Matrixdock’s tokenized dold XAUm launches on Sui

Matrixdock has launched its flagship gold-backed token, XAUm, on the Sui blockchain, marking the first issuance of XAUm on a non-EVM chain.

- XAUm is backed 1:1 by LBMA-accredited gold of 99.99% purity and audited by Bureau Veritas.

- The Sui blockchain was chosen for its parallel execution, sub-second finality, and horizontally scalable infrastructure.

Matrixdock, Asia’s leading RWA tokenization platform under Matrixport Group, has officially launched its flagship tokenized gold product XAUm, on the Sui (SUI) blockchain — marking the first time XAUm will be issued on a non-EVM chain.

“By bringing gold onchain, XAUm transforms a traditionally static asset into one with expanded digital utility,” said Eva Meng, Head of Matrixdock. “We’re excited to expand XAUm to Sui, a blockchain purpose-built for scalability.”

“Tokenized assets are rewiring global finance, and XAUm on Sui is a powerful example of Sui being at the forefront of this wave of innovation,” commented Christian Thompson, Managing Director of the Sui Foundation.

Matrixdock selected the Sui blockchain for the XAUm launch because of its advanced technical architecture and growing user base. The blockchain’s parallel execution, sub-second finality, and horizontally scalable infrastructure make it ideal for fast, cost-efficient, and high-throughput tokenized asset transactions.

About XAUm

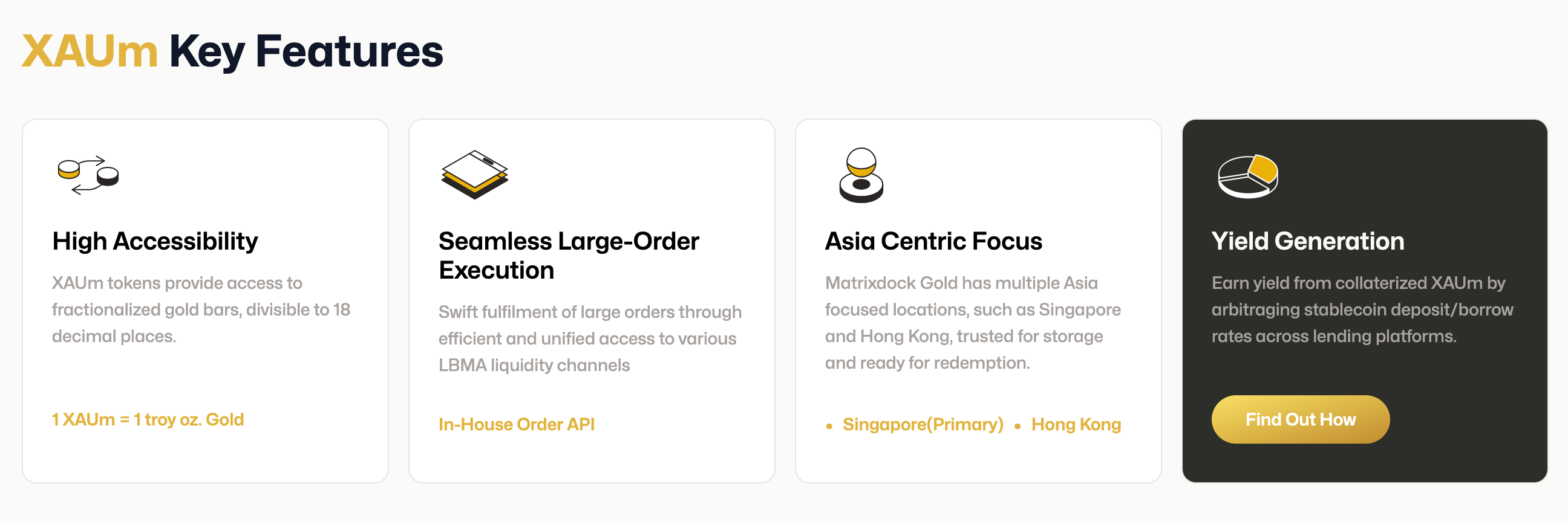

XAUm enables users to hold, trade, lend, and redeem institutional-grade physical gold, combining the stability of tangible gold with the speed and transparency of blockchain technology.

The token is fully backed 1:1 by London Bullion Market Association (LBMA)-accredited gold of 99.99% purity and undergoes rigorous audits by Bureau Veritas. Its H1 2025 physical gold reserve audit report is publicly available.

You May Also Like

Why Multicoin Capital’s Kyle Samani Is Leaving Crypto for AI and Robotics

SUI Price Rebounds Above $1 as HashKey Enables Trading Support

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more