Trump, an old fan of Monopoly, enters blockchain games, making another move in the crypto space

Author: Zen, PANews

Donald Trump, the US President, is known for his "business thinking". His career involves real estate, reality shows, vodka, mortgages, NFL, aviation, bottled water, steaks and even board games. His business territory is also expanding in the cryptocurrency industry. After successively laying out NFT, DeFi, stablecoins, memecoin and crypto mining companies, Trump is now extending his tentacles to the blockchain game field.

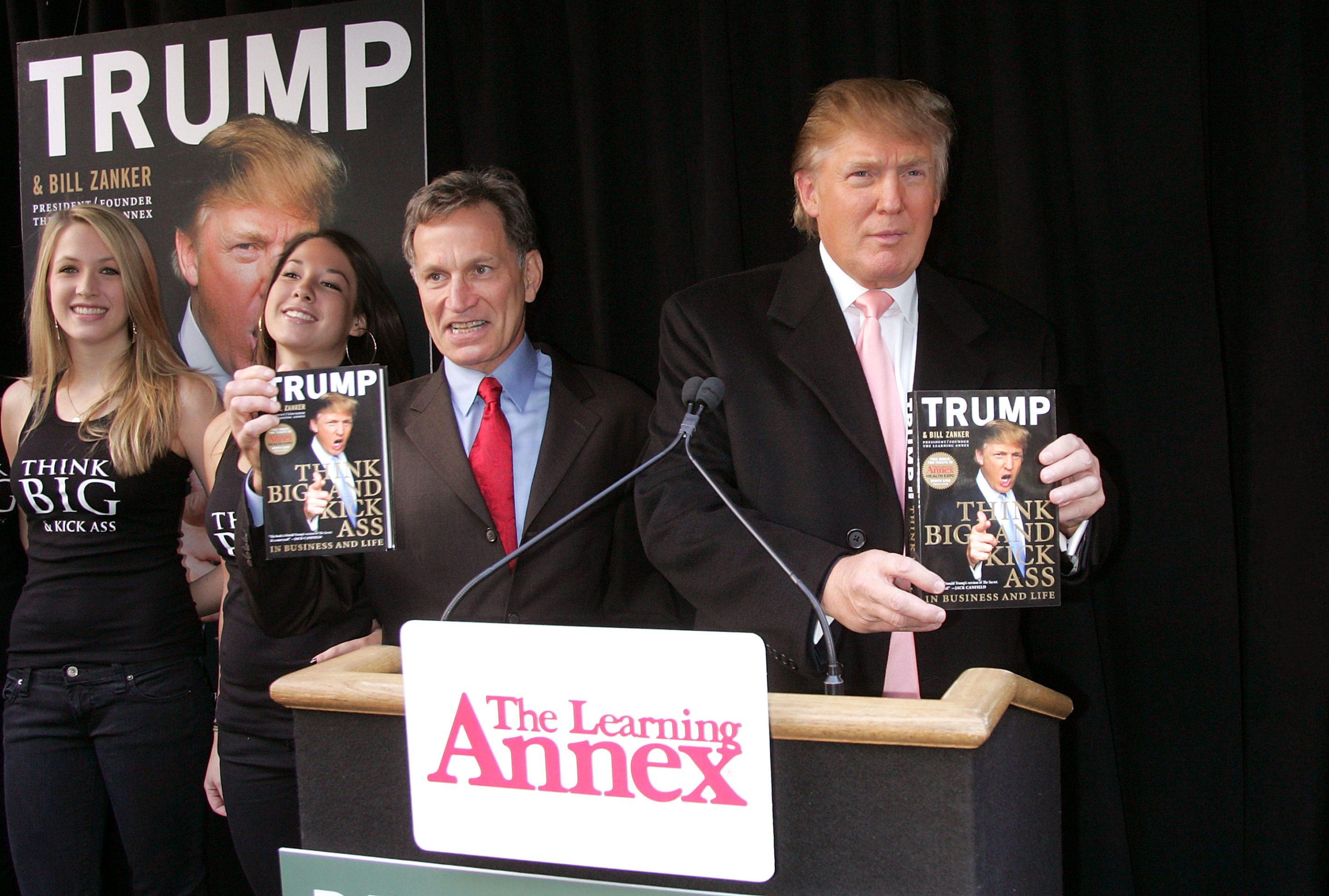

According to Fortune magazine, citing two people familiar with the matter, Trump is working with his business partner Bill Zanker to prepare a real estate crypto game with his brand at the core, similar to Monopoly Go! For this "senior enthusiast" who launched a Monopoly-like board game 30 years ago, the release of a digital version of Monopoly with the support of blockchain and cryptocurrency was both unexpected and expected, but it did bring a wave of excitement to the long-dormant blockchain game track.

Real estate tycoon Trump: A long-time fan of Monopoly

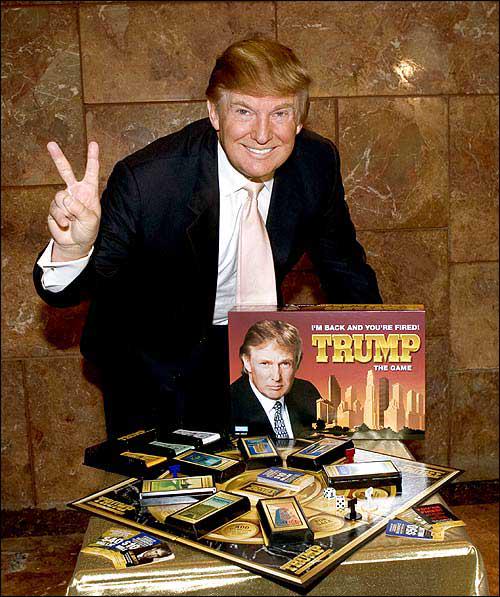

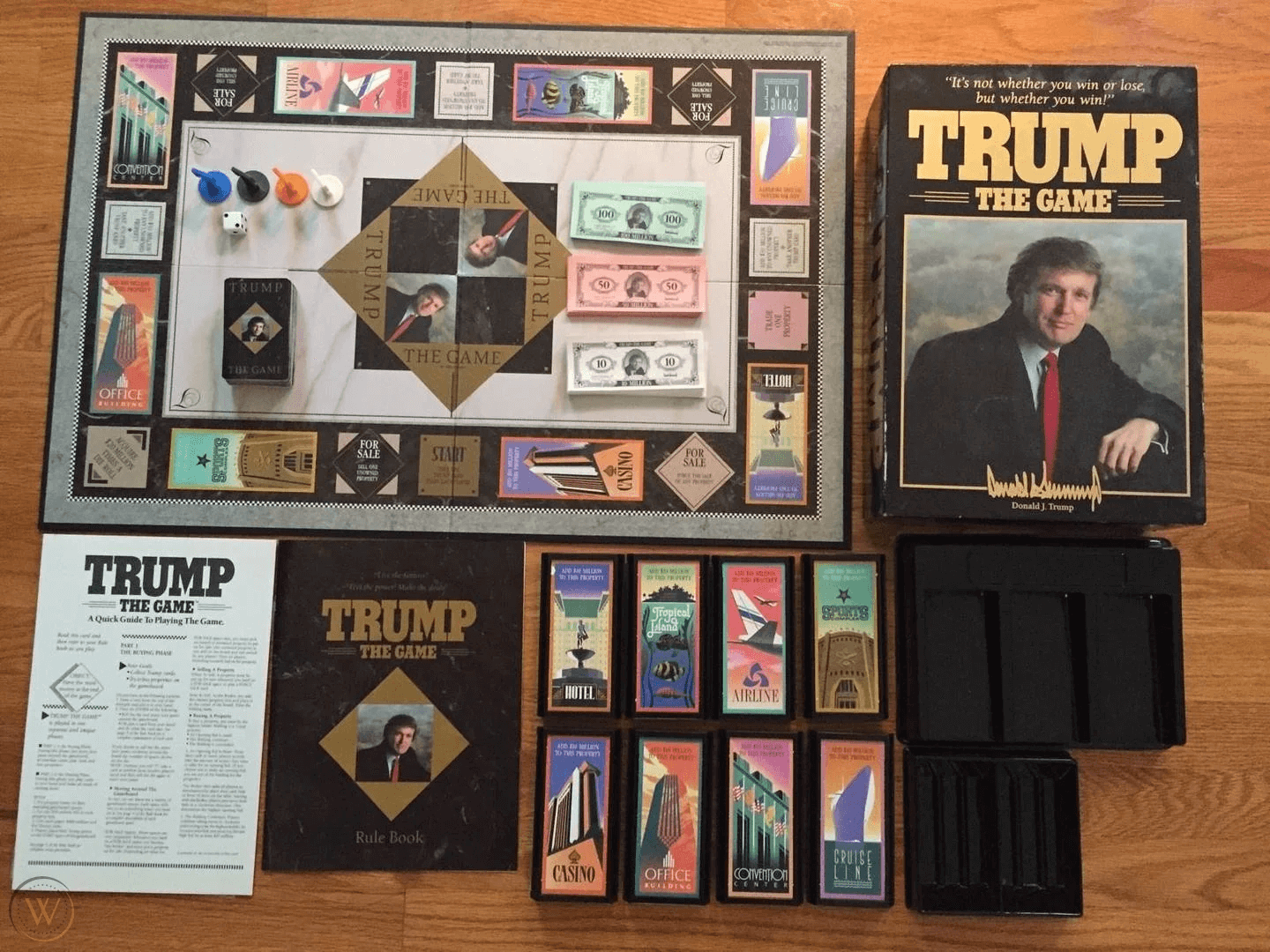

In May 1989, Donald Trump and Milton Bradley, a veteran board game company, launched the board game Trump: The Game, which was inspired by Monopoly and Trump's career as a real estate tycoon. Milton Bradley, then president of Milton Bradley, said that the game was based on high-stakes gambling, transactions, and Trump's 1987 bestseller The Art of the Deal. Trump also filmed a TV commercial for the game with the slogan "It's not about winning or losing, but whether you win!"

At a pre-launch event for Trump: The Game, Trump said he would donate an undisclosed portion of the game's revenue to charities for cerebral palsy and AIDS research, as well as to help the homeless. Before the $25 board game was officially released, Trump and Milton Bradley had ambitious plans, believing it would sell 2 million copies, but the final sales were 800,000 copies, far below expectations.

The reason is that, on the one hand, because the game is directly named after Trump, it is easy to be seen as a tool for the rich to make money, and the public is not aware that part of the proceeds are used for charity; on the other hand, the misleading marketing makes it be considered a copycat version of Monopoly. Trump believes that the main reason is that the game itself is too complicated, the rule book is more than 12 pages long, and lacks mass appeal. Although subsequent advertisements specifically stated that "Mr. Trump's proceeds from Trump: The Game will be donated to charity", the game sales are still sluggish. In addition, the Huffington Post reported in 2016 that Trump's previous claim that he donated the income from the board game to charity could not be confirmed, and Trump and related entities declined to comment on this.

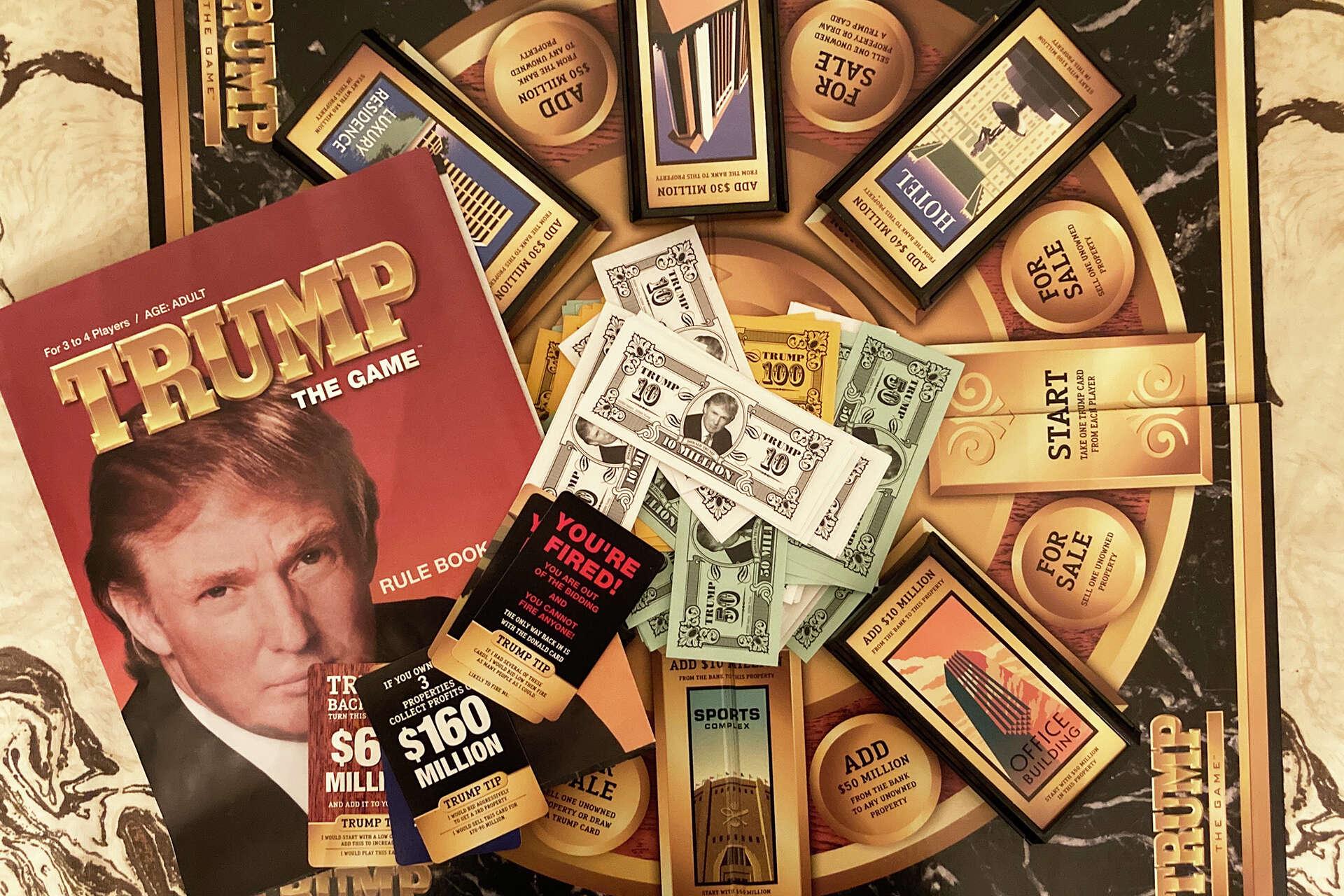

In 2004, after the success of Trump's reality show "The Apprentice", Parker Brothers re-released "Trump: The Game". The new version introduced Trump's classic catchphrase in "The Apprentice": "You're fired!" and the slogan "It takes smarts to make millions, and it takes Trump to make billions." However, even with Trump's celebrity effect, this game in a new bottle ultimately received mediocre response.

It should be pointed out that Milton Bradley was acquired by toy and entertainment giant Hasbro in 1984 and merged with Parker Brothers, another subsidiary of Hasbro, in 1998. The brand was later abandoned in 2009 in favor of the parent company's name and eventually adjusted to Hasbro Games. Therefore, the IP of this Trump-authorized board game should belong to Hasbro.

"I've always thought Monopoly is a great game, and a lot of people are interested in it." In 2006, Trump, a "real fan" of the Monopoly game, tried to launch a prime-time reality show based on Monopoly. Trump and documentary producer RJ Cutler will co-star, and Hasbro will be a partner in the program. However, the program eventually died quietly during the development stage, was not bought by any TV network, and no official program name or number of episodes were announced.

After more than 30 years, the Monopoly game is back based on encryption technology

Now, Trump is returning to the Monopoly game once again, only this time he’s taking it on-chain.

According to Fortune, multiple sources revealed that Trump is working with his business confidant Bill Zanker to develop a crypto-based real estate-themed game, which is expected to be launched at the end of April this year. The game is an adaptation of MONOPOLYGO! (Monopoly Go!), in which players earn game coins by moving pieces on a virtual Monopoly board and building buildings in a digital city.

People familiar with the matter said that Zanker was the driving force behind the blockchain game project and had initially planned to launch the project before the inauguration of the 47th president. Zanker can be regarded as Trump's "guide" into the cryptocurrency industry, and Trump's NFT project was facilitated by his repeated suggestions.

According to Zanker's recollection, when he suggested to Trump to launch NFT in early 2022, although Trump was quite interested in "NFT of the former president's artistic image", he was reluctant to use the term "NFT" and preferred to call it "digital trading card on the computer." At the end of the same year, Zanker pushed the matter again, and Trump readily agreed: "Many friends said I shouldn't do it, but I like it, so let's do it."

Zanker also plays an important role in Trump's memecoin project TRUMP. According to the memecoin's website, the remaining tokens after the TRUMP token ICO are held by CIC Digital LLC and Fight Fight Fight LLC, accounting for 80% of the total supply. In the registration documents of "Fight Fight Fight LLC", Zanker is listed as the primary contact person.

Regarding the specific details of the crypto game project, Zanker spokesman Kevin Mercuri only revealed that they are developing a "game." Mercuri denied that the game would have any similarities with Monopoly Go, saying that the relevant news was just "rumors." Previously, DTTM Operations, the entity responsible for Trump's trademark, applied to expand Trump's name to various virtual products and NFT-related services. But Mercuri refused to disclose whether these trademark applications were directly related to the project and how blockchain functions would be integrated into the gameplay.

In addition, there are doubts as to whether the upcoming blockchain game will be based on “Trump: The Game”, which has been launched for more than 30 years.

According to sources, Zanker approached Hasbro in May last year, hoping to buy back the IP of Trump: The Game. But Hasbro informed Zanker that it no longer owns the copyright to the game, which is more than 30 years old. However, according to Fortune, a spokesperson for Hasbro, the original developer of the Monopoly board game, said that the company did not license the Monopoly IP to Trump's organization for cryptocurrency investment.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?