Bitcoin retraces to $112K as ETH gains strength but $1T in Realized Cap could fuel next BTC rally

Bitcoin slipped backed to the $112,000 region extending weekly losses even as its Realized Cap crossed $1 trillion for the first time.

- Bitcoin drops to $112K as weekly losses deepen.

- Realized Cap surpasses $1T, showing record capital inflows.

- Ethereum gains momentum with whale accumulation.

Bitcoin (BTC) retreated to $112,378 on Aug. 25, marking a 2.2% drop in the past 24 hours and extending weekly losses to 2.6%. The decline places the world’s largest cryptocurrency at the lower end of its seven-day range between $112,023 and $117,016. Over the past month, BTC has shed about 4%, cooling after a strong mid-summer rally.

Ethereum (ETH), by contrast, continues to show resilience. ETH was changing hands at $4,710 at press time, slightly lower on the day but still up 9% over the past week and 26% in the last 30 days. Its rally culminated in a fresh all-time high of $4,946 on Aug. 24.

Bitcoin whales shift into ETH

Some of the market’s oldest Bitcoin holders appear to be rotating into Ethereum. In one such transaction, on-chain monitoring platform Lookonchain reported on Aug. 24 that a dormant BTC wallet, active for years, moved 6,000 BTC worth $689.5 million into ETH.

The wallet has so far accumulated 278,490 ETH ($1.28 billion) at an average price of $4,585. It still holds 135,265 ETH ($581 million), suggesting a strong conviction in Ethereum’s trajectory.

Ethereum has also been gaining ground in exchange-traded fund inflows and ETH treasury company accumulations. Such whale moves add weight to ETH’s relative strength in recent weeks, with traders speculating that capital rotation could sustain Ethereum’s momentum even as Bitcoin consolidates.

Bitcoin Realized Cap tops $1 trillion

Despite its short-term retracement, Bitcoin has notched a historic milestone on-chain. On Aug. 24, CryptoQuant contributor Burakkesmeci highlighted that Bitcoin’s Realized Cap surpassed $1 trillion for the first time.

Unlike traditional market capitalization, which multiplies supply by the latest price, Realized Cap values coins based on the price they were last transacted. This metric captures the “real” capital that has flowed into Bitcoin rather than just nominal market value.

The $1 trillion threshold reflects record levels of liquidity entering the network and suggests that the rally is supported by tangible investment rather than speculative froth.

“Just wait until Realized Cap hits $2 trillion — then you’ll really see our little guy shine,” Burakkesmeci wrote in his CryptoQuant note.

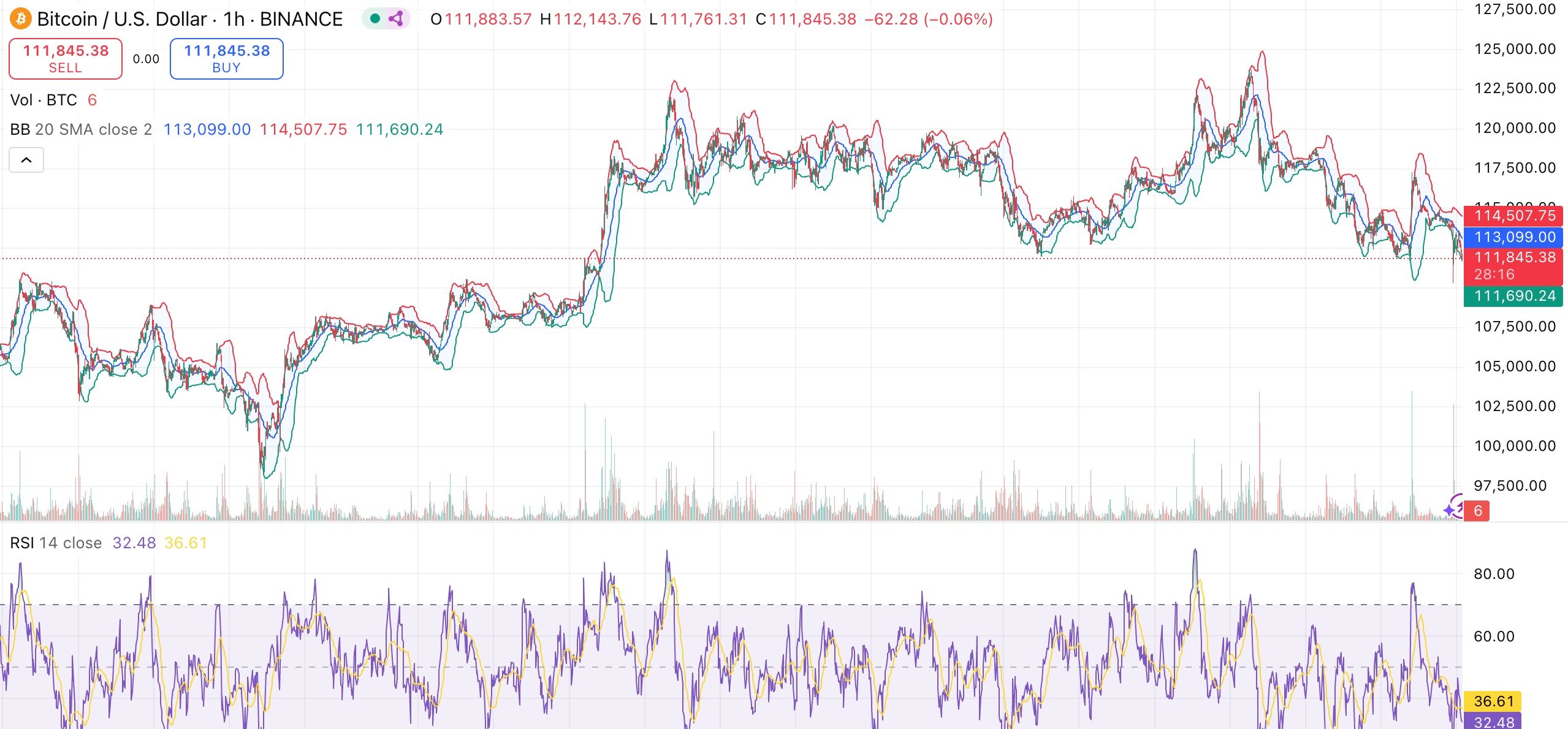

Bitcoin technical analysis

Bitcoin is showing mixed signals. The MACD is still in bearish territory, indicating that the downward pressure has not completely subsided, while the relative strength index is hovering at 48, indicating neutral momentum. Oversold conditions are also indicated by momentum indicators like the Stochastic RSI, which suggests that sellers may soon run out of steam.

Short-term moving averages tell a cautious story. Bitcoin is trading below both its 10-day and 20-day exponential moving averages, signaling continued weakness. However, the longer-term trend remains intact, with the 100-day and 200-day moving averages still pointing upward, reflecting structural support beneath current levels.

Traders anticipate a possible rebound toward the $115,000–$117,000 resistance zone if Bitcoin maintains above $110,000. A deeper decline toward the $105,000 mark, however, might be possible if there is a break below $110,000.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Hoskinson to Attend Senate Roundtable on Crypto Regulation