Behind the surge in Unichain TVL: a carefully planned liquidity feast, or the prelude to a new DeFi landscape?

Author: Frank, PANews

Since its official launch in February 2025, the Layer2 network Unichain did not seem to cause a huge splash in the market at the first time. Coinciding with the overall crypto market entering a period of adjustment, its voice was once drowned out.

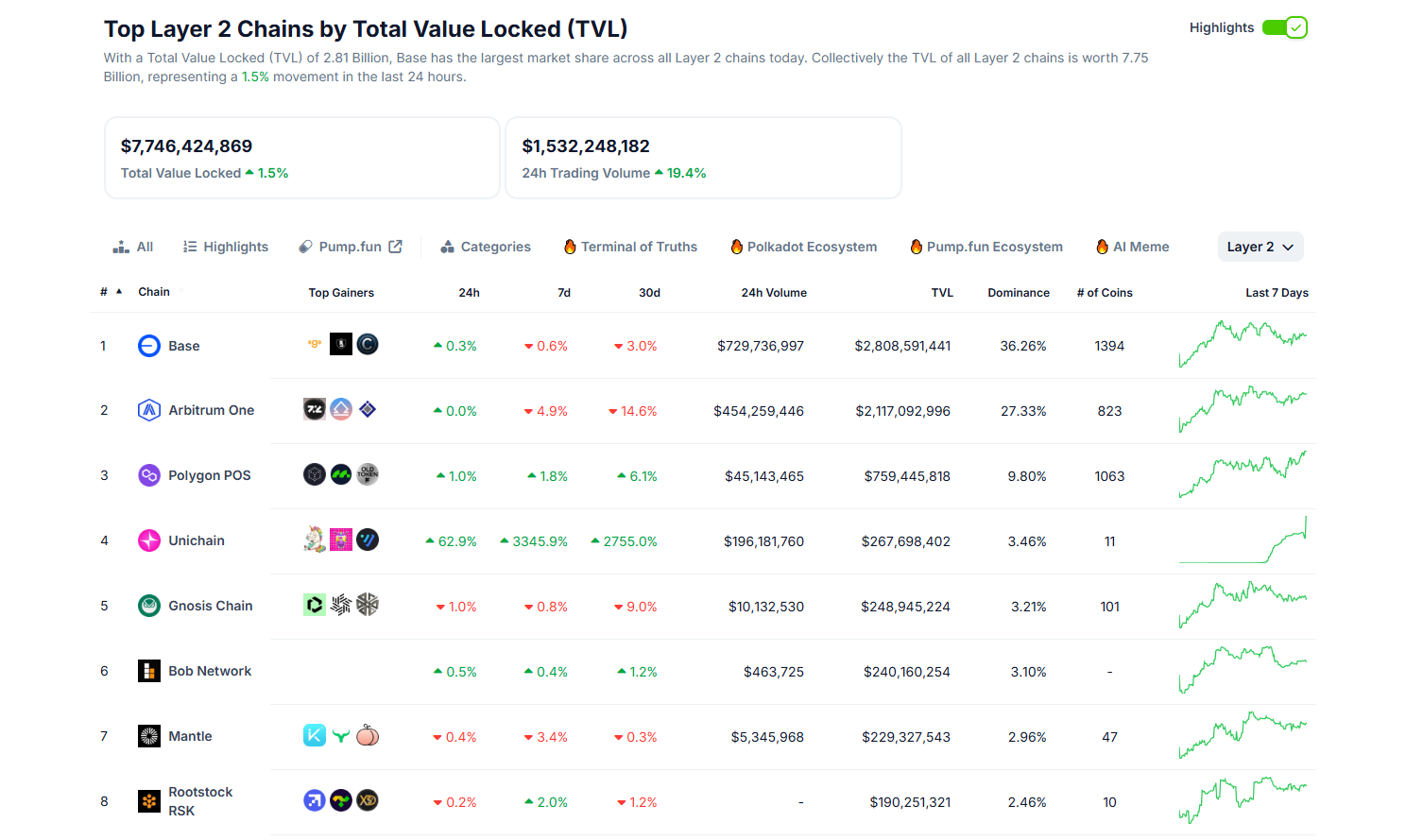

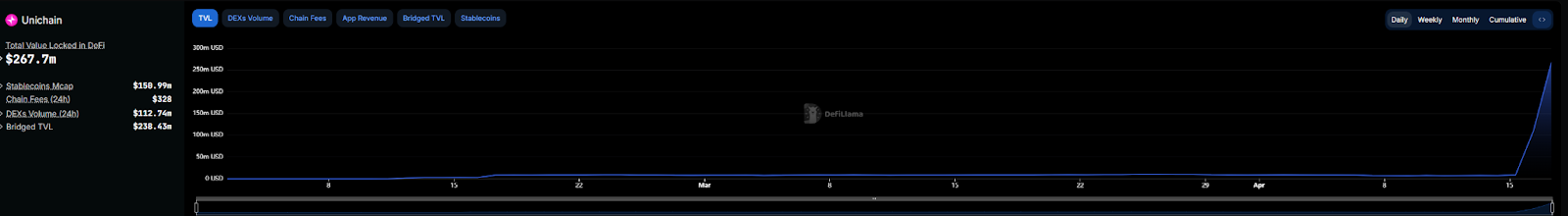

However, the silence did not last long. On April 15, after Unichain and Gauntlet jointly launched a $5 million liquidity incentive campaign, Unichain's cross-chain activities heated up significantly. In just 24 hours, 11 addresses cumulatively injected tokens worth about $22.23 million into Unichain. The effect of this sudden "money-throwing" activity was immediate. According to DefiLlama data, Unichain's TVL saw an astonishing jump after April 15, soaring from about $9 million to $267 million in 2 days. This figure has quickly climbed to the fourth place among many Layer2s. Is Unichain's incentive-driven TVL