Strategy (MSTR) Stock: Snubbed by S&P 500 as “Secret Committee” Blamed for Exclusion

TLDR

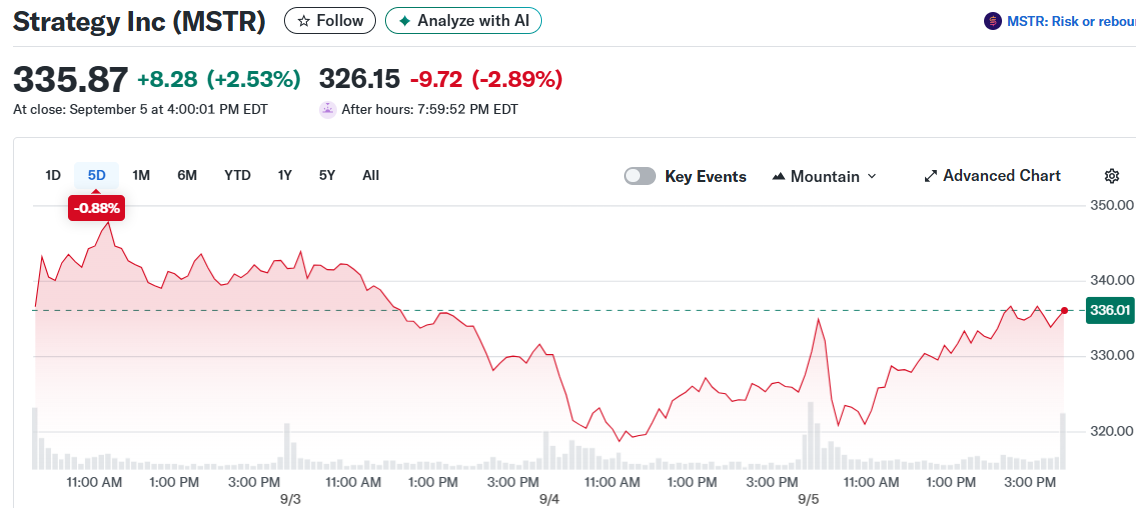

- Strategy (MSTR) was excluded from S&P 500 despite meeting all eligibility criteria, causing stock to drop 2.9% after hours

- Bloomberg analyst Eric Balchunas blamed a “secret committee” for the rejection decision

- Robinhood (HOOD) was surprisingly added to the S&P 500 instead, boosting its stock 7% after market close

- MSTR stock fell below $330 level, raising concerns it could revisit $300 support

- The exclusion represents a setback for the largest corporate Bitcoin holder’s institutional recognition

Strategy missed its shot at S&P 500 inclusion on Friday despite meeting all the necessary criteria. The rejection sent MSTR stock tumbling 2.9% in after-hours trading, erasing Friday’s gains and pushing shares below the $330 mark.

Strategy Inc (MSTR)

Strategy Inc (MSTR)

The exclusion came as a surprise to many investors who expected the largest corporate Bitcoin holder to finally earn its spot in the prestigious index. MicroStrategy had checked all the boxes for inclusion, including market capitalization, liquidity, and public float requirements.

Bloomberg ETF strategist Eric Balchunas pointed fingers at what he called a “secret committee” behind the decision. He questioned why MSTR was passed over despite meeting the eligibility requirements that should have guaranteed inclusion.

The committee has a history of rejecting major companies before eventually including them. Past examples include tech giants like Microsoft and Tesla, which faced initial resistance before joining the index.

Market Impact and Technical Outlook

The rejection puts MSTR stock in a precarious position technically. Trading below $330 raises concerns that shares could revisit the $300 support level that many analysts are watching closely.

MSTR has been moving sideways since hitting highs around $450 in mid-July. Some experts predict the stock could touch $300 again before any meaningful trend reversal to the upside occurs.

All eyes are now on the Federal Reserve’s upcoming meeting on September 17. A potential rate cut could provide the liquidity boost that MSTR shares need to regain momentum.

Robinhood Gets the Nod Instead

While MicroStrategy got shut out, digital trading platform Robinhood secured a surprise spot in the S&P 500. The news sent HOOD stock soaring 7% in after-hours trading as investors celebrated the unexpected inclusion.

Robinhood joins only two other crypto-linked stocks in the index: Coinbase and Block. The changes take effect on September 22, giving index funds and ETFs time to adjust their holdings.

The inclusion typically triggers buying activity from funds that track the S&P 500 benchmark. This mechanical buying often provides price support for newly added stocks.

AppLovin and Emcor Group also earned spots in the index alongside Robinhood. The trio of additions left many wondering why MicroStrategy didn’t make the cut despite its strong fundamentals.

MicroStrategy’s exclusion represents more than just a stock price disappointment. The company had hoped S&P 500 inclusion would expose millions of investors and portfolio managers to its Bitcoin strategy, potentially serving as a catalyst for both the stock and the broader crypto market.

The post Strategy (MSTR) Stock: Snubbed by S&P 500 as “Secret Committee” Blamed for Exclusion appeared first on CoinCentral.

You May Also Like

RFK Jr. may have perjured himself with key vaccines claim: newly revealed emails

ai.com Launches Autonomous AI Agents to Accelerate the Arrival of AGI