Trump’s American Bitcoin Hits Nasdaq with $273M BTC – Here’s Our 1000x Crypto Recommendations

ABTC stock jumped up 72% during initial trading on Wednesday, reflecting an industry-wide appetite for crypto. The company disclosed to the SEC that it holds 2,443 BTC valued at $273M.

Other corporations are also increasing their crypto exposure. Bitmine just purchased another 14,665ETH, worth around $65M. Bitmine is already the largest ETH treasury in the world and this purchase solidifies their ETH-first position.

As widespread corporate adoption is exploding, we’ve identified three cryptos that might reach 1000x in the next few years. Read on to find out why Snorter Bot ($SNORT), Bitcoin Hyper ($HYPER) and Chainlink ($LINK) are our recommendations for 1000x crypto.

1. Snorter ($SNORT) – A Telegram-Based Trading Bot with Advanced Honeypot Detection

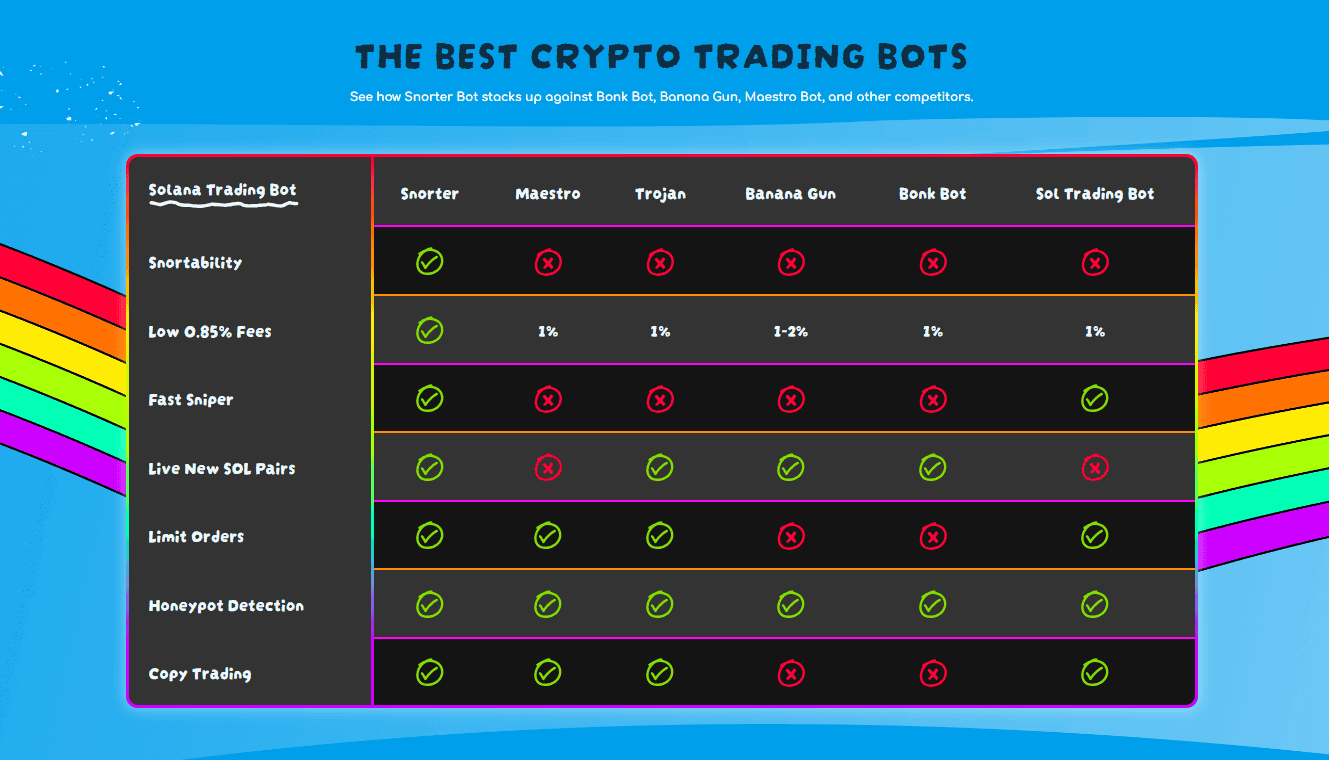

Snorter Token ($SNORT) is the presale token that powers Snorter Bot, a crypto trading bot designed for automated token sniping within a powerful Telegram-based interface.

Snorter automatically identifies new altcoins with potential, scans them for rugpull indicators, and notified you if all’s looking good. The honeypot detection engine scored an 85% success rate in beta testing, which we expect to only get better on full release.

Solana support will be available on launch. However, after release, the devs will also release trading modules for Ethereum, BNB, Polygon, and Base, too.

Snorter is pretty useful on its own, but the $SNORT token unlocks the daily cap on trading, allowing you to make as many transactions as you want.

That’s particularly important if you want to take advantage of Snorter’s mirrored wallet function, only available to $SNORT holders.

All you have to do is nominate a wallet with a winning strategy and Snorter monitors their trades, executing identical ones as quickly as possible thanks to a sub-second RPC.

While you’re waiting for Snorter to go live (it’s due for release pre Q4-2025), you can buy $SNORT in the presale now. It’s raised over $3.7M in token sales already. And our Snorter Token price prediction claims a potential $1.07 price by the year’s end, a 936% increase from today’s price.

Join the Snorter Token presale today for only $0.1033 and lock in staking rewards of up to 125% per annum.

2. Bitcoin Hyper ($HYPER) – A Super-Fast Layer-2 for Bitcoin with Smart Contract Capabilities

Bitcoin Hyper ($HYPER) is taking the Bitcoin network to the next level. It’s clear from the level of institutional investment we’re seeing that Bitcoin is an amazing store-of-value, but it’s not the most friendly cryptocurrency to transact in – it’s expensive to trade and slow to clear transactions.

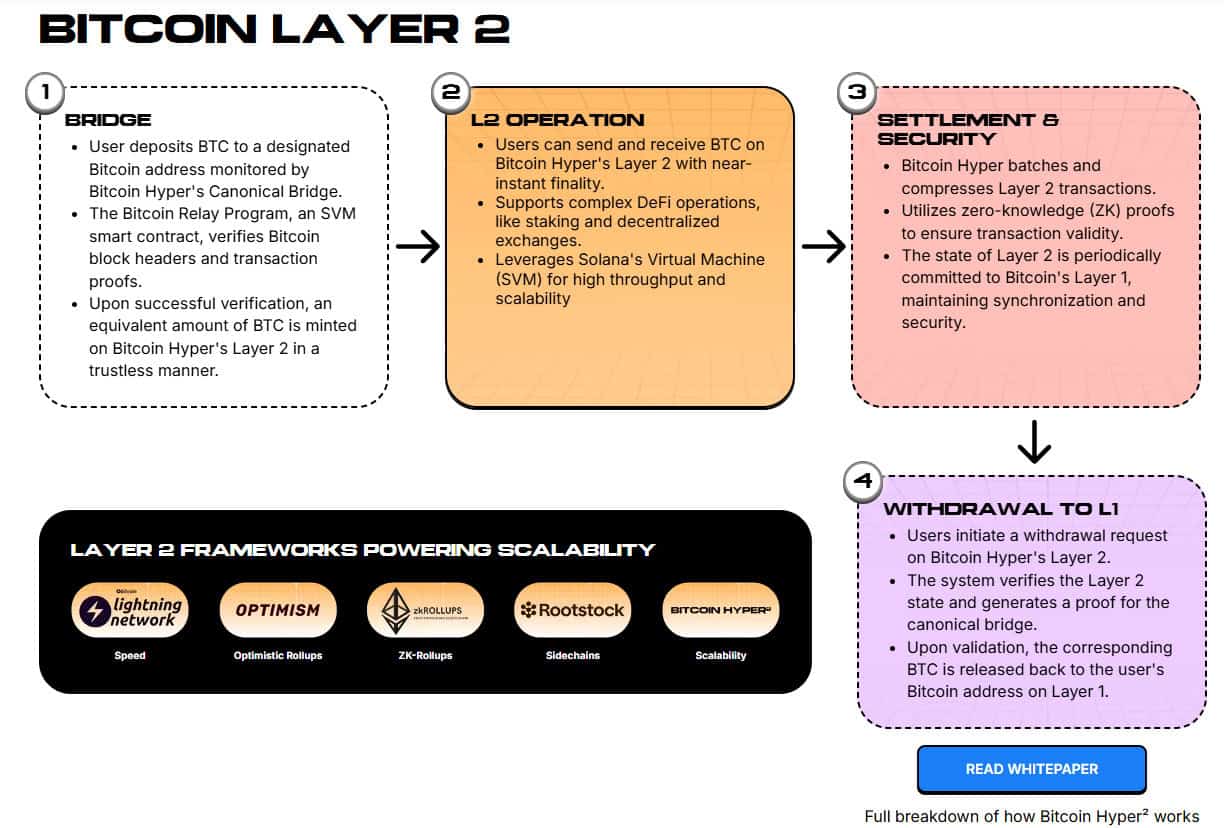

To solve these issues, Bitcoin Hyper adds a Solana Virtual Machine (SVM) to Bitcoin via a Layer-2 with zK rollups. Solana is built for scalability, capable of processing tens of thousands of transactions per seconds instead of the 7-10 per second possible on the Bitcoin Layer-2.

The exciting part is that this Layer-2 also adds smart contract capabilities, allowing Bitcoin Hyper devs to build dApps that facilitate DeFi functions like crypto swaps and NFT trades, all with the value of $BTC built into the underlying ecosystem.

Onramping to the Bitcoin Hyper network couldn’t be simpler. Send your $BTC to the appropriate wallet address on the Layer-1 and the Canonical Bridge mints an equivalent amount of wrapped $BTC straight to your account on the Layer-2.

Your $BTC is in custody while you use Bitcoin Hyper. To release it, make a withdrawal request by depositing $wBTC on the Layer-2 and your $BTC is returns to your L1 wallet.

It’s all made possible thanks to $HYPER, the official token of the Bitcoin Hyper network. By using $HYPER, you receive lower fees when interacting with dApps or trading crypto on the Layer-2.

Want to suggest features or vote on existing proposals? Holding $HYPER gives you participation rights in the Bitcoin Hyper DAO, so you can have your say on the future of the project.

Youțll want to buy $HYPER cheaply before the project goes live, though – it’s already raised nearly $13.8M in presales so far. If you do, you can lock in up to 80% in staking rewards per annum.

However, those rewards won’t stick around forever. It’s a dynamic presale, so the quicker you buy in the better rate of return you’ll get.

Get your $HYPER tokens today for $0.012855, ahead of tomorrow’s price increase.

3. Chainlink ($LINK) – Providing Verified Off-Chain Knowledge to DeFi Apps

Chainlink is a decentralized blockchain oracle service that provides verified sources of knowledge to other blockchains.

As we’ve seen, businesses are turning towards crypto as an investment vehicle and a technology for carrying out trusted code execution, which has fuelled the DeFi revolution.

However, there’s a fundamental problem stopping DeFi from integrating with real-world markets: How do you get off-chain information on the blockchain in a way that’s as trustworthy as if the information was generated on-chain?

By bridging blockchains to real-world sources of data via a network of oracle nodes through Chainlink. A node is rewarded in $LINK when it fetches off-chain data that is validated by the rest of the network as valid.

Source: CoinMarketCap

Chainlink could be the solution of choice for large financial service providers, including BlackRock. $LINK’s price is $23 at the moment, having increased 126% over the last year. We expect this to jump even higher as large institutions continue to move into the Web3 ecosystem.

You can purchase $LINK through any major CEX or DEX.

Are Businesses Finally Adopting Crypto?

The wave of treasuries opting into crypto indicates a bright future for $BTC, $ETH, and the crypto market as a whole.

We could see B2B transactions in $BTC becoming normal in the next few years as small businesses start holding Bitcoin as an investment opportunity. If that’s the case, there will be a need for a scalable solution for Bitcoin, which is where we expect Bitcoin Hyper ($HYPER) to capture the market.

Of course, the capital brought in by small businesses will benefit the Web3 ecosystem as a whole, resulting in more users, more volume, and more opportunities to profitably trade using tools like Snorter, pushing up the value of Snorter Token ($SNORT).

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation