Hidden Gem Presales for 2026: IPO Genie Unlocks 1000x Private Market Gains

16th February 2026: Gone are the Wild West days when tokens launched on hype alone. Today, investors want projects that solve real problems, with efficient teams and real use. That’s why early presales are getting noticed, and why IPO Genie $IPO stands out.

Think of presales like a VIP entrance to a top altcoin crypto project. You get in early, often at lower prices. The upside? If you choose the right project, the rewards can be big. $IPO is catching attention by using AI tools and easy DeFi access, all starting at just $10. Icing on the top is that it recently crossed over $1 Million. Which means it’s gaining attention and momentum.

This isn’t financial advice, it’s a simple look at what makes some presales special, what crypto experts like Michael Wrubel are watching, and how you can spot good opportunities yourself.

Why Early Crypto Presales Matter in 2026

Altcoin crypto presales are becoming more open to everyone. A few years ago, only big investors or companies could join early token sales. Now, anyone can take part with as little as $10.

Crypto presales in 2026 lets you see and analyse the best projects up close. You can read the whitepaper, check the token plan, and learn about the team before the token goes on big exchanges.

In 2026, serious projects focus on real use, following rules, and growing steadily. This helps show which projects are real and which are just trying to make quick money.

Being transparent and simple makes it easier for investors who do their research to find good opportunities.

What Makes IPO Genie Stand Out

IPO Genie $IPO differentiates itself through several key features that address common investor concerns:

Transparency First: The project maintains a public roadmap with clear milestones. Every smart contract is verified, and progress updates are regular. This openness builds trust in an industry where vaporware has burned too many people.

Low Entry Barrier: The $10 minimum investment opens doors for retail investors who want exposure without risking large sums. This democratic approach aligns with crypto’s foundational principles.

Real Utility: The $IPO token isn’t just speculative. It powers AI-driven analytics tools and grants access to Web3 applications. Token holders can use it for market insights, trading signals, and DeFi services creating genuine demand beyond speculation.

Proven Milestones: Unlike projects promising the moon without evidence, IPO Genie points to real-world implementations and partnerships. Stage 51 of their presale indicates sustained interest and continued development momentum.

Expert Perspectives: Michael Wrubel’s 2026 Altcoin Analysis

Michael Wrubel, a crypto investor with a track record of identifying early opportunities, has picked IPO Genie in his 2026 altcoin watchlist. His analysis highlights projects combining technological innovation with market accessibility.

What the analyst say about IPO Genie – Michael Wrubel & Heavy Crypto

However, expert endorsements should inform your research, not replace it. Wrubel’s methodology focuses on:

- Fundamental Analysis: Does the project solve a real problem?

- Team Credentials: Who’s building it, and what’s their track record?

- Market Timing: Is the sector gaining traction?

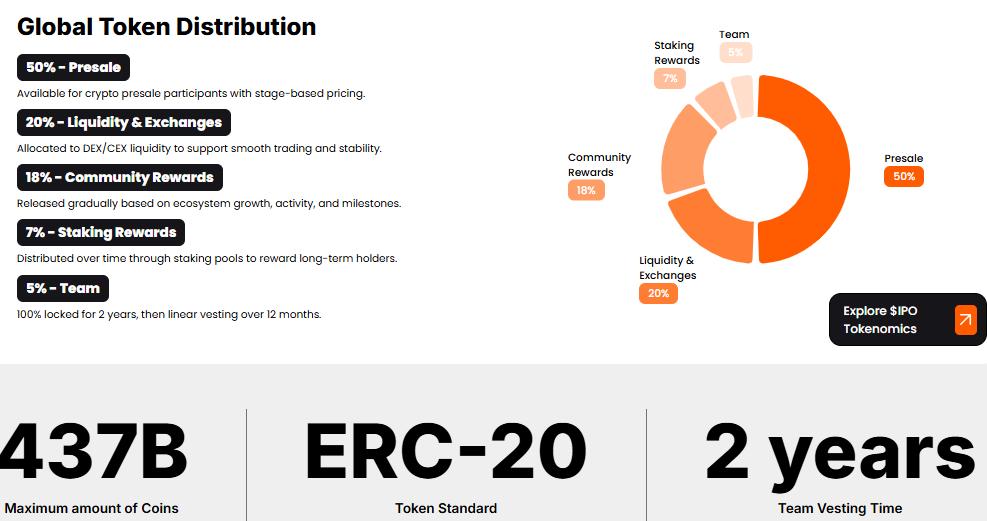

- Tokenomics: How is value created and distributed?

Use expert picks as starting points for deeper investigation. Check the project’s GitHub activity, read independent audits, and join community discussions. A celebrity mention might spark your interest, but your own due diligence should drive your decisions.

Comparing Leading Presale Projects

Here’s how IPO Genie stacks up against other notable 2026 presales:

Each project serves different purposes in the real world. NexChain targets smart contract developers, Bitcoin Hyper focuses on scaling solutions, and ZKP emphasizes privacy. IPO Genie’s edge lies in combining AI capabilities with financial tools while maintaining exceptional transparency.

Essential Presale Due Diligence Checklist

Before investing in any presale, run through these essential checks:

Review the Roadmap:

- Do the project’s milestones have clear, achievable targets? Vague promises like “revolutionary platform” without specifics are red flags.

Verify the Team:

- Research the founders and developers. Do they have relevant experience? Are they doxxed (publicly identified) or anonymous?

Understand Token Utility:

- Why does this token need to exist? If the same function could be achieved with existing cryptocurrencies, then question the necessity.

Check Smart Contracts:

- Look for third-party audits from reputable firms. Unaudited contracts carry significant risk.

Assess Community Engagement:

- Active, informed communities indicate healthy projects. Be wary of channels filled only with price speculation and “wen moon” posts.

Understand Vesting Schedules:

- How are team tokens locked? Immediate unlock periods can lead to dumps.

Integrating Presales Into Your Investment Strategy

Presales shouldn’t dominate your crypto portfolio. They’re high-risk, high-reward plays that complement more stable holdings.

A balanced 2026 crypto portfolio might allocate: (This section is an example of portfolio allocation)

- 35-60% to established cryptocurrencies (Bitcoin, Ethereum)

- 25% to mid-cap altcoins with proven use cases

- 10% to presales and early-stage projects

- 5% to experimental DeFi positions

IPO Genie Tokenomics Screenshot for a deeper insight

This structure lets you capture upside from early crypto projects like IPO Genie while protecting your capital through diversification. Never invest more in a presale than you can afford to lose completely.

Remember that presale tokens often have lock-up periods. Your capital might be illiquid for months. Factor this into your cash-flow planning and emergency-fund strategy.

Take Control: How to Navigate Presales Safely

The 2026 crypto presale market rewards research and patience. Projects like IPO Genie demonstrate how combining real utility, transparency, and accessibility can create compelling early-stage opportunities.

But the promise of “1000x gains” should never override common sense. Most projects fail. Even well-intentioned teams can struggle with execution, market timing, or competition. Approach presales as venture investments, high risk, requiring deep understanding, and appropriate only for capital you can afford to lose.

Do your homework. Verify claims independently. Diversify broadly. And remember that in crypto, as in all investing, if something sounds too good to be true, it usually is. The opportunity exists, but success requires discipline, research, and realistic expectations.

Official Channels:

IPO Genie Presale Link | Telegram | X – Community

This publication is sponsored and written by a third party. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned.

The post Hidden Gem Presales for 2026: IPO Genie Unlocks 1000x Private Market Gains appeared first on Coindoo.

You May Also Like

Pikachu Illustrator PSA 10 sets record at Goldin sale

SEC clears framework for fast-tracked crypto ETF listings