outbreak just a short-lived "wool-pulling" carnival, or is it an effective verification of Uniswap, the DeFi giant, turning from the protocol layer to the underlying public chain? Can Unichain take this opportunity to truly become the new home of DeFi?

L2 for DeFi

To understand Unichain’s recent explosion, let’s review its fundamentals. Unichain is the product of UniswapLabs’ years of hard work in the DeFi field. It is positioned as a high-speed, decentralized Layer 2 solution designed specifically for DeFi and cross-chain liquidity.

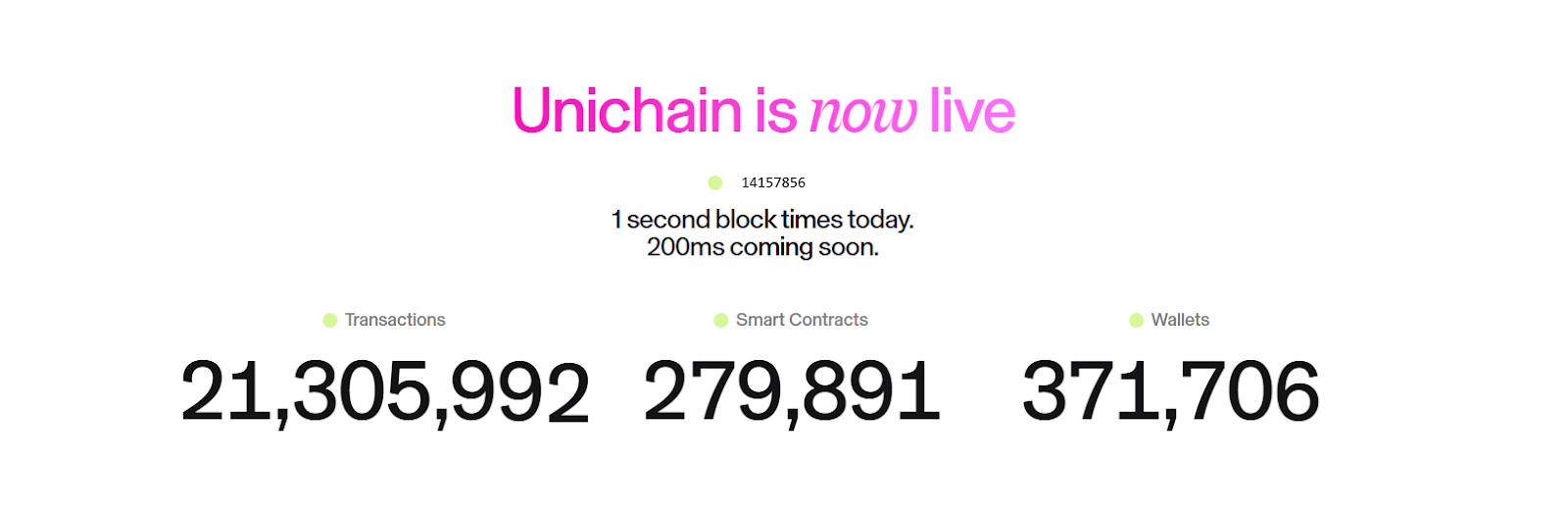

In terms of performance, Unichain performs similarly to other L2s. Officially, the mainnet achieved a block time of 1 second after it went online, and plans to achieve a "sub-second" effective block time of less than 200 milliseconds in the future through TEE (Trusted Execution Environment) technology developed in cooperation with Flashbots, making transactions almost instantaneous. In terms of cost, Unichain's transaction fees are significantly reduced by about 95% compared to the Ethereum mainnet.

