Shiba Inu Faces Increased Selling Pressure as This Key Metric Dips Over 90%

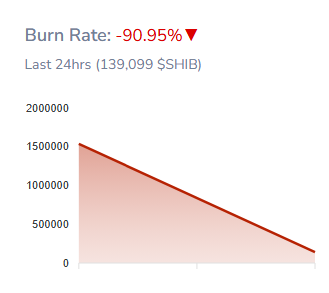

Leading canine-themed token Shiba Inu is facing increased selling pressure as its burn rate has dropped significantly over the past day. Shiba Inu has been attempting to recover from the broader market downturn, which sent its price to a multi-week low of $0.00001206 yesterday. Shortly after the collapse, it recovered to an intraday high of $0.00001267 and suffered a slight retracement to $0.00001250. Shiba Inu Burn Rate Slumps Over 90% As Shiba Inu battles persistent bearish momentum, token burns have drastically reduced. Data from Shibburn shows that Shiba Inu’s burn rate has slumped by 90.95% over the past day, with only 139,099 SHIB tokens sent to the burn wallet across three transactions.  Shiba Inu burn rate reaches 90Shiba Inu burn rate reaches 90 Many attribute the long-term value proposition of Shiba Inu to reducing its massive supply of 589 trillion tokens through burns. As the rate is now dropping, it could impact sentiment. Notably, removing more tokens from circulation and sending them to the dead wallet contributes to Shiba Inu’s price seeing a long-term spike. As the burn activity declines, it raises supply concerns, and some investors might panic sell. Shiba Inu Current Performance In the meantime, Shiba Inu has continued to show resilience, rising from a multi-week low of $0.00001206 to $0.00001250. With a current price of $0.00001250, Shiba Inu has surged by a mere 1.57% over the past day. However, it is still down 8.15% over the past week and 16.36% over the past month. Investors’ momentum has waned in the past day, with the trading volume plunging by 3.08% over the past 24 hours to $197.77 million. Liquidation Overview Amid the ongoing recovery, Shiba Inu futures traders have suffered a total liquidation of $87,450 in the past day. While long positions comprised $37,450, the short ones incurred most losses at $49,990. Notably, investors betting on a Shiba Inu price drop (shorts) could face $746,520 in liquidations if SHIB climbs to $0.000013. Conversely, those expecting the rally to continue (longs) risk $919,610 in liquidation if the price falls under $0.000012. Meanwhile, several community experts remain confident in Shiba Inu’s prospects. Analyst MMB Trader projects an imminent rally to $0.00007716.

Shiba Inu burn rate reaches 90Shiba Inu burn rate reaches 90 Many attribute the long-term value proposition of Shiba Inu to reducing its massive supply of 589 trillion tokens through burns. As the rate is now dropping, it could impact sentiment. Notably, removing more tokens from circulation and sending them to the dead wallet contributes to Shiba Inu’s price seeing a long-term spike. As the burn activity declines, it raises supply concerns, and some investors might panic sell. Shiba Inu Current Performance In the meantime, Shiba Inu has continued to show resilience, rising from a multi-week low of $0.00001206 to $0.00001250. With a current price of $0.00001250, Shiba Inu has surged by a mere 1.57% over the past day. However, it is still down 8.15% over the past week and 16.36% over the past month. Investors’ momentum has waned in the past day, with the trading volume plunging by 3.08% over the past 24 hours to $197.77 million. Liquidation Overview Amid the ongoing recovery, Shiba Inu futures traders have suffered a total liquidation of $87,450 in the past day. While long positions comprised $37,450, the short ones incurred most losses at $49,990. Notably, investors betting on a Shiba Inu price drop (shorts) could face $746,520 in liquidations if SHIB climbs to $0.000013. Conversely, those expecting the rally to continue (longs) risk $919,610 in liquidation if the price falls under $0.000012. Meanwhile, several community experts remain confident in Shiba Inu’s prospects. Analyst MMB Trader projects an imminent rally to $0.00007716.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth