You can participate by staking 1 KCS. How does KuCoin use the "KCS Loyalty Level Program" to leverage new momentum for the platform?

Author: Weilin, PANews

In the crypto world, the role of exchange tokens is continuously evolving. From the initial “fee deduction tool” to the core asset of the ecosystem today. The value of exchange tokens not only reflects the strength and vision of crypto exchanges, but also becomes a bridge for user participation, ecosystem construction and revenue sharing.

As the native token of KuCoin Exchange, KCS has played a key role in the ecological evolution since its launch in 2017. Users can use KCS to pay transaction fees, earn incentives, and obtain exclusive rewards. It was originally issued based on Ethereum (ERC-20 standard), and then migrated to KuCoin Community Chain KCC to support more scalability needs.

As the number of KuCoin users worldwide exceeds 38 million, the platform is accelerating the construction of a new generation of crypto-financial ecosystem. The KCS loyalty level program launched in March 2025 is an important part of KuCoin's launch of the user incentive system 2.0 - making KCS no longer just a platform currency, but a pass to the future financial world.

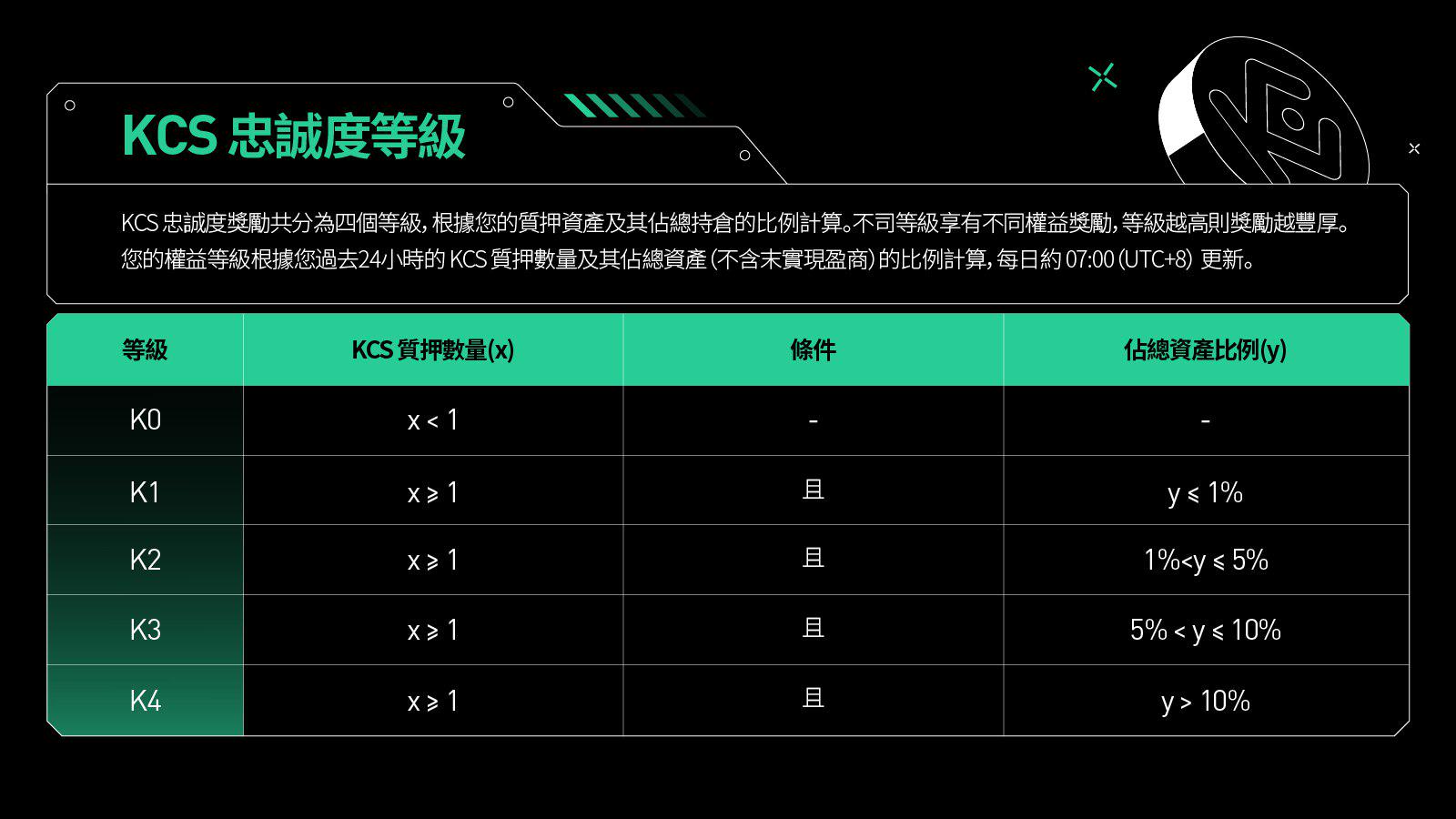

KCS Loyalty Level Program: Four Levels to Improve User Engagement and Asset Activity

The KCS Loyalty Level Program has four levels: K1 Explorer, K2 Voyager, K3 Navigator and K4 Pioneer. The levels are divided according to the user's KCS staked amount and its proportion of total assets. The design concept takes into account both "low threshold" and "high incentive": users only need to invest 1 KCS to participate and unlock exclusive rights and interests that increase step by step.

The main incentives and benefits of the KCS Loyalty Level Program include:

- Staking income bonus : The higher the holding level, the higher the annualized income ratio, which effectively improves the compound interest potential of assets.

- Additional returns from financial products : When participating in fixed-income products such as USDT, BTC, and ETH, you can enjoy level-specific income bonuses.

- GemPool IPO multiples increased : GemPool allows users to stake crypto assets to obtain token airdrops. By staking KCS, USDT and other tokens, new coins can be obtained at no additional cost. During the event, users can stake KCS, USDT or other tokens listed on the GemPool page. If eligible, the airdrop token rewards will be deposited into the user's trading account after the staking period, and users can also claim the accumulated airdrop token rewards according to the prompts on the event page. Now, users who participate in the loyalty tier program and participate in the GemPool KCS pool can get the GemPool multiple bonus to increase potential returns.

- Comprehensive platform benefits : including KuCard payment rebates, KCS deduction of transaction fees, withdrawal fee refunds, interest-free quota for new KA users, etc. At the same time, KuCoin is planning to add support for KCS staking in its Spotlight platform, allowing users to directly participate in project subscriptions through staking.

As the KCS loyalty tier program goes online, KuCoin has officially launched a site-wide welfare frenzy, preparing three gifts for KCS supporters: Exclusive airdrops for KCS holders - rewards loyal users, rewards will soon be airdropped into accounts. New user subscription challenge - race to subscribe, sprint to the top of the list, and win exclusive KCS rewards. "Pioneers" exclusive bonus - become a pioneer member and unlock high-level rewards.

It can be said that through these activities, KuCoin has made positive explorations to enhance the capabilities of KCS and bring more practical benefits to users.

KCS destruction mechanism: Continuously optimize circulation and promote value growth

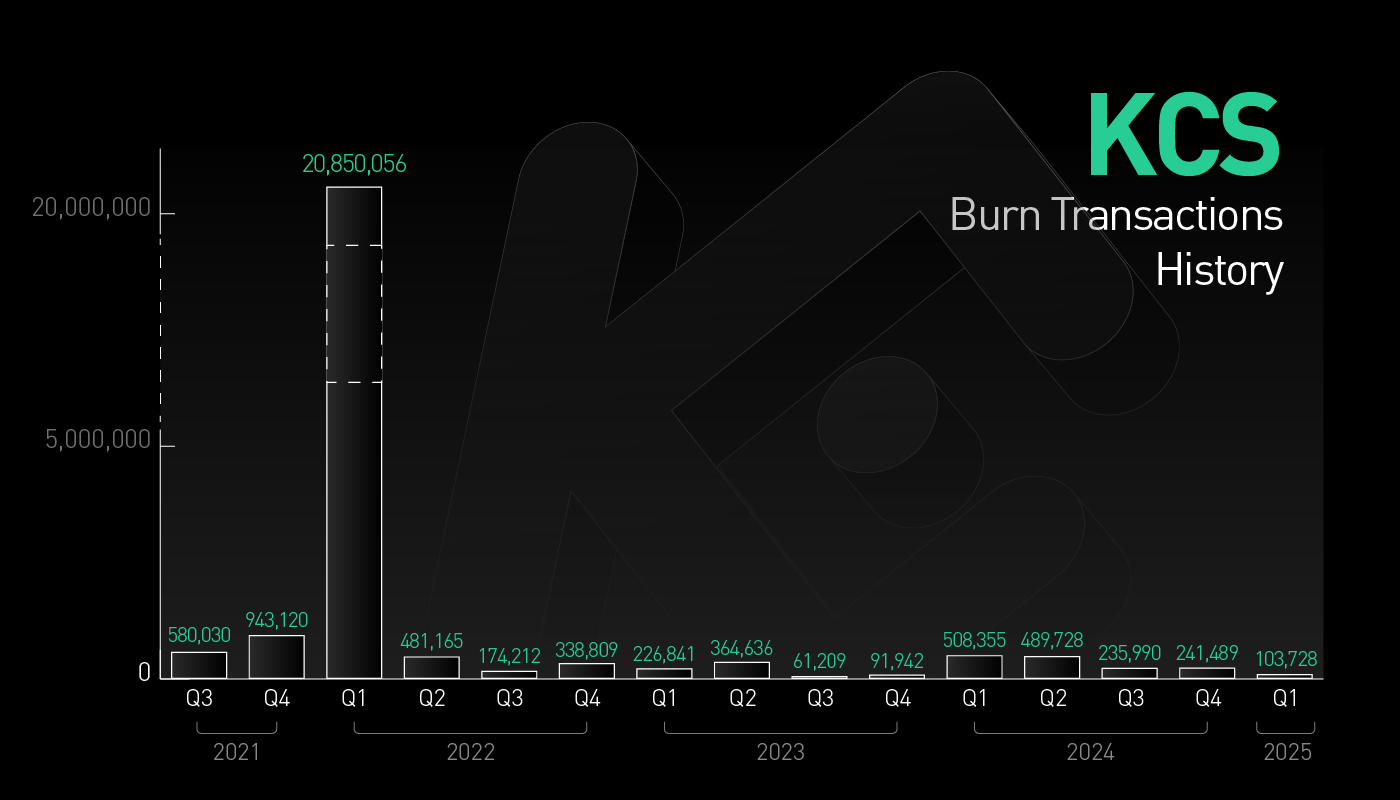

Token burning is a common token economic model, similar to buybacks in the stock market, which means that its total supply will gradually decrease over time through the token destruction process, and the reduction in circulation also promotes the scarcity of tokens. KCS also implements a deflationary model, where KuCoin uses a portion of its net profit to buy back KCS and then destroys the tokens to permanently remove them from circulation. The goal is to reduce the total supply from the initial 200 million tokens to 100 million tokens. This scarcity may help drive the value of the token over time.

In March 2025, the KCS team completed the 57th KCS destruction, burning a total of 17,836 KCS, worth approximately $218,074. In the past year, a total of more than 1.0888 million KCS were destroyed, worth approximately $10.867 million, demonstrating the platform's determination to continuously optimize the token structure.

From chains, payments to Web3 ecosystems, KCS is moving towards a dual identity of "platform currency + equity certificate". At the same time, KuCoin adheres to the compliance route to provide more users around the world with a safe and innovative trading experience KCS. KuCoin has a bright future. With the vision of "from geeks to mass adoption" as its core, KCS promotes an innovative economic model through three strategic pillars:

First, we will strengthen the KCC ecosystem.

KCC 1.0 was officially launched on June 16, 2021. It is an EVM-compatible blockchain that supports DeFi, games, and Web3.0 applications, with millions of blocks and a growing number of users.

KCC 2.0 upgrades internal subroutines to improve performance, scalability, and Gas limits (up to 500 million per block) while maintaining EVM compatibility.

KCC 3.0 evolves into a cross-chain ecosystem, adding low-cost Layer 2 and multi-functional SDK, providing efficient cross-chain transfer functions, and expanding the scope of DeFi and game applications.

The second strategic pillar is to establish a comprehensive payment system. KCS is participating in the construction of a payment system throughout the KuCoin ecosystem, including transactions, lending, NFT and offline payment access, lowering the threshold for global digital asset payments and forming a connection with the external chain ecosystem.

The third strategy is to lead the evolution of the Web3.0 ecosystem. KCS advocates a decentralized, user-driven Internet, which is achieved through:

- Decentralized Identity: Secure and private decentralized identity (DID).

- NFT Management: Simplified ownership and trading protocols.

- Metaverse platform: Supports social, gaming and virtual work environments.

- Developer Support: Provide funding and build a vibrant community with a dedicated Web3.0 incubation fund.

Driven by the continuous expansion of the platform ecosystem and the steady growth of the user base, the long-term potential of KCS is being released at an accelerated pace. KuCoin has comprehensively improved the participation and long-term holding motivation of KCS holders through the loyalty level program, further stimulating the vitality of the platform ecosystem. With the quarterly repurchase and destruction mechanism, the circulation of KCS continues to be optimized, and the supply and demand relationship tends to be balanced, laying a solid foundation for the mid- and long-term value growth.

Looking to the future, KuCoin will continue to adhere to the strategic direction of globalization and compliance, deepen local markets, embrace supervision, and provide global users with a more secure, transparent, and innovative trading experience. With the continuous expansion of product lines such as KuCard, Earn, and Launchpad, the use scenarios of KCS will continue to expand, becoming a key link between the exchange ecosystem and user rights.

With a more relaxed regulatory environment and policy support, the crypto market will have more development opportunities in the future. The launch of the KCS loyalty level program is an initiative of KuCoin to optimize the user incentive mechanism, and also reflects its direction of promoting global compliance and enhancing the platform's ability to release value. In this context, KCS may have greater development potential and opportunities through continued efforts in the future.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?