As of April 16, 2025, data from Unichain's official website shows that it has processed more than 20 million transactions and has more than 371,000 wallet addresses. In addition, 95 million transactions were processed and 14.7 million smart contracts were deployed during the testnet phase, which also reflects the advantages of the brand effect to a certain extent.

In terms of ecological cooperation, Unichain has received support from many industry giants since its launch. Nearly 100 crypto projects and infrastructure providers have announced support for or will build on Unichain, including Circle, Coinbase, Lido, Morpho and other heavyweight players.

Overall, Unichain seems to have gathered all the basic conditions for building DeFi L2: high performance, low cost, and early support from industry leaders.

How does $5 million of UNI leverage 270 million TVL?

Although Unichain has a good foundation, the explosive growth of TVL is undoubtedly directly ignited by the liquidity incentive campaign launched by Gauntlet. This campaign plans to distribute a total of $5 million in UNI tokens as rewards to 12 specific liquidity pools on Unichain in the first two weeks. These 12 pools are mainly concentrated in mainstream asset pairs such as USDC/ETH, ETH/WBTC, USDC/WBTC, as well as UNI/ETH and various LST/LRT pairs with ETH.

There may be two underlying reasons why this event was so effective in attracting liquidity.

On the one hand, there is the “wool-pulling effect”: the $5 million UNI token reward is concentrated in 12 pools and distributed in a short period of time (initially two weeks), which may bring potential high returns to liquidity providers.

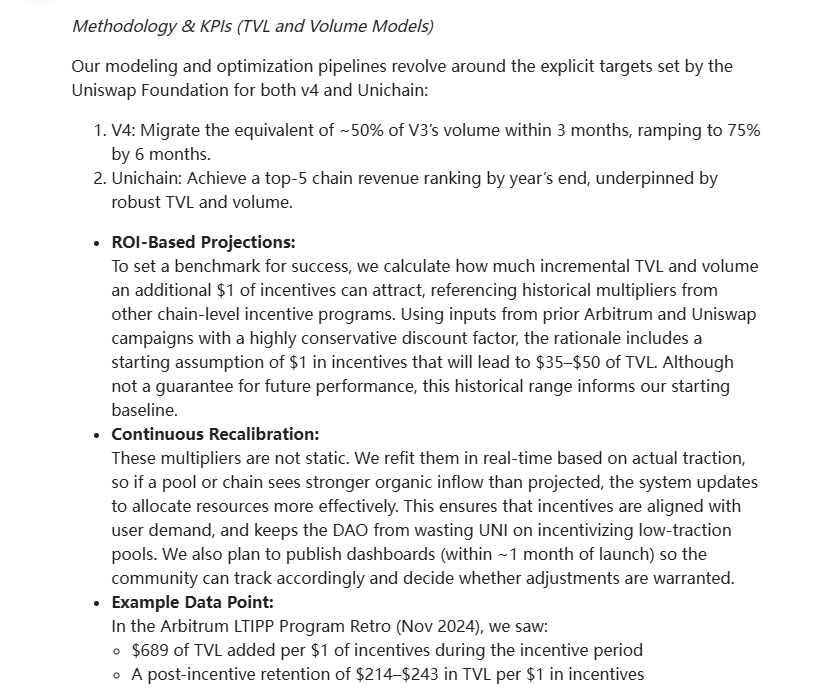

We can refer to the historical data of Gauntlet running similar incentive programs on other chains to estimate its appeal. A Gauntlet analysis mentioned that based on historical data, a conservative estimate of $1 in incentives can bring $35-50 in TVL. Based on this calculation, this event may eventually bring about $175 million to $250 million in TVL growth for Unichain. Judging from the current data, Unichain's performance has exceeded conventional expectations.

How much return can this activity bring? Based on the TVL growth of $267 million, users can get about $181 in return for every $10,000 invested, with a return rate of about 1.81%. Of course, this is the result calculated based on the current TVL level. The final TVL may be higher, and the actual return to users will be relatively less.

On the other hand, the deeper reason behind the big money chasing this kind of hair-pulling effect is the demand for "stable returns" during the market downturn. In the first quarter of 2025, the overall crypto market experienced a correction, the prices of mainstream assets such as Bitcoin and Ethereum fell, and market volatility increased. In this environment, a large amount of funds, especially large amounts of funds, tend to look for safe havens with relatively low risks and stable returns.

As more and more funds poured in, the situation of too many wolves and too little meat intensified the internal circulation. Blogger @0x_Todd complained that this mechanism forced LPs to concentrate liquidity in a very narrow price range. For example, USDC/USDT is maintained between 0.9998-1.0000, which leads to tens of millions of dollars of ultra-high liquidity depth in this narrow range, but because the fee rate is only 0.01%, the daily transaction fee income is only 1K-2K US dollars. This internal circulation also caused a huge waste of funds.

In general, the surge in UnichainTVL is the result of high short-term incentives and the demand for stable returns under the market's risk-averse sentiment, but whether this short-term surge has practical significance remains to be seen.

Uniswap’s “conspiracy” to return to the top of DeFi with Unichain and V4?

As Unichain's mainnet launch and incentive activities begin to activate the market, Uniswap Labs' overall layout has also begun to land in the near future. From the launch of Uniswap V4 to the calming of regulatory storms, and then to the community governance to promote the fee switch proposal, Uniswap seems to be working hard to return to the leading position in DeFi.

In January this year, Uniswap V4 was deployed on more than 10 mainstream networks including Ethereum, Polygon, and Arbitrum. V4 introduced the "Hooks" mechanism, which allows developers to insert custom code at key nodes in the life cycle of the liquidity pool, greatly enhancing the customizability of the protocol and transforming it from a DEX to a DeFi developer platform. As of April 17, Uniswap V4's TVL has reached US$369 million, exceeding the V2 version.

In addition, the protracted SEC investigation ended in February 2025 without taking enforcement action against UniswapLabs, and a $175,000 settlement was reached with the CFTC regarding certain leveraged token transactions. Overall, the systemic regulatory risks faced by Uniswap's core business have been greatly reduced.

The promotion of Unichain and V4 is inseparable from financial support. In March this year, the "Uniswap Unleashed" proposal was passed, approving a total of approximately $165.5 million in funds to support the growth of Unichain and V4, including $95.4 million in grants, $25.1 million in operating expenses, and $45 million in liquidity incentives. This funding comes directly from the UniswapDAO treasury.

The protocol fee switch is undoubtedly one of the core issues that UNI holders are most concerned about. Although the relevant proposal has passed the preliminary vote and the final "UniswapUnleashed" funding vote with a high vote, its implementation still needs to wait for the Uniswap Foundation to resolve the relevant legal entity issues. Once successfully activated, it will directly bring protocol income to UNI holders who pledge and participate in governance, becoming a key step in capturing the value of UNI tokens.

In general, Unichain is more like a core, highly optimized "home field" built by Uniswap, and V4 is the strongest weapon demonstrated on this battlefield. Ultimately, migrating most TVL to Unichain is a possible long-term goal, but it seems difficult in the short term. At present, Unichain TVL (about 178 million US dollars) is still far behind Ethereum mainnet (about 2.5 billion US dollars) and Base (about 600 million US dollars).

However, Uniswap will most likely continue to stimulate the achievement of this ultimate goal through continuous community incentives. Currently, Uniswap DAO has approved an initial liquidity incentive of $21 million for Unichain (for a period of 3 months), and estimates that a total of about $60 million in incentive funds will be needed in the first year. In addition, there is a grant budget of $95.4 million, part of which will be used for the Unichain ecosystem.

Unichain's recent TVL surge, triggered by its liquidity incentive plan, is not just a carnival of funds chasing short-term high returns, but more like a "fire reconnaissance" carefully planned by Uniswap. It has successfully refocused the market's attention on this L2 network tailored for DeFi, and preliminarily verified the feasibility of leveraging strong financial resources to start the ecosystem cold.

Behind this incident is UniswapLabs' more far-reaching strategic plan: by launching Unichain and V4 protocols, vertical integration from applications to infrastructure is achieved, and a high-performance, low-cost, and highly customizable DeFi exclusive chain is created to consolidate its leading position in the fierce competition. However, whether Unichain can truly transform from a "protocol application chain" to a "new home for DeFi" still faces many challenges. Can short-term incentives be transformed into long-term user stickiness and real ecological prosperity? Can the innovative potential of V4Hooks be fully stimulated? When will the much-anticipated protocol fee switch finally land and truly empower the UNI token?

For Uniswap and UNI holders, the future is full of opportunities and challenges. The success or failure of Unichain will profoundly affect Uniswap's position in the next generation of DeFi. The market is waiting to see whether this gorgeous transformation from application to chain will be successful.

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore