From L1 to DePIN, we have selected 8 of the latest potential airdrop projects.From L1 to DePIN, we have selected 8 of the latest potential airdrop projects.

Zero-cost interaction: 8 selected latest potential airdrop projects

3 min read

Author: Atoms Research

Compiled by: Tim, PANews

Selected 8 latest testnet projects, they have:

- Potential/Confirmed Airdrops

- Zero-cost interaction

Let's look at the full list of projects:

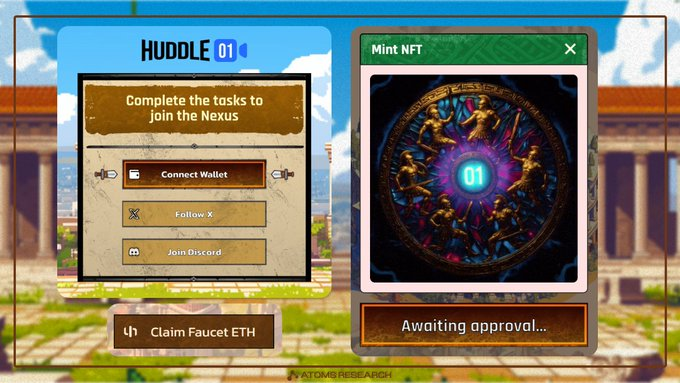

1.Huddle01

- Huddle01 is a needs-first DePIN project dedicated to accelerating digital connectivity in cyberspace.

- Financing: Invested by Balaji Srinivasan, Stani Kulechov and others, totaling US$7 million.

Interaction Guide

- Join the official Discord channel

- Enter the official website and connect your wallet

- Click "Claim Faucet ETH" to claim the test tokens

- After completing the first transaction, you will receive the "Landing NFT"

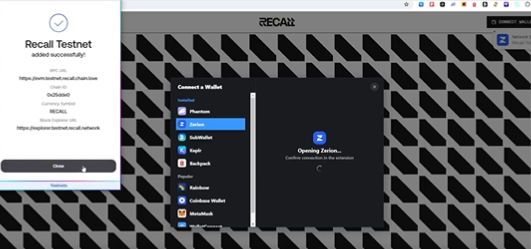

2. Recall

- Recall is a decentralized platform for testing, validating, and upgrading AI agents, enabling machine-verifiable decision-making.

- Funding: $30 million raised from Multicoin Capital, Coinbase Ventures, and others.

Interaction Guide

- Go to the faucet to get test tokens

- Purchase points on the official website

- After connecting your wallet, click “Create Bucke”

- Insert JSON with metadata (use ChatGPT for other schemes)

3. Irys

- Irys is a provenance layer that allows users to extend permanent data and accurately trace its origin.

- Financing: $8.9 million from Framework Ventures, OpenSea Ventures and other institutions.

Interaction Guide

- Enter the official website and connect your wallet

- Go to the faucet to get test coins

- Go back to the game room and start playing games. You can get test tokens for each game.

4. RISE

- RISE is Ethereum's second-layer scaling solution, featuring instant transactions, high scalability, and complete decentralization.

- Financing status: $3.2 million has been raised, with investors including Ethereum founder Vitalik Buterin, Polygon co-founder Sandeep Nailwal, Aave founder Stani Kulechov and other well-known figures.

Interaction Guide

- Go to the faucet to get the test coins

- Go to the official website and add the network to your wallet

- Go to the website to exchange tokens and add liquidity pools

- In addition, there are other ecological protocols that can be used for lending and minting NFTs, which readers need to explore on their own.

5. Somnia

- Somnia Network is a Layer 1 blockchain with a particular focus on enhancing the Metaverse and Web3 experience.

Interaction Guide

- Enter the website and connect your wallet

- Click and complete the "Netherak Demons" quest:

- Follow Netherak Demons account on X platform

- Retweet the official announcement of Netherak Demons

- Join the Netherak Demons Discord server

- Once completed go back and click on the "Somnia Yapstorm" quest

- Publish Somnia related content to share the weekly prize pool of 5000USDC + 100000 Somnia points

6. Seismic

- Seismic gives developers access to novel token onboarding models, consumer payment flows, a real-world asset RWA marketplace, and more

- Financing: $7 million raised, with investors including a16z, Polychain Capital and others.

Interaction Guide

- Go to the faucet to get the test coins

- Enter the official website and connect your wallet

- Select “Seismic Network” and click “Deploy”

- Join the Discord group, active people can get status

7. Seal

- Seal is a decentralized key management (DSM) service built based on the access control policies defined and verified by Sui.

Interaction Guide

- Installing the wallet

- Go to the faucet to get the test coins

- Go to the Seal website and connect your wallet

- Click “Try It” and sign the transaction

- Select "staketab" to download the file

- Return to the website and select Subscription Example

- Fill in all fields and create the service

8. MultipliFi

- MultipliFi is a multi-chain yield protocol that aims to solve two major industry pain points: the limited variety of cryptocurrencies that support interest-bearing, and the widespread problem of low yields.

Interaction Guide

- The Multipli mainnet testing phase is invitation-only

- The minimum account balance requirement is $1,000 (total amount of Ethereum, Arbitrum, BSC, Base, Matic, Optimism multi-chain assets)

- Support Join the waiting list to get the qualification to participate

- Visit the official website to submit your email address and receive notification when a spot opens up

Market Opportunity

L1 Price(L1)

$0.0024

$0.0024$0.0024

USD

L1 (L1) Live Price Chart

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

The post SBI VC Trade Adds Litecoin to Japanese Lending Program appeared on BitcoinEthereumNews.com. SBI VC Trade added Litecoin to its regulated lending program

Share

BitcoinEthereumNews2026/02/03 19:53

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?

Work Dogs Token Listing Date Expected in Q2 2026 as WD TGE Nears Completion

The countdown to the Work Dogs (WD) token listing date has officially begun. Afte

Share

Hokanews2026/02/03 20:16

Bitcoin: Treasury Corporation’s Strategic OTCQX Listing Unlocks New Growth

BitcoinWorld Bitcoin: Treasury Corporation’s Strategic OTCQX Listing Unlocks New Growth The world of cryptocurrency is constantly evolving, and a recent development has captured the attention of investors and enthusiasts alike. Bitcoin Treasury Corporation, a a company dedicated to accumulating digital assets, has made a significant move by listing on the U.S. OTCQX Best Market under the ticker BTCFF. This isn’t just another listing; it signals a growing trend of institutional confidence in digital assets and their long-term potential. What Does This Strategic OTCQX Listing Mean for Bitcoin Treasury Corporation? For those unfamiliar, the OTCQX Best Market is the highest tier of the three marketplaces for the over-the-counter (OTC) trading of stocks. It’s designed for established, investor-focused U.S. and international companies. Being listed here offers several distinct advantages for a company like Bitcoin Treasury Corporation. Enhanced Visibility: The listing provides a more transparent and regulated trading environment, making the company more attractive to a broader range of institutional and retail investors. Increased Liquidity: A higher-tier market often leads to greater trading volumes, which can improve the liquidity of the company’s shares. Credibility Boost: Operating on a recognized market lends significant credibility, especially for an entity deeply involved in the nascent crypto space. Bitcoin Treasury Corporation began its journey of accumulating BTC in June and has rapidly grown its holdings to over 700 BTC. This strategic accumulation underscores their belief in Bitcoin as a foundational asset for the future. Why Are More Companies Embracing Bitcoin for Their Treasuries? The move by Bitcoin Treasury Corporation isn’t an isolated incident. We’ve witnessed a remarkable shift in corporate finance over the past few years, with numerous companies integrating digital assets into their balance sheets. Why this sudden embrace of Bitcoin? Many view Bitcoin as a powerful hedge against inflation, especially in an era of quantitative easing and rising global debt. Its decentralized nature and finite supply of 21 million coins make it an appealing “digital gold” alternative to traditional fiat currencies. Companies like MicroStrategy have famously adopted Bitcoin as their primary treasury reserve asset, demonstrating a bold vision for corporate capital allocation. While the potential for significant gains is attractive, companies must also navigate the inherent volatility of the crypto market and evolving regulatory landscapes. Despite these challenges, the long-term strategic benefits often outweigh the risks for those with a strong conviction in this digital asset. How Does This Listing Impact the Broader Bitcoin Market? Each time a company like Bitcoin Treasury Corporation makes such a move, it sends a ripple through the entire crypto ecosystem. It serves as a strong validation of Bitcoin as a legitimate and valuable asset class, not just a speculative tool. This increased institutional involvement can lead to: Greater Stability: As more large entities hold Bitcoin for the long term, it could potentially reduce some of the extreme price swings often associated with the asset. Mainstream Acceptance: Corporate adoption paves the way for wider public acceptance and understanding of cryptocurrencies. Regulatory Clarity: With more traditional companies engaging, regulators may be compelled to provide clearer guidelines, fostering a more secure environment for everyone involved with digital currencies. For individual investors, this trend suggests a maturation of the market. It implies that fundamental analysis and long-term investment strategies are becoming increasingly relevant in the Bitcoin space. Navigating the Future of Corporate Bitcoin Holdings The listing of Bitcoin Treasury Corporation on the OTCQX Best Market marks a pivotal moment. It highlights a growing confidence among corporations in integrating digital assets into their financial strategies. As the digital economy continues to expand, we can expect more companies to explore similar avenues for their Bitcoin investments. However, it’s crucial for any company considering Bitcoin for its treasury to conduct thorough due diligence. Understanding market dynamics, regulatory compliance, and secure custody solutions are paramount. The journey into corporate crypto holdings is still relatively new, but pioneers like Bitcoin Treasury Corporation are charting a course for others to follow. In conclusion, Bitcoin Treasury Corporation’s OTCQX listing is more than just a procedural step; it’s a powerful testament to the enduring appeal and increasing institutional acceptance of Bitcoin. This move not only benefits the company but also reinforces the broader narrative of digital assets’ emergence as a crucial component of modern financial portfolios. It’s an exciting time to watch the intersection of traditional finance and digital assets evolve. Frequently Asked Questions About Bitcoin Treasury Corporation’s Listing Q1: What is the OTCQX Best Market? A1: The OTCQX Best Market is the highest tier for over-the-counter (OTC) stock trading in the U.S. It’s for established companies that meet stringent financial and disclosure requirements, offering enhanced transparency and credibility for investors. Q2: Why is Bitcoin Treasury Corporation’s listing significant for Bitcoin? A2: This listing signifies increasing institutional confidence in Bitcoin as a legitimate asset. It provides a regulated platform for a company focused on accumulating Bitcoin, potentially encouraging more traditional investors and corporations to consider digital assets. Q3: How much Bitcoin does Bitcoin Treasury Corporation hold? A3: As of their announcement, Bitcoin Treasury Corporation holds over 700 BTC, having begun its accumulation strategy in June. Q4: What are the benefits for Bitcoin Treasury Corporation by listing on OTCQX? A4: Benefits include enhanced visibility, increased liquidity for its shares, and a significant boost in credibility by operating on a recognized and regulated market, making it more attractive to a wider investor base. Q5: Does this mean Bitcoin is becoming more mainstream? A5: Yes, corporate actions like this listing contribute significantly to Bitcoin‘s mainstream acceptance. It helps validate digital assets as a serious component of financial portfolios, paving the way for wider public and institutional understanding. If you found this article insightful and believe in the growing importance of corporate Bitcoin adoption, please share it with your network! Your support helps us continue to provide valuable insights into the evolving world of cryptocurrency. To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin institutional adoption. This post Bitcoin: Treasury Corporation’s Strategic OTCQX Listing Unlocks New Growth first appeared on BitcoinWorld.

Share

Coinstats2025/09/18 19:40