What Is DeFi? Inside MakerDAO, DAI, and the Future of Finance

Table of Links

Abstract and 1. Introduction

-

Bitcoin and the Blockchain

2.1 The Origins

2.2 Bitcoin in a nutshell

2.3 Basic Concepts

-

Crypto Exchanges

-

Source of Value of crypto assets and Bootstrapping

-

Initial Coin Offerings

-

Airdrops

-

Ethereum

7.1 Proof-of-Stake based consensus in Ethereum

7.2 Smart Contracts

7.3 Tokens

7.4 Non-Fungible Tokens

-

Decentralized Finance and 8.1 MakerDAO

8.2 Uniswap

8.3 Taxable events in DeFi ecosystem

8.4 Maximal Extractable Value (MEV) on Ethereum

-

Decentralized Autonomous Organizations - DAOs

9.1 Legal Entity Status of DAOs

9.2 Taxation issues of DAOs

-

International Cooperation and Exchange of Information

10.1 FATF Standards on VAs and VASPs

10.2 Crypto-Asset Reporting Framework

10.3 Need for Global Public Digital Infrastructure

10.4 The Challenge of Anonymity Enhancing Crypto Assets

-

Conclusion and References

8. Decentralized Finance

The financial system performs a critical job of financial intermediation and enables the flow of capital from lenders to borrowers. Similarly, in the domain of crypto assets using platforms like centralized crypto exchanges or decentralized platforms using smart contracts, such financial intermediation is possible. The smart contract ecosystem enables the automation of deposit, disbursal, lending and repayment of funds. This has created an entire ecosystem of financial services which operate on the blockchain, called DeFi or Decentralized Finance. DeFi enables enormous opportunities of financial innovation using crypto assets and smart contracts. At the same time, it also poses new challenges to tax administrations and law enforcement agencies as lack of KYC norms and regulatory oversight can enable tax evasion and money laundering. The wide variety of applications and products offered by DeFi warrant a separate paper to describe the mechanics as well as the taxation aspects of this ecosystem, which are not very clear and well understood today. However, this paper discusses two prominent DeFi platforms MakerDAO and UniSwap which account for a significant portion of assets locked up in DeFi applications.

8.1 MakerDAO

MakerDAO is one of the most popular DeFi projects. It is a Decentralized Autonomous Organization that issues and manages two ERC-20 tokens. The first token is known as DAI, which is a cryptocollateralized so called stablecoin soft pegged to the US Dollar, the second token is Maker (MKR) which is used as a governance token of the Maker protocol as well as a utility token for auctioning DAI for MKR and vice versa. In unforeseen situations it can also be used as a resource for recapitalization and repayment of Maker protocol debt. The MakerDAO is essentially a system of smart contracts running on the Ethereum Blockchain that manage the supply of DAI and MKR. A system of incentives and other mechanisms enable creation and destruction of DAI as well as its backing with appropriate collateral to maintain its soft peg to the US Dollar using smart contracts. Unlike the so called centralized stablecoins, the collateralization and assets in the MakerDAO ecosystem are publicly available and do not require any proof of reserve or audit. A detailed overview of the MakerDAO is available in the whitepaper[115].

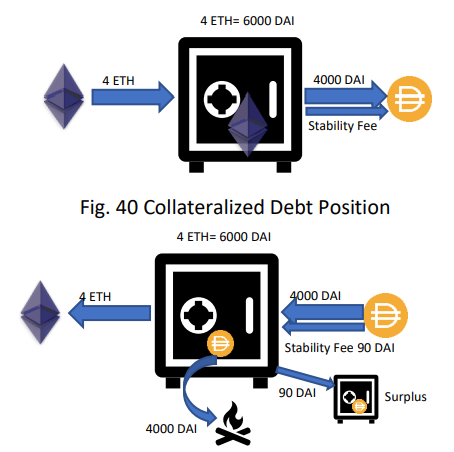

\ The MakerDAO can be considered a digital vault system which gives a DAI denominated loan to users which lock-up their Ether or other authorized crypto assets into a smart contract, which is called a Collateralized Debt Position (CDP). This is the mechanism that generates DAI as shown in Fig. 40. The DAI loan accrues interest denominated in DAI which is called the ‘stability fees’ in the Maker protocol. When the DAI loan is returned along with the stability fee by the borrower, the retuned DAI is burnt, the stability fees go to the surplus smart contract account and the collateralized assets are released (Fig. 41).

\

\ This system is analogous to a mortgage in the traditional financial system. One of the key differences is that the collateralized crypto assets like ETH and Basic Attention Token (BAT) are much more volatile than the assets mortgaged in traditional finance. Thus, MakerDAO users need to overcollateralize the DAI loans by at least 150% for ETH which can be higher (>175%) for some other crypto assets like BAT. This facilitates the stability of the protocol as well as the peg of DAI to the USD, as even if the value of CDP reduces, the Maker protocol would still be able to discharge the liability of issued DAI. If the CDP value falls below the threshold, the protocol enables three scenarios:

\ i) The borrower deposits more collateral to the CDP.

\ ii) The borrower repays some of the DAI debt.

\ iii) The protocol opens the CDP for auction by keepers which liquidate the CDP.

\ The MKR token is the governance token of the Maker protocol which enables the holders to vote on proposals as well as initiate proposals for changes in the protocol. The parameters like stability fee, the crypto assets to be taken as collateral, as well as their collateralization ratios are decided through voting, with each MKR token holder entitled to one vote. If due to an extreme event the protocol accrues a debt, the governance mechanism decides through voting to issue new MKR tokens for recapitalization. This is very similar to a situation in traditional finance where new equity is issued to infuse capital in a sick enterprise.

\ It is also noteworthy that apart from the Maker protocol DAI and MKR can also be bought and sold on various crypto exchanges. In order to incentivise people to hold DAI rather than selling it and to stabilize its value in the open market, the Maker protocol also enables the DAI borrowers to deposit the borrowed DAI into smart contracts that yield returns at the rate of the DAI savings rate. The DAI savings rate is also determined by the governance ecosystem of MakerDAO. Just like in ordinary finance where the lending rate is higher than the savings rate, the stability fee is always higher than the DAI savings rate. Besides this, the borrowers of DAI can use it to earn passive income on other DeFi applications or create further leveraged positions. The DAI stability fee, savings rate and the collateralization ratio are like instruments in the armour of a central bank which can affect the demand and supply of DAI resulting in movement of price of DAI in the desired direction as compared to the US Dollar.

\ Various external actors also play an important role in the Maker protocol operations. They play a critical role in maintaining the peg against the US Dollar. The main external actors in the Maker protocol are:

\ i) Keepers: They are independent actors which take advantage of arbitrage opportunities which help DAI to move towards the target price of 1 USD. They participate in Surplus Auctions, Debt Auctions, and Collateral Auctions which help to maintain sufficient reserves against the issued DAI in the protocol. Keepers are usually bots operated by natural or legal persons.

\ ii) Oracles: As the blockchains cannot access any off-chain information like asset prices of assets locked in CDPs or the price of DAI, oracles deliver price information about the assets locked in CDPs in order to enable the protocol to know when to trigger a liquidation.

\ iii) Emergency Oracles: They are the oracles selected by Maker governance as last line of defence against Maker governance or oracles. They are authorized by Maker governance to freeze oracles and trigger an emergency shutdown in an unforeseen situation.

\ iv) DAO Teams: These are individuals and service providers who are authorized by Maker governance to provide services to MakerDAO.

\ Keepers play an important role in maintaining the peg of DAI to the US Dollar as they participate in various auctions like the Surplus Auctions, Debt Auctions, and Collateral Auctions. The various auctions in the MakerDAO ecosystem and their role in the protocol is as follows:

\ i) Surplus Auctions: The DAI loans with accrued stability fee denominated in DAI is repaid back to the CDP smart contract. Once the DAI principal along with the stability fee is repaid, the collateralized assets are released. The excess DAI obtained from the stability fee goes to a smart contract which accumulates it to a level determined by the Maker governance, after which an auction for the surplus DAI to be converted to MKR can be triggered by a keeper and the MKR tokens obtained consequent to the auction are burnt.

\ ii) Debt Auctions: It is possible in certain cases that in situations where the value of the collateralized asset collapses rapidly, the liquidations might not be able to repay the entire collateralized assets and the protocol may incur debt. When this debt crosses a certain threshold determined by the Maker governance, an auction can be triggered by a keeper to recapitalize the protocol by auctioning off MKR for a fixed number of DAI.

\ iii) Collateral Auctions: These auctions are triggered to recover debt in liquidated vaults. When the collateral position in a CDP vault drops below the specified liquidation ratio the vault becomes available for liquidation. The keeper bots liquidate the vaults by sending transactions which trigger an auction of the assets locked in the vault. It is important to note that as the liquidation transactions can only originate from an externally owned account on Ethereum, the Maker protocol cannot automatically trigger the collateral auctions and relies on keepers for the same. The amount of DAI recovered by the auction is used to repay the debt and the remaining collateral is returned to the user after deduction of a penalty fee. The keeper gets a fee for the transaction as an incentive to keep a watch on vaults that can be liquidated.

\ The MakerDAO users and owners of MKR and DAI do not undergo any KYC procedure to determine their tax residency or for identification of the beneficial ownership of the assets, this gives rise to a complex scenario where a number of individuals or entities come together to transact on a decentralized lending platform which also issues a so-called stable coin and maintains its peg to the US Dollar. The individuals or entities also participate in the governance of the Maker Decentralized Autonomous Organization and take decisions which have financial implications for the protocol and the holders of MKR token themselves.

\ The tax implications of transactions in such ecosystems can be very complex and due to unforeseen and trans-national nature of such organizations there is virtually no guidance available for taxation of the truly Decentralized Autonomous Organizations which do not have a well-defined legal identity. Although, the individual transactions are still governed by the tax guidelines and laws of the respective jurisdictions of the members and users of the Decentralized Autonomous Organization’s platforms/protocols. The taxation of such Decentralized Autonomous Organizations is discussed in the subsequent sections.

\

:::info Author:

(1) Arindam Misra.

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

- https://makerdao.com/en/whitepaper/

\

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation