BTC's new journey after breaking $100,000: 10 reasons to hit $150,000 in 2025

Original author: Miles Deutscher , Crypto Analyst

Compiled by: Yuliya, PANews

The market is experiencing a critical turning point. After Bitcoin broke through the $100,000 mark this week, investors' attention has turned to the next price target. Based on comprehensive data analysis, multiple indicators are showing that Bitcoin is expected to reach a new high of $150,000 by 2025.

This report will conduct in-depth analysis from the following four dimensions through 10 key indicators:

-

Timing cycle analysis

-

Macroeconomic factors

-

Market demand dynamics

-

On-chain data indicators

Timing cycle analysis

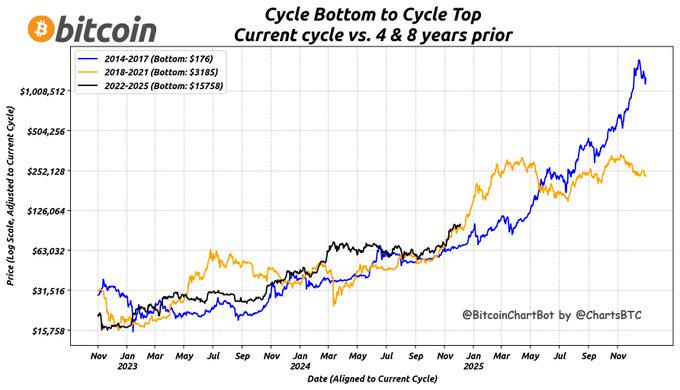

1. The current Bitcoin price trend is highly similar to previous cycles.

2. The market has entered its most explosive phase, which is the period when prices accelerate fastest.

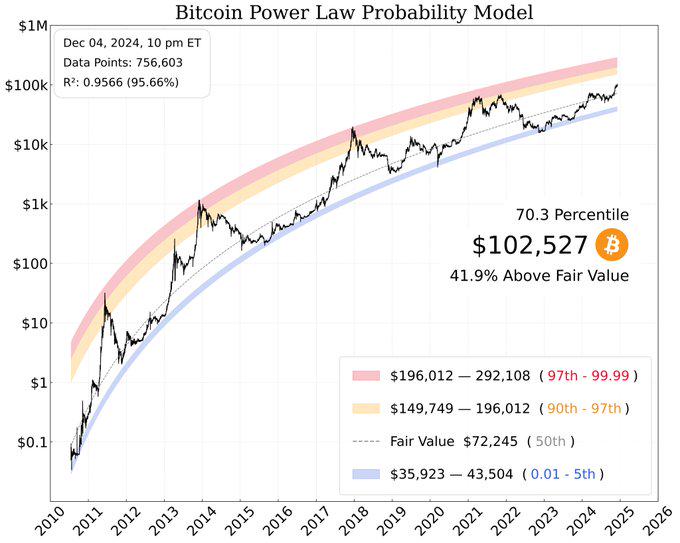

3. Throughout historical cycles, Bitcoin will enter the red area (97%) of the power law probability model. If this cycle repeats this pattern, it means that the price of Bitcoin will exceed $196,000.

Macroeconomic factors

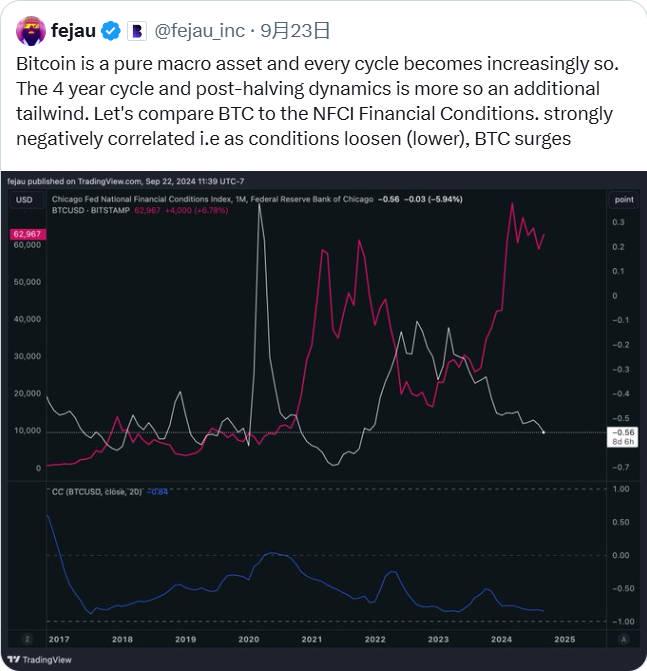

4. The current macro environment is in the most favorable state since 2021. Bitcoin is extremely sensitive to changes in monetary policy and global liquidity.

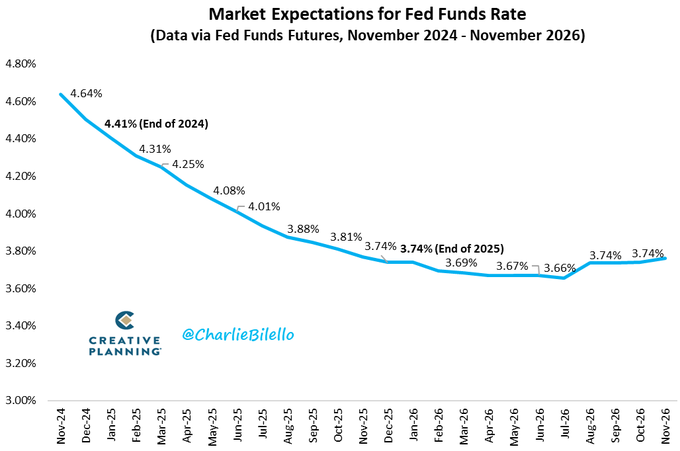

5. Interest rate cuts are expected to continue in 2025, which will create strong macro support for risky assets.

Market demand dynamics

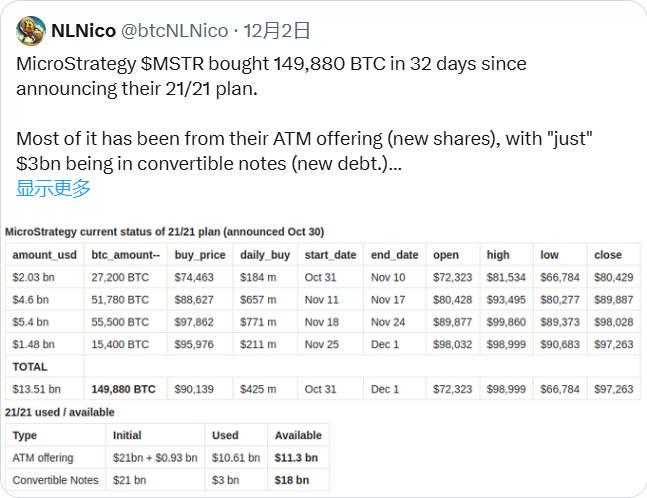

6. MicroStrategy continues to buy according to its 21/21 plan (targeting to hold 21% of the total supply of Bitcoin, with $29.3 billion remaining to be invested).

This affects Bitcoin demand in two ways:

-

MicroStrategy’s sustained and aggressive buying pressure

-

Speculative funds are deployed in advance to cope with future buying pressure

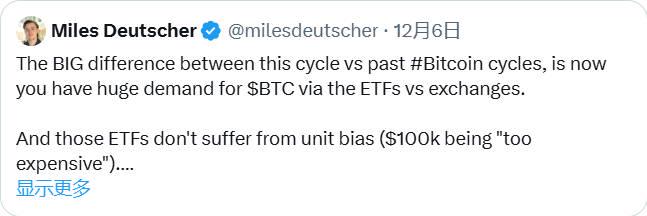

7. US spot ETF holdings have exceeded 1.1 million bitcoins, exceeding Satoshi Nakamoto's holdings. This brings continuous buying pressure. Spot ETFs also produce an extremely powerful "unit deviation" effect.

On-chain data indicators

8. Retail demand for Bitcoin surges to its highest level since 2020.

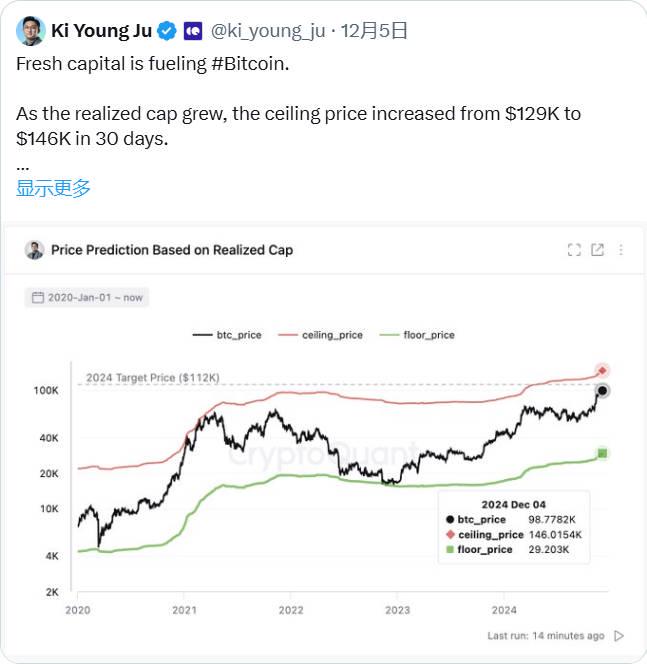

9. New money is driving Bitcoin's current price action. "Even at $102,000, it's still far from bubble levels - it would take another 43% to reach what is generally considered a bubble threshold."

10. Even at $100,000, profit-taking pressure is easing, indicating that selling pressure is cooling.

Market Outlook

Currently, multiple factors are highly consistent, indicating that the upward trend will continue. In such an environment, Bitcoin breaking through $150,000 will inject strong momentum into the entire cryptocurrency market.

The increase in market liquidity will inevitably lead to a greater rise in prices, especially for the altcoin market. In the next few weeks, we will continue to track and share altcoin investment opportunities that are worth paying attention to.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!