Opinion: Flywheel starts, Solana becomes the winner of meme craze

Author: Duo Nine , Crypto Analyst

Compiled by: Felix, PANews

PANews Note: This article only represents the author’s views and does not constitute investment advice, DYOR .

Solana did one thing right and captured the retail market in a way that no other chain could during this cycle.

Competitors like Ethereum failed at this and paid a heavy price. BNB Chain failed. Tron tried and failed.

These competing L1 chains failed, but Solana succeeded, and for that SOL deserves respect.

How does Solana do it?

Solana VC captures the market’s greed in a way that no other L1 can.

Tron also has low transaction costs, as does BNB Chain. Solana has no advantage in this regard. However, the two competing chains are focusing on the wrong thing.

Binance focuses on their CEX, generating airdrops to users from new coins listed on Binance. Users must stake BNB for this. This method works well to keep the price of BNB high.

BNB has also hit a new all-time high in this cycle, but it has not risen 28x like Solana (compared to its 2022 low).

Tether's official data shows that there are 60.2 billion USDT on the Tron network, which is close to half of the current total USDT of 130.7 billion. There are 66.3 billion USDT on the Ethereum chain, and only 860 million USDT on the Solana network.

USDT on ETH is mainly used for DeFi, while USDT on Tron is used for transfers and payments. Tron and Justin Sun tried to create a meme and introduce retail investors to their chain, but failed. They entered the market too late, and the TRX price has not been able to rise 28 times in this cycle.

As for Ethereum, it is completely out of touch with the market reality. Vitalik talked a lot on the forum, talking about the 5-year roadmap.

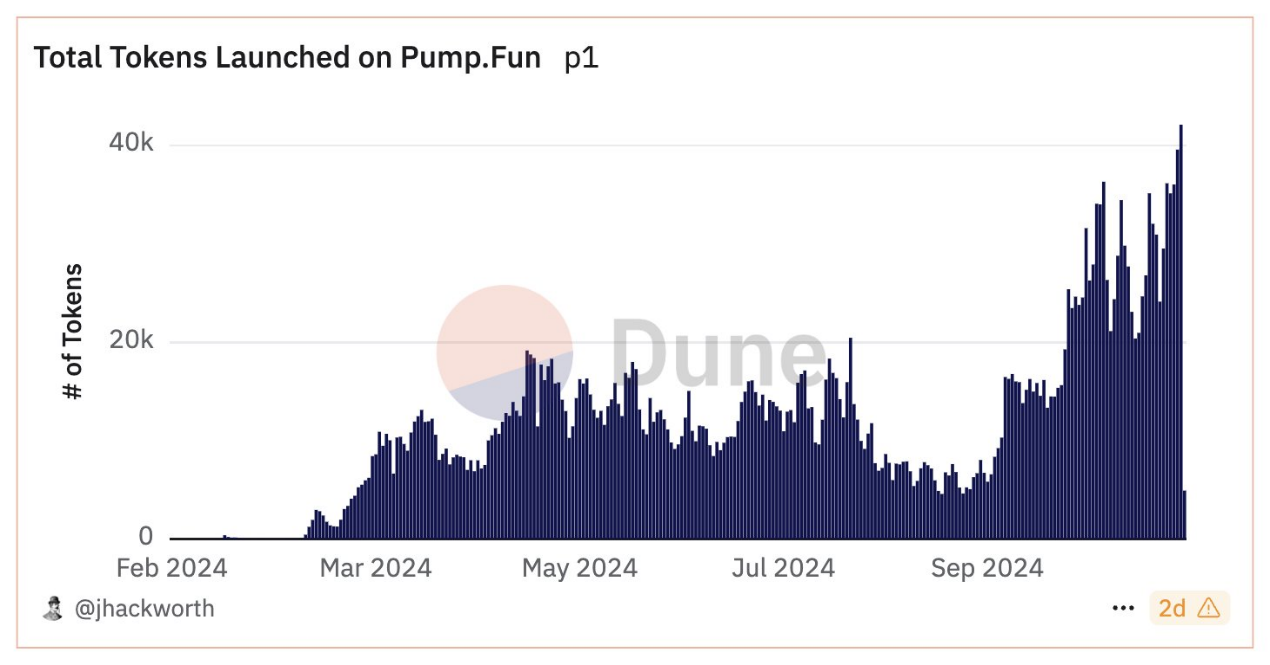

However, retail investors have an attention span of 30 seconds, which is how long it takes for the Solana meme to grow 10x on pump.fun.

What makes Solana a winner?

Besides having low transaction costs and a 28x increase since 2022 (which is important to major retail investors), Solana has done another important thing.

They created applications and ecosystems to feed their greed through memes. Solana VC invested a lot of cash, they also subsidized the network costs and actively created FOMO through memes.

They also focus on creating applications and wallets that retail investors can easily understand. Retail investors don’t care about infrastructure (unlike Ethereum developers), they care about price increases.

Solana achieves this and allows retail investors to gamble like Degens. Solana is literally a meme machine, the king of memes. Their ecosystem is constantly churning out new memes, just like Tron does with USDT transactions.

Other L1s do not have this advantage, and retail investors like memes.

This also had unexpected consequences.

If you talk about crypto with your friends, Solana will be the first and most talked about altcoin. During this cycle, the question you get from new people is “How do I buy Solana” instead of “How do I buy Ethereum/BNB/TRX?”.

This should be underestimated. New money is flowing into Solana and the price of SOL shows it.

Even Solana’s VCs were surprised by this success. They’re doing great. And they’re planning to cash out big time, too.

In early 2025, tens of millions of SOL will be unlocked and dumped on the market. Retail investors may invest crazily in SOL due to FOMO. One meme token basically costs hundreds of dollars.

The fact is that the Solana token is the ultimate meme. Retail investors will actually think “I’ll sell this meme coin and plow the profits into SOL”.

They don’t know that Solana is also a meme.

This thinking will now only drive up the price of Solana. As long as retail investors think Solana is a “safe” or a “blue chip,” the game will continue until the music stops.

Whenever people bet on a meme on SOL and realize “profit” by buying SOL, the real winner is the VC who sold SOL.

Solana doesn’t have a real use case for payments or remittances like Tron, nor does it have DeFi like Ethereum. It has memes. Solana is very good at this and performs well in bull markets.

You can take a gamble on Solana but eventually exit, don’t put your money in SOL or any token on the Solana network. It is a centralized database, not a decentralized currency like Bitcoin.

One could argue that Solana is full of fake users, which is true.

But this doesn’t stop real retail investors from being lured into its ecosystem.

Once onboarded, the Solana-created bots will go to work. On pump.fun alone, hundreds of bots will immediately snap up/buy any newly created meme tokens.

It’s a flywheel that incentivizes users to keep spending money in the hopes that one of their tokens will explode.

Some will, but most won’t. This works well until liquidity dries up when retail investors flee in a bear market.

By then all planning is complete and the VC has cashed out hundreds of millions or even billions of dollars.

You see, retail investors only need to spend $100 to buy some meme tokens to become millionaires. This story will satisfy the FOMO needs of thousands of new users.

And then the cycle repeats. Over and over again. Solana captures this cycle very well. And there have been other similar cycles in the crypto market in the past.

Related reading: How do VCs view the current Memecoin craze?

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm