A new round of airdrops is coming. Multiple factors drive the market sentiment to rebound. These 21 projects may be "big money".

Author: Nancy, PANews

As the secondary market gradually picks up, the crypto ecosystem is undergoing subtle changes, and the market's liquidity is gradually withdrawing from on-chain activities. In the bull market atmosphere, many projects are accelerating their pace to launch their own tokens in an attempt to attract more capital and user attention. At the same time, the recent strong performance of crypto projects in multiple sectors has further stimulated investment sentiment, and the market's expectations for the "copycat season" have become stronger, and they have begun to look for potential crypto assets.

DeFi and L1 become the main forces in coin issuance, and the token distribution strategy is optimized and adjusted

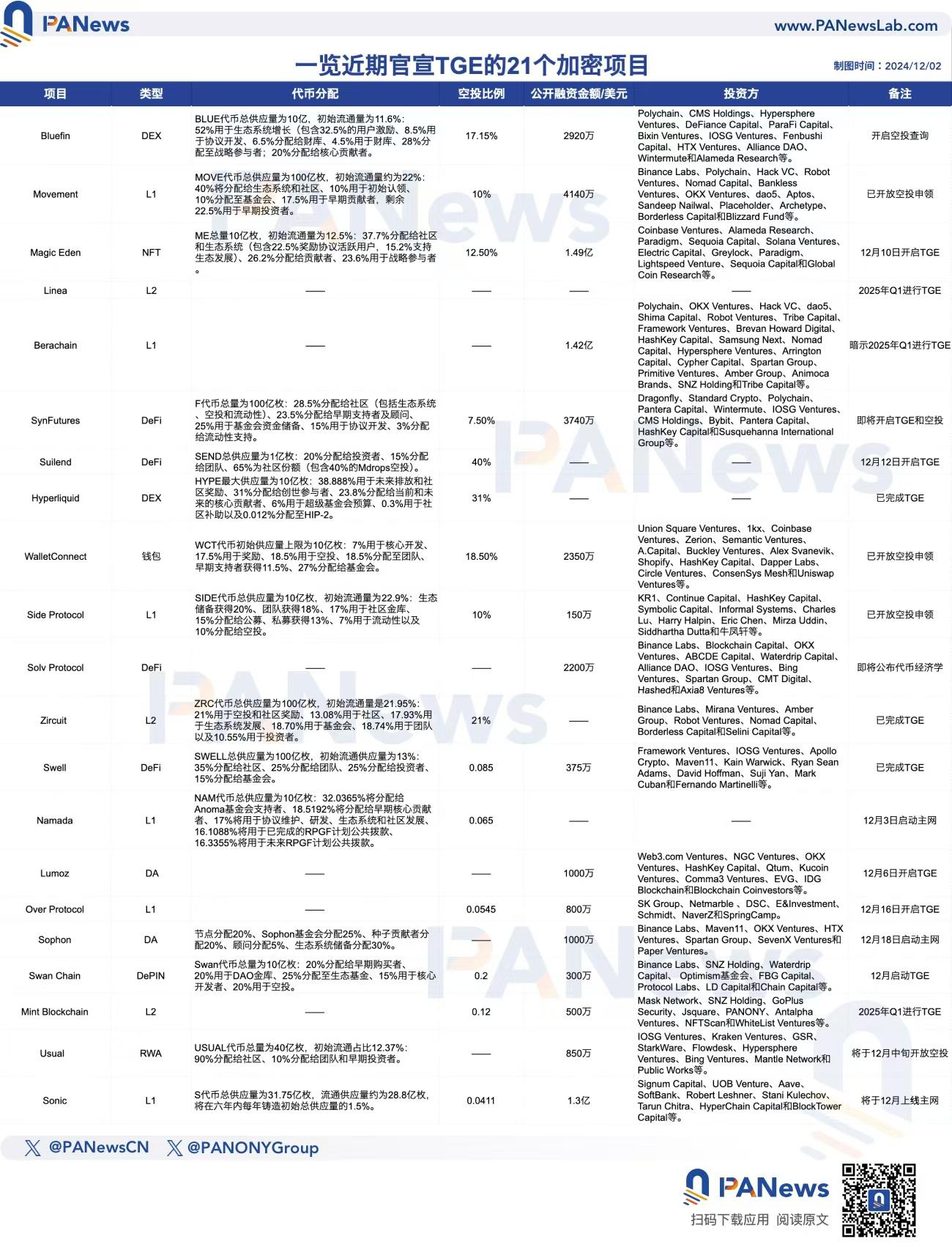

In recent times, the crypto market has seen a number of projects announce the issuance of tokens. PANews has counted 21 crypto projects that have recently announced TGEs, covering DeFi, L1, NFT, L2, and DAO. Among them, DeFi and L1 projects are the main issuers, with nearly half of the projects coming from these two tracks.

According to public information, these projects are generally favored by the capital market, with a total financing amount of more than 620 million US dollars, and investors include well-known institutions such as Polychain, Binance Labs, Coinbase Ventures, Dragonfly, Wintermute, Alliance DAO, GSR and DeFiance Capital. VC endorsement is often regarded as an important symbol of project reliability and potential, which can add more reliability and potential to these projects.

However, as capital intervened, the continuous decline in coin prices due to high FDV and low circulation gradually aroused strong dissatisfaction and controversy in the market. Faced with this dilemma, the market's attention began to shift significantly, including turning to relatively fair and decentralized crypto assets, such as MEME coins. For example, 10x Research recently released a report stating that the Google search trend for "Meme Coins" hit a record high, exceeding the previous peak in March 2024. This data also indirectly confirms that investors at this stage are relatively more inclined to community-driven and more fair investment opportunities.

From the perspective of token distribution, many projects have begun to adjust the problem of low initial circulation to avoid the dilemma of limited sustainable growth space brought by high FDV. For example, Movement's initial circulation reached 22%, Side Protocol's was 22.9%, and Zircuit's reached 21.95%. This change reflects the market's reflection on the low circulation and high FDV model, especially in such projects, ordinary investors often become the "victims" of liquidity withdrawal.

In addition, the token allocation strategy also pays more attention to ecosystem construction and community participation. For example, Bluefin uses 52% of the total tokens for ecosystem growth, Movement allocates 40% of the total tokens to the ecosystem and community, Magic Eden allocates 37.7% of the total tokens to the community and ecosystem, and Usual allocates 90% of the tokens to the community. Such a strategy helps to enhance the community cohesion and market competitiveness of the project and better promote the long-term development of the project.

Especially in terms of airdrop intensity, the average token airdrop ratio of these 21 projects reached 14.9%, among which Suilend, Hyperliquid, Zircuit, Swan Chain and WalletConnect reached 40%, 31%, 21%, 20% and 18.5% respectively, which was much higher than the average. In particular , Hyperliquid became one of the crypto projects with the largest airdrop scale this year with an airdrop value of up to $28,500 per person . As an effective means to attract and motivate community members, airdrops still play an important role in project promotion, not only providing generous returns to early supporters, but also effectively enhancing the influence and popularity of the project.

Multiple factors may help the return of the altcoin season, but Bitcoin alone cannot be the driving force

The reason why crypto projects have intensively announced coin issuance is closely related to the market recovery and the loosening of the US policy environment. Recently, as Bitcoin continues to rise, mainstream public chains, DeFi, Metaverse, L2, games and other sectors have experienced a strong rebound. At the same time, the intensified PVP competition in the MEME market has also discouraged many players, and the market's attention has gradually begun to turn to the secondary market.

"The copycat season may be about to begin," top trader Eugene said not long ago.

According to the latest report released by Bitfinex, the overall crypto market has reached a new cycle high, and the market value of altcoins is now close to the high of $984 billion in May 2021, indicating that speculative funds are shifting from Bitcoin to altcoins. Historically, this rotation of funds usually heralds the arrival of the "altcoin season", that is, the rise of altcoins relative to Bitcoin is more prominent. Crypto analyst Mikybull Crypto said that Bitcoin's dominance in the crypto market has fallen below its two-year support line, which may indicate that the market has "officially entered the altcoin season." Because the decline in Bitcoin's dominance means that investors are taking profits from their BTC positions and investing part of their funds in altcoins.

QCP also pointed out that the recent decline in Bitcoin's market capitalization reflects the trend that funds may gradually shift from BTC to ETH and other altcoins. According to data disclosed by IntoTheBlock, November hit the highest level of net outflow of CEX stablecoins since April, about US$4.5 billion. Combined with the strong price performance, it shows that traders are locking in profits, and these funds may be redeployed into altcoins or used as reserves to cope with future declines.

Moreover, as the crypto market gradually moves towards the mainstream, the loose crypto policy environment in the United States has also stimulated the market's optimism about the overall development of the industry, including altcoins. According to previous reports by PANews , the list of members of Trump's new government has been gradually revealed recently, and many of them have publicly expressed their friendly attitude towards cryptocurrencies, which may bring more positive policy expectations to the industry. In particular, the upcoming departure of Gary Gensler, chairman of the US SEC, is believed to provide more space for the further development of the crypto industry. It is worth mentioning that with the ETF applications of currencies such as Solana, XRP and LTC, the market's expectations are getting higher and higher.

However, CryptoQuant CEO Ki Young Ju also pointed out that compared with the previous bull market, the current rise in Bitcoin is mainly driven by institutional investors and spot ETF demand. These funds are different from cryptocurrency exchange users and have no intention of shifting assets from Bitcoin to altcoins. At the same time, since institutional investors mainly operate outside exchanges, asset rotation becomes unlikely. Although institutions may allocate mainstream altcoins through investment tools such as ETFs, small-cap altcoins still rely on retail users of exchanges. For the total market value of altcoins to reach new highs, a large amount of new funds need to flow into exchanges, but the current level below historical highs indicates that the liquidity brought by new users has decreased. Therefore, altcoin projects should focus on developing independent strategies to attract new funds, rather than relying on the potential brought by Bitcoin.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm