-second latency.

This provides developers with more than just a single price point. It includes high-frequency market data and liquidity-weighted bid-ask spreads.

These features enable DeFi applications on Sei to better manage risk and ensure accurate pricing for users in lending, trading, and derivatives.

A key part of the collaboration is the onchain availability of U.S. Bureau of Economic Analysis data, including key macroeconomic indicators such as Real GDP and the PCE Price Index.

Access to this federal data is intended to unlock more advanced trading opportunities and institutional use cases, allowing DeFi protocols to build products that can react to real-world economic shifts.

Sei’s Rapid Ecosystem Growth

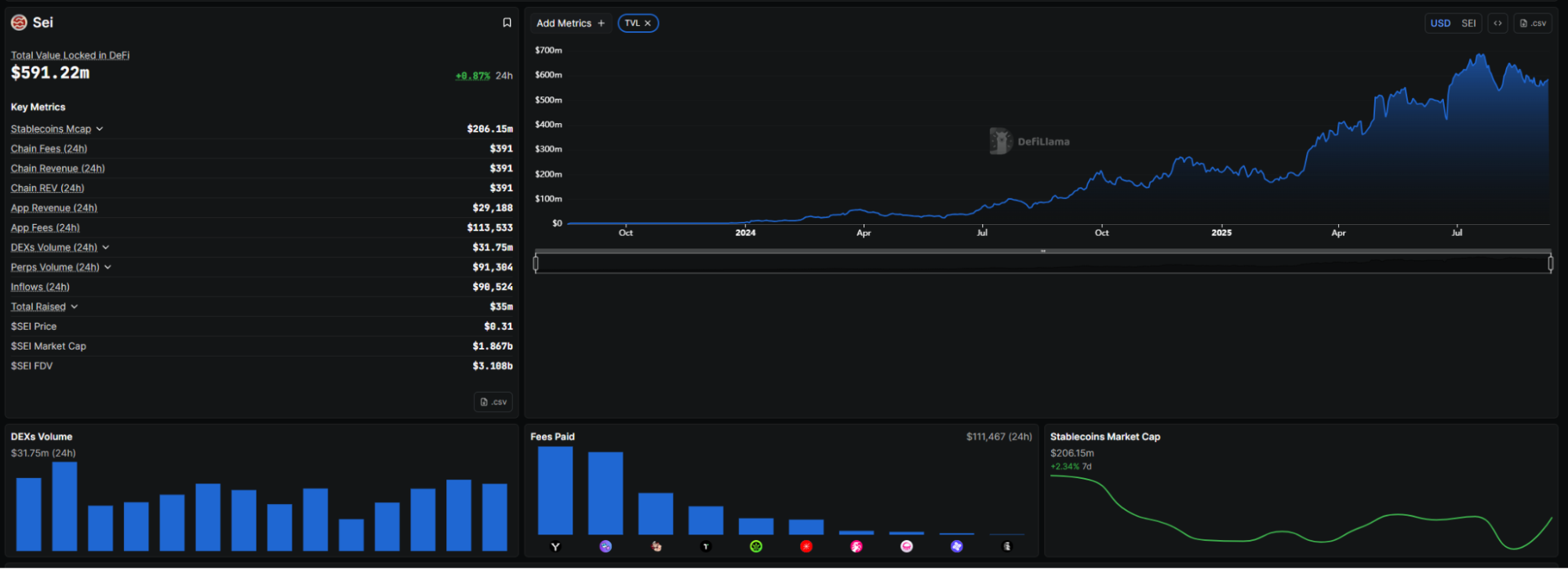

Sei’s on-chain activity remains strong, with over $591M TVL and millions of transactions. | Source: DeFiLlama

The Chainlink integration comes as Sei experiences a period of explosive on-chain growth. The network has surpassed 64.3 million total unique addresses and processed over 3.8 billion transactions to date, according to its official block explorer, Seiscan.

Activity in the last 24 hours remains high, with over 2 million transactions and 395,000 new addresses created.

This on-chain activity is complemented by over $591 million in Total Value Locked (TVL), according to data from DeFiLlama.

This momentum is supported by key strategic developments. In late August, asset manager 21Shares filed for a spot SEI ETF, boosting investor sentiment.

Earlier in the year, the network also made a strategic shift from Cosmos ATOM $4.66 24h volatility: 3.2% Market cap: $2.18 B Vol. 24h: $111.63 M to Ethereum ETH $4 370 24h volatility: 2.0% Market cap: $527.74 B Vol. 24h: $30.47 B to better integrate with the largest DeFi ecosystem.

The “preferred” designation for Chainlink is primarily a marketing term, as Sei continues to support a multi-oracle environment with competing providers like Pyth PYTH $0.17 24h volatility: 10.3% Market cap: $1.00 B Vol. 24h: $345.19 M and Band Protocol BAND $0.76 24h volatility: 4.2% Market cap: $124.28 M Vol. 24h: $12.70 M .

While both Chainlink and Pyth offer low-latency solutions, research indicates Pyth’s on-chain performance on Sei is around 800 milliseconds, whereas Chainlink’s is estimated to be closer to one second.

This offering complements Chainlink’s recent achievement as the first oracle to receive ISO 27001 certification.

nextThe post Sei Taps Chainlink to Bring Official US Government Economic Data On-Chain appeared first on Coinspeaker.

You May Also Like

Recovery extends to $88.20, momentum improves

Saudi Awwal Bank Adopts Chainlink Tools, LINK Near $23

